Can an investment in a solid and attractive – but “maturing” – company deliver decent returns despite slowing dividend growth?

Yes. But it is extremely important not to overpay and to take a long term view.

There are several wonderful businesses in my investment portfolio where I expect future growth to be weaker than in the last decades. I think in particular of Coca Cola, Nestlé, Novartis and Roche.

The Swiss company Roche has a market capitalisation of well above USD 200 Bn and is one of the largest pharma and biotechnology businesses in the world. It’s just massive!

In 2011, I acquired 18 non-voting shares of Roche at a price of around Swiss Francs 135 (CHF; trades more or less at parity to the USD).

Few weeks before I made that investment, shares of Roche had become kind of “unpopular” due to some damped expectations regarding profit contributions of one of its blockbuster drug. The stock price came down by around 20 %, making an investment even more attractive to me.

The worries of the market proved exaggerated, Roche delivered solid results and stock price quickly recovered. In the last four years, the trading range was between CHF 230 and 280.

I don’t focus too much on the stock price or book gains/losses regarding my investments, but it is still interesting to see how some short term market expectations can lead to quite a nice entry price.

Much more important for me is the cash flow I get in form of dividends.

When I make an investment, I want to see at least these two things over time:

- the market value of the principal amount to stay “intact” on a inflation-adjusted basis. I mean hereby that the market value should grow more than 3 % year over year (YoY)

- dividends to grow three percentage points above inflation YoY

If a stock investment does not meet (or excel) these two criteria, it does not contribute to my wealth building process.

Roche’s dividends from 2005-2010

The dividend payments in that time period were as follows (in CHF; gross amounts before witholding tax): 3.00, 2.50, 4.60, 5.00, 6.00. The payouts doubled in just five years which is very strong.

If someone had bought Roche in 2005 and is still holding that investment, he or she would have been rewarded handsomely in the past and will be so spectacularily in the future.

From 2005 to 2015, Roche showed a dividend growth rate of well above 14 %. But there are two crucial points to consider:

- The last five years (2011 – 2015) of that time period showed a significant slowdown of the dividend growth rate to less than 6 %.

- The payout ratio substantially increased, even the slowed dividend growth from 2010 to 2015 exceeded the growth of earnings per share (EPS) in that period.

Roche’s dividends 2011-2015

From 2011 to 2015 the dividend payments (in CHF; gross amounts) from Roche were as follows: 6.80, 7.35, 7.80, 8.00, 8.10. The 5 year dividend growth rate was around 5.9 %, much less than in the past.

My investment in Roche falls exactly in that slow growth period.

Fair enough. Let’s have a look at the development of the yearly cash returns compared to my initial investment of CHF 135 in 2011 (yield at cost). The deduction of the Swiss witholding of 35 % has hereby to be considered (if there is a double taxation treaty with the country of the investor, twenty percentage points can be reimbursed to that investor to lower the tax rate to 15 %).

My dividend yields at cost (after witholding taxes) from 2011 to 2015 were as follows: 3.25 %, 3.54 %, 3.75 %, 3.85 %, 3.9 %.

I expect my dividend yield at cost for 2016 (paid in 2017) to be well above 4 %. In the last five years, I collected over 18 % of the invested amount in dividends.

These are quite decent returns so far (I don’t even factor in the book gain or dividend (re-) investments).

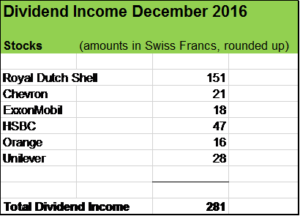

Just to put the dividend returns into relation: The dividend yield of my total portfolio currently stands at around 3.3 %, “organic growth” due to dividend hikes of my holdings has been between 3 % and 4 % in the past years. So Roche was an important contibutor to “organic growth” of my portfolio and I expect it to be so in future.

Conclusion

Roche is a leader in biotechnology, cancer treatment and diagnostics. The company shows a 28 years of consecutive dividend growth. The business has a broad economic moat and shows strong fundamentals and attractive growth prospects.

The increasing payout ratio of Roche shows that EPS growth didn’t catch up with dividend growth. For decades, the payout ratio was low (under 20 %) and “jumped” above 40 % in 2003. Since the financial crisis starting in 2007 the payout ratio climbed steadily to settle currently at around 55 %. Still quite comfortable. Dividends are very well covered by free cash flow and there is some room for growth. But I expect dividend growth hikes to be modest in the future.

As a long term investor I don’t complain about that. A slowing payout is even prudent by the company.

I will rather have a look whether

- the “cash generation machine” is intact,

- fundamentals remain strong and

- the growth rate is well above inflation.

Stocks of an outstanding company such as Roche acquired at a fair price can still deliver very decent returns over time. And if dividends are reinvested, the compound effect can do miracles.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.