Leading a down to earth lifestyle, consequently increasing our savings rate and investing systematically are key elements of our wealth building process and of our journey to gain financial flexibility to pursue our dreams in life and to focus on things that really matter to us.

Building a passive income machine consisting of investments in businesses I like and holding them for the long run regardless market volatility has been extremely rewarding over the past eigh years. And it is a lot of fun. I just love receiving dividends and watch that cash flow increase over time.

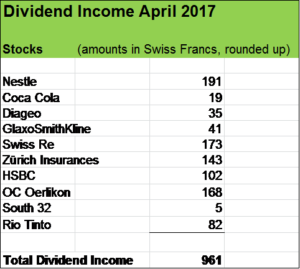

April is a good month in terms of my portfolio income in the amount of CHF 961 (the Swiss francs trades mor or less at parity to the USD). Compared to the previous year, that’s an increase of 11 % (my April 2016 dividend income was USD 865). Considering a special dividend received from GlaxoSmithKline in April 2016, that’s a quite decent growth.

I target a passive income increase of at least 15 % each year and have been quite well on track so far.

April, May and June are my favourite dividend months. As the bulk of my investment portfolio consists of Swiss stocks (such as Nestlé, Swiss Re, Zürich Insurances etc.), my passive cash inflow is heavily concentrated on the second quarter of each year.

Defensive stocks provide portfolio stability and reliable organic growth

For Nestlé, my 2017 yield on cost (YoC) after witholding taxes is 3.8 % and taking into account the reimbursement with regard to the Swiss witholding tax (reducing the burden from 35 % to 15 %) my YoC stands at 4.9 %. In 2017, Nestlé hiked its dividend quite modestly by 2.2 %. In my view, slowing dividend growth is nothing to lament about as long as stocks of a solid company have been acquired at a fair price and such investment is held for the rong run.

Coca Cola’s growth prospects have been weakening, at least in the short and medium term. The company is in the midst of a huge transformation process refranchising its bottling operations and adapting to changing consumer taste. Taking this into consideration, the announced dividend of over 5 % is quite decent. My YoC stands at 2.5 % (net of taxes) and I expect that rate to climb quite nicely over time. Looking ahead, I am optimistic Coca Cola to become a leaner and significantly more profitable company with an even bigger brand portfolio and a broader economic moat.

The British company Diageo is the world largest producer of spirits (Johnnie Walker, Smirnoff, Baileys, Captain Morgan etc.) and of beer (Guiness). Diageo rewarded us shareholders with a nice dividend hike of 5 %. The company offers a Dividend Reinvestment Program (DRIP) allowing me to get my dividends in additional stocks. I expect the compound effect to work quite well in my favour over the next decades and substantially increasing my position in that wonderful company. Currently, my YoC is at around 3.5 %.

The British pharmaceutical company GlaxoSmithKline (with brands such as Voltaren, Panadol, Sensodyne, Aquafresh etc.) offers me a very decent YoC of 5.1 %. In combination with the company’s DRIP my stock count will increase significantly over the years.

Swiss insurances providing stable and strong cash payments

Over the last years, my insurance investments have paid off quite handsomely. Zurich Insurance and Swiss Re offer very attractive dividends and very decent YoC (especially when the reimbursement of the witholding taxes is taken into consideration). For Zurich Insurance, my YoC is 7.8 % and in the case of Swiss Re 4.1 %. These cash dividends have provided me with fresh funds to invest into new holdings in the past years and will do so in the future.

Cyclical stock OC Oerlikon and Hongkong & Shanghai Bank (HSBC): high dividend yield but no growth

The Swiss technology company OC Oerlikon provides industrial solutions for the productison of food, clothing, transportation system, infrastructure, energy and electronics. It’s a very cyclical business facing some headwinds especially in the near term, so no surprise that there was no dividend increase. Nevertheless, since I entered into my position some years ago, I have been rewarded quite handsomely. My current YoC stands at 4.3 %.

Presenting its 2016 full year results, HSBC announced to hold its dividend payments steady and to start another share repurchase program. The company offers so-called scrip dividends which means that investors can choose to receive stocks in lieu of cash dividends. The flipside is that the company issues new stocks (“scrip dividends”) leading – to some extent – to a share dilution. I acquired 466 shares in June 2016 at a price of GBP 4.6 and the invested amount was around USD 3’000. With my quarterly dividend income of around USD 100, my YoC lies above 10 % which is extremely high. The flipside of high yield stocks shouldn’t be underestimated but given the fact that I acquired the shares at an attractive price significantly below book value I am not too concerned with regard to setbacks in the near and medium term. HSBC’s 2016 results were disappointing and the company is clearly facing some headwinds in the near and medium term. But the bank’s core capital has also been significantly strengthened and the debt profile looks robust.

Remarkable recovery of mining companies

Amid collapsing resource prices, Rio Tinto slashed its dividends quite substantially in early 2016. Twelve months later, the financial condition of the company looks much stronger. Rio Tinto managed to pay down debts and generate strong free cash flow covering a substantial dividend increase. I expect my projected YoC for 2017 to be at around 3.8 %.

The metals and mining company South32 is a spin-off of BHP Billiton. South32 is mining and producing bauxite, aluminium, energy and metallurgical coal, silver etc. In my view, the company has been doing pretty fine so far. Free cash flow is positive, the debt level is low. Last year, the company paid out its first dividend. I received USD 1.32 and for 2017, I expect the payments (interim and final dividend) to be at around USD 10. That’s quite a nice development.

How was your April in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Very interesting analysis. Thanks for sharing your thoughts. I hope it an continue to provide you with some excellent income. Cheers

Hi BHL

Thanks! Yes I hope my portfolio to keep on track in terms of passive income growth.

Appreciate you stopping by and commenting.

Cheers