To grow your nest egg quickly and big enough to gain financial flexibility during your working career, targeting a high savings rate is the key. The savings rate is the percentage of your income that you are not spending.

In order to calculate your savings rate, you need to know your income and your spendings. These are the two levers in building your wealth you need to watch and manage: money in (income) and money out (spendings).

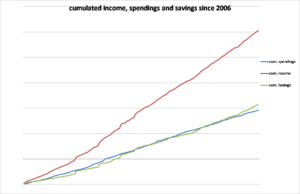

I have been tracking my income (take-home pay, dividends etc.), spendings (rent, costs for groceries, commuting, insurances etc.) and savings for each month on an excel sheet since 2006. You can see on the graph the cumulated income (red “income-line”), cumulated spendings (blue “spending-line”) and cumulated savings (green “saving-line”).

The graph shows the development of my savings rate over time: on an earlier stage, the “spending-line” was above the “saving-line” which means that my savings rate was below 50 %. Since 2011, the “saving- line” has a greater slope and is consistently above the “cost-line” and therefore the saving rate is higher than 50 %.

Moving above the 50 % savings rate gave my wealth building process a powerful boost. I reached this solely by being more conscious with my spendings and leading a down to earth lifestyle. As you can seen, during the last years my income was more or less constant.

see also post You are not a millionaire man, you are just living high

Leave a Reply