My first investing experiences

I started investing by the end of 1999, somewhere near the peak of the so-called “Dot-com Bubble” buying stocks of two high-tech companies.

By investing in two companies from the same sector being completely overvalued at that time all my eggs were in one basket. I had done a lot of research before and knew these two businesses had a very wide economic moat. Probably one of the few things I did right was to focus on quality. But I had listened too much to the analysts and the media at that time justifying the high prices of these companies, the sector and the stock markets as a whole. Finally I had become greedy when everybody was and overpaid for the stocks. The biggest mistake however was to invest money I actually would have needed for my studies at the university.

As you certainly know, the “Dot-com Bubble” burst in march 2000 and of course my stock holdings plunged rapidly. I was scared and literally paralysed finding my portfolio with a book loss of aproximately 70 % few months later. My nest egg had nearly evaporated.

But I held on to my stock positions. After all I had done my homework and knew that these companies would thrive for decades to come. But I had overpaid which makes the engagement in a good company a terrible investment. What I did was to grind my teeth and hold these shares for several years. They recovered finally and I immediately sold them. Including the dividends received the total return was … zero.

Hindsight I must say that it is quite dangerous to hang on positions hoping that they recover one day from their book losses. Benjamin Graham refers to such a behaviour as long term speculation (in my view, before investing, everybody should read at least one of his great books “Security Analysis” and “The Intelligent Investor”). The oportunity costs can be huge as money is blocked for many years. In my case that money would have served me well during my studies. I managed the situation by working part-time and slashing my spendings.

My investing approach

After my daunting experience, I never wanted to invest again. I took it personally and felt discourage. After all I wanted to build wealth in the stock market but all I had found was just a lot of hassle.

But my experiences served my well. I was still interested in businesses and I love reading books about finance and investing. My key take aways in a nutshell: invest consistently and be patient. Investing is a process. I focused to put a system in place allowing me to invest on a regular (monthly) basis slowly building a powerful portfolio over time. I also learned that bear markets can (and should) be seen as friendly conditions to buy stocks or Index Funds at attractive prices.

I had a different mental framework now and my view on the market completely changed. I stopped listening to the noise and wrote a list, my personal watchlist, with companies I wanted to own a piece of (Nestle, Novartis, Roche, Swiss Re etc.).

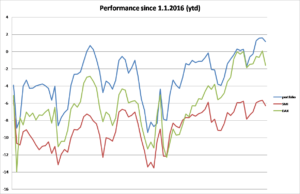

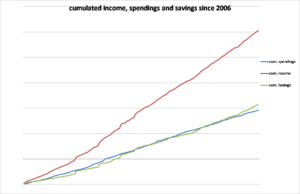

I stood at the sidelines until 2009 and since then I invest according to following “system”: (1) saving at least 50 % of my income to increase my stash, (2) investing in Index Funds and shares of high quality companies with a wide economic moat according to my watchlist, (3) reinvest the dividends and (4) repeat over the years. I focus only on investments I am willing to hold for decades (or even forever).

What really matters for me from a financial perspective is the saving rate and the amount of money I am able to put to work on a regular basis. That’s going to determine my economic future much more than a particular failure or success I have with my investments. I have neither the time nor any interest in handling daily market fluctuations.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

I love ice cream, chocolate and coffe. To consume and to invest in (drawing by the author)

I love ice cream, chocolate and coffe. To consume and to invest in (drawing by the author)