drawing by the author

Financial Independence describes the state in which the assets of a person generate enough income to sustain or even exceed his or her expenses. Financial independent people don’t have to work anymore to cover their basic needs as their wealth throws off enough passive income (e.g. dividends, rents, interests etc.).

What would you do, if you were financially independent?

Reaching financial independence puts someone in a tremendously powerful position. There is no need to trade money against time and effort. Is there the wish to follow creative activities earning little or even no money? No problem at all! Dreaming of taking a sabbatical? Just go ahead! Planning to work at various interesting projects around the world? Here’s your ticket! Wanting to spend more time with your family? Take a part time job or even stop working! Finding fulfillment at the current job? Enjoy your working career and watch your wealth growing steadily!

The list with realistic options is indefinite.

What does it take to become financially independent?

Financial Independence is not a function of a certain amount of money. It is kind of a moving target depending on two levers:

High savings rate and income producing assets

According to the Trinity Study one could stop working and never run out of money if his or her portfolio (consisting of a mix of bonds and stocks) is higher than 25 times the annual expenses. People with a frugal lifestyle are able to become financially independent in a relatively short time period and on a relatively small stash. Having a low cost basis, they don’t need a high passive income to cover their expenses. For example annual expenses of USD 20’000 would require a portfolio of USD 500’000 whereas someone spending USD 50’000 needs a portfolio of at least USD 1.25 Mio.

Quality of the assets

Financially independent people highly rely on the quality of their assets. Using the word quality in this context I mean the “capability” of the invested assets to generate a steady, reliable and constantly increasing stream of cash flow.

A good friend of mine just told me lately: One million is not what it used to be. Well, I think that’s correct. At least in parts. My friend is right, that the purchase power of one million substantially decreased during the last decades due to inflation. Although a small percentage of the population are millionaires, that “club” is less exclusive nowadays than before. And it is also correct, that some decades ago one million just lying on a bank account would easily throw off USD 50’000 in interests every year enabling to retire in comfort. But even nowadays, that amount is notable and- invested sensibly – can “buy” Financial Independence.

Increasing passive income streams over time

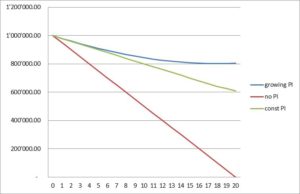

Just take a family with two kids spending USD 50’000 per year. For simplicity, let’s say the inflation rate was zero. And let’s assume they had a portfolio of USD 1 Mio. being 100 % invested in quality stocks (e.g. Nestle, Johnson & Johnson, Coca Cola, Pepsi etc.). Such portfolio throws off dividends of USD 30’000 per year (3 %). That amount can be withdrawn annually without touching the principal, right? Yes, but keep in mind, that successful and thriving companies tend to increase their dividend payments over time, let’s assume by 5 % annually. This is a very important factor which makes it possible that the withdrawals can even exceed the passive income (in our example by USD 20’000 annually). As the graph shows, the principal decreases in the first 15 years but then it is stabilising to grow again over time. The graph below also shows the importance of the capability of assets to generate sustainable and “organically growing” passive income (blue line “growing PI”). One million just laying at the bank and generating no passive income (red line “no PI”) would last for just 20 years. These assets are not productive and therefore I would consider them as of low quality. Even a constant passive income of USD 30’000 per year (see the green line “constant PI”) compares very favourably against the red line. These USD 30’000 per year make a significant difference, the principal lasts significantly longer than under the scenario “zero passive income”.

As shown, a family with a down to earth lifestyle can easily be financially independent on USD 1 Mio.

Using the power of the compound effect

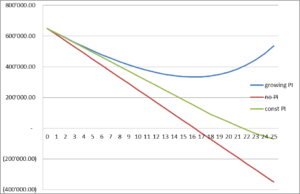

But is this also possible with a substantially smaller net worth of say USD 650’000? Let’s assume yearly spendings of USD 40’000 (and here again, for simplicity zero inflation rate) and a portfolio consisting of USD 350’000 in quality stocks and USD 300’000 in cash and bonds. In contrast to the example above now let’s assume that all dividends (“organically growing” by 5 % per year) were reinvested. As the blue line “growing PI” shows on the graph below, there is a significant decrease of the principal during the first 15 years. But then a crazy thing happens: the principal increases quite sharply. That’s due to the magic of the compound effect boosted by “organic growth” of 5 % and the reinvestment of these growing dividends year by year. Over time, the compound effect can do miracles.

Conclusion

The key take aways: Nearly everyone can reach Financial Independence.

The examples are simplified by assuming a zero inflation . But the essence remains the same.

It requires a high savings rate and investments in high quality, income generating assets. A low cost basis, the focus on the quality of the assets, being a little bit patient and the magic of the compound effect will make it so much easier.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.