Hi there! Appreciate you stopping by. It’s time for my first monthly dividend report in 2017!

But before that, just a short look back to 2016: my investments in shares generated around CHF 4’000 in passive income and I target an increase of 15 % through dividend increases, dividend reinvestments and by adding new positions.

As the bulk of my investment portfolio consists of Swiss stocks (such as Nestlé, Novartis, Roche, Swiss Re, Zurich Insurance, ABB, UBS etc.), my dividend income is heavily concentrated on the second quarter of each year as these companies usually pay their dividends in April, May or June.

My January 2016 dividend income? Zero.

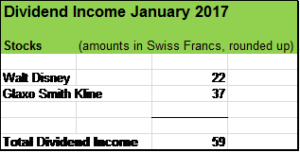

So much to the past. My financial portfolio is significantly stronger and more diversified than before and I am pleased to see two solid businesses – Walt Disney and Glaxo Smith Kline – contributing to my January 2017 dividend income in the amount of Swiss Francs 59 (trades more or less at parity to the USD).

Walt Disney (DIS)

I acquired 40 shares of that company in November at a price of USD 91.8. Far from being cheap but I am fine with that price (see also blogpost Disney is a wonderful company but is the price fair?).

It’s the first time I receive dividends from DIS. Projected dividend yield at cost of my investment will be very modest in the near term, it stands below 1,5 % for 2017. The projected dividend yield of my portfolio for the current year in contrast is well above 3.3 %.

Fair enough, it’s not the first position in my investment portfolio starting with a very low yield at cost and paying off handsomely after a couple of years.

Given the company’s exceptionally strong market position, its track record in the past decades, the strong financial fundamentals and the stable growth prospects I am quite optimistic that the company will grow earnings per share and dividends quite nicely over time.

In December 2016, DIS announced a dividend hike of its semi-annual dividend payout per share. The company’s payment for 2017 will be USD 1.49 a share, up from USD 1.37 a share in 2016. A nice boost of 8.8 %.

GlaxoSmithKline (GSK)

I acquired 150 shares of GSK by the end of 2015, so it’s a relatively new position as well.

GSK is in my view a fine company with a strong position in three segments: pharmaceutical, vaccines and consumer healthcare with well-known brands such as Voltaren, Panadol, Sensodyne and Aquafresh.

The company offers a so-called Dividend Reinvestment Plan (DRIP) which means that dividends are paid out in shares if the investor chooses so.

GSK pays dividends quarterly. In January 2016 I was not yet eligible to receive payouts as the stocks had been acquired after the record date. So my position started to become “productive” from the second quarter 2016 on.

Since then, I collected dividends in form of shares for each quarter by participating in the company’s DRIP. The share count grew more than 6 % from 150 to 160. I expect the compound effect to work quite nicely in my favour over time.

How was your January in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

I have some stocks that are starting at a low yield. After a few years, I too, hope they pay a lot more in the future.

Hi DM

Patience and healthy dividend growth rates are very rewarding over time. Well positioned businesses with strong fundamentals and a low payout ratio can boost their growth exceptionally well as a large portion of their profit are reinvested year by year.

Thanks for your commentary.

Cheers

Hi there,

Could you also state the Dividend Yield of each position? – Especially in light of all time low interest rates, dividend shares offer an attractive alternative. It would be interesting to see the yields.

Cheers

Hi efinancialmodels

Thanks for your inputs. Yes, I am planning to include in my next monthly dividend income updates the current dividend yield as well as my (projected) yield at cost for the specific positions.

Appreciate you stopping by.

I still won’t tally my January totals for another couple weeks but so far so good. Congrats on showing a 15% year over year growth. Just goes to show that with fresh capital, reinvestment and dividend increases double digits are possible. Keep building that passive income stream with those solid names you have and are buying.

Hi DH

Thanks for your encouraging words. Yes, I will definitively stick to my holdings and steadily building up my “dividend machine”.

Look forward to following your next dividend update for January.

Appreciate you stopping by and commenting.

Disney is a solid company. I think they’ll grow their dividend for years to come.

Yes, I see it the same. DIS really is one of the few companies of such massive size and long history still being able to deliver double digit eps- and dividend growth rates in the future. DIS has such a unique position and broad economic moat, its diversification and healthy financials make it an extremely stable business.

Appreciate your commentary!

Cheers

Congrats on your growth. I just bought into Disney they look like a solid pick.

Hi there.

Glad to have you as fellow shareholder in DIS.

Thanks for stopping by and commenting!

Cheers

I missed the DIS below $95 because I thought it was too expensive, I’m kicking my self now, I will wait for the next downturn to pick some up. DIS is a stock to pick up at any price.

I made the same experience as you several times (and certainly will so in the future). It’s unpleasant not having seized an oportunity but I think that’s part of investing. The last time it happened to me was in spring 2016 when I could have bought Johnson & Johnson stocks in the low nineties. Much to my regret I did not pick some up.

But amazing things will happen over the long run giving us plenty of attractive investment oportunities and very nice entrice prices.

Appreciate your commentary and wish you good luck in 2017!