My path as a dividend growth investor

My first steps in the stock market go back to 1999, somewhere near the peak of the “Dot-Com Bubble” which left my investment portfolio consisting of two high tech stocks with a hefty book loss of over 50 % when the bubble eventually burst in spring 2001.

Quite an unpleasant and discouraging start as an investor, right?

Well, it turned out that these early experiences served me well.

I was kind of forced to take a long-term perspective and to become patient in order to successfully pursue my goal to building up a stock portfolio providing me with a reliable and ever growing passive income stream over time.

A temporary book loss of 50 % can be frustrating and sometimes hard to to stomach but it is no reason to sell a position in a good dividend stock, if cash generation remains intact and there is no sign that fundamentals of the business deteriorate.

My early mistakes were a a reminder that I had to learn a lot about investing and businesses, which is a great thing, not only to make sound investing decisions but also to optimise the cost structure of our household. There is not such a great difference between businesses and households: both have to manage limited resources in the most efficient way and will become extremely successful if basic principles are applied (see If your household was a company, would it be an attractive investment?).

Since 2009 I consider myself as a dividend growth investor, consistently trying to focus on the fundamentals of businesses instead of short term share price movements. It’s also at that time when I put a system in place in order to support my investment process:

- saving at least 50 % of my net income to increase my stash (a large portion is in liquid assets as We are looking for our dream house)

- investing regularily accordingly to my watch-list

- reinvesting all dividends into existing and new holdings

- repeat again and again over the years

It has been a bumpy road, but after haven gone through many dips and some crises such as

- the burst of the so-called “Dot-com Bubble” in 2000

- the Financial crisis of 2007/2008 and the Great Recession

- the European debt crisis since the end of 2009

- the Oil glut and price collapse of major commodidities by the end of 2014

- the market turmoil before the BREXIT vote in summer 2016

- etc.

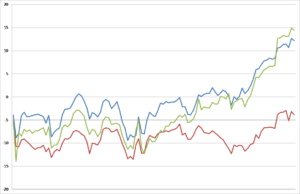

I can say, that over the years my share portfolio as a whole has been doing pretty fine. Despite some short-term setbacks and having made several mistakes, I am pleased with the development of the book value of my holdings and the decent returns of my stocks.

My dividend income has been growing by 15 % Year over Year (YoY) since 2009 through organic growth (dividend hikes), dividend reinvestments and by adding new positions (see Passive Income Review 2016 and Outlook).

In general, I don’t care about market fluctuations. At least not too much. But I remember one day as a particularily unpleasant experience as an investor which was when the

Swiss National Bank (SNB) abandoned the euro peg

On January 2015 the Swiss central bank took markets by surprise by announcing that the three year old floor under the euro/Swiss franc pair was not maintained any longer. The SNB had installed that floor in 2011 and communicated to the markets that it will sell Swiss franc in unlimited quantities to ensure the value of the currency didn’t appreciate beyond 1.2 against the euro.

The SNBs move on January 2015 was unexpected and caused market turmoil. In just a few minutes after the central bank’s accouncemend, the Swiss franc shot up against all major currencies. It soared by around 30 % against the euro and also gained 25 % against the USD. Swiss stocks tanked as the three-year-old euro peg was scapped, some of them more than 25 %.

How my portfolio was impacted

My stock holdings depreciated in book value by 15 % within minutes. Almost 50 % of my stock portfolio consist of Swiss companies (Nestlé, Roche, Novartis, ABB, UBS, Oerlikon etc.) and European businesses (Royal Dutch Shell, Deutsche Telekom, Banco Santander, Orange etc.) make around 40 % of my holdings. So it is pretty clear, that the exchange rate between the Swiss franc and the euro plays a significant role for my portfolio which is denominated in Swiss franc. My Swiss holdings fell by around 15 % on average and all euro-holdings depreciated by 30 %. My USD-stocks such as ExxonMobil and Chevron as well as my GBP-shares (BHP Billiton and Rio Tinto) gave a slight support against the drop as the devaluation of the USD and the GBP against the Swiss franc was not that strong.

My biggest concern however was not the book value loss but the fact that my Swiss holdings might lose their competitive edge against their (european) peers and that the move of the SNB might cause a deep recession in Switzerland.

Luckily, my worries were unjustified. The Swiss economy proved extremely resilient and didn’t slide into recession. Weeks after the SNB’s move, the Swiss franc eased back to settle at around 1.07 against the euro.

My Swiss stocks recovered quite fast within a few weeks and some of them now trade slightly higher than before the SNB’s move. The strong Swiss franc of course is a drag and I expect slow growth regarding my Swiss stocks and prices to remain rather flat for some years, which is not per se a bad thing, especially when new funds are added to these positions and dividends are reinvested (see also Slowing dividend growth is nothing to lament about).

With regard to my stocks in euro, the devalutaion against the Swiss franc was very negative, causing the same effect as if there was a dividend cut of 25 % regarding all my European holdings.

And yet, my investment portfolio as a whole showed a dividend growth of 18 % from 2015 to 2016 as the negative impact could be offset by adding some new positions with strong dividend payments (e.g. Swiss Re), increasing existing holding (e.g. Banco Santander) and due to dividend hikes.

Looking ahead

The SNBs move confronted my share portfolio with a short-term lose-lose situation in which no favourable outcome was possible. All my stock holdings were hit by a loss in book value (in Swiss franc) no matter from which segment or in which currency the stocks were traded (EUR, USD, GBP). But as said, my stock portfolio recovered from that blow and remained perfectly intact as cash generation machine.

As an investor in the accumulation phase, a strong Swiss franc – particularily towards the EUR, GBP – is a real blessing. When I am buying stocks, I am interested in getting as many shares of a high quality business as possible for a certain Swiss franc amount.

With regard to my investment approach I don’t plan to make substantial adaptations. I will continue to focus on investments I am willing to hold for decades or even forever. There are several good dividend stocks to buy. Consumer staples and health-care shares will continue to build the backbone of my investment portfolio and I will for sure keep some exposure to cyclical sectors and commodities. Over the long run my focus lies on giving my portfolio a more defensive shape (I’ll keep an eye on stocks such as J.M. Smucker and Johnson & Johnson) in order to make it more stable especially with regard to organic dividend growth.

What about you, have you experienced a double digit drop in book value of your portfolio in a very short time period?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Thank you for sharing your story. I do not know when the next drop is coming. But it can turn out be a buyer opportunity for more dividend stocks as opposed to selling, as long as you are mentally prepared.

Hi DividendMonkey

I completely agree, buying quality stocks when they are on sale is extremely rewarding, unless there is a fundamental problem with the business or the sector. Bear markets should be perceived as buying oportunity but sometimes they are “paralysing” especially when the market retreat is intense and/or takes very long.

Appreciate your commentary!

That seems like a large fall due to some unforeseen circumstances. I too try not to focus too much on day to day fluctuations. Over the long run, I know I will end up with a better outcome.

Hi BHL

Yes, such an event causing a 15 % drop is an unusual experience. But as you point out, a long term perspective and consistency is key. Time is our friend.

Thanks for stopping by and commenting!

Ouch, rather unfortunate side effect of the Swiss Frank decoupling from the euro. But time will likely heal those wounds, as you noted already. You’re in it for the long run, so fluctuations are not that important. Best of luck going forward!

Hi Team CF

Exactly! That one day drop was an amazing experience and a great reminder how important and rewarding it is to stay the course as a dividend growth investor.

Appreciate your commentary!

Excellent attitude to stay positive and be patient. It pays off.

Hi eFinancialModels

Thanks for the nice words. Yes, consistency, focusing on the underlying business, sticking to the plan and to high quality assets is rewarding in the long run. It’s simple as a concept but in my view not always easy to follow. From time to time, it is even scary to see how strongly markets can (over-)react.

Appreciate you stopping by and commenting!

It seems that you could hedge the Swiss holdings by using a Swiss ETF and sell calls against it. The real question is if your portfolio loses 15% in a day, can you still sleep at night?

Most people would say no. Worth considering.

Interesting read. Cheers.

Hi Frugal Prof

Hedging is definitively a measure worth considering. Appreciate your input and will have a look at these Instruments.

Thanks for stopping by and commenting.

Cheers