To me it is always fascinating how strongly people focus on their salaries as a kind of “well-being indicator”, which is quite illusive from a personal finance perspective.

Just think of that: a high income earner, making USD 600’000 and spending USD 500’000 annually and on the other side a middle income earner with a very decent salary of USD 60’000 and annual spendings of USD 30’000. After ten years, our high income earner has saved USD 1 Mio which is quite a fair amount, representing two times his resp. her annual spendings (for simplicity, let’s assume inflation rate to be zero resp. the annual spendings to stay constant). And what about our middle income earner? His resp. her nest egg would have grown to USD 300’000, representing ten years of the spending budget (again, we assume inflation rate to be zero for simplicity).

Ten years versus two years, what a huge difference!

So, which one of the two is “better off” from a personal finance perspective? Which one will be more likely to retire early and in comfort?

Having a good paying job is a great thing, but more importantly than making us consume and leading a pleasant life, money should give us flexibility. Spending everything or a huge portion of what we earn can easily make us stuck, trapped in a ratrace. How can you rise to the top of your capabilites and pursue dreams like that?

Most people don’t have an effective wealth accumulation process in place. The general misconception on wealth and income is deeply rooted in our society. There is no automatic translation of a high income into substantial wealth. In fact, the net worth of high earners is often relatively “unspectacular”. Living high alone does not make one a millionaire. And it does certainly not make one wealthy. What matters is not how much one earns but how much one is able to accumulate and to invest in productive assets. What matters is to put oneself in a financial and mental position in which one has options.

Mind your profitability

If you want to grow your wealth quickly and big enough to become financially independent, what really matters during your working career is the bottom line of your household, expressed as the savings rate. It’s the percentage of your income you are not spending. The higher that rate, the better. It gives you the possibility to invest and create different sources of income boosting your assets even further. A high savings rate makes you less dependent on a (high paying) job and gives you tremendous flexibility in life.

Money in (income) and money out (spendings) are the two levers and main drivers of your wealth accumulation process in the short and medium run. Over the long haul of course the compound effect can do miracles when financial assets generate passive income growing tremendously over time.

To me, it has always been very important to work with people I like and respect and having an interesting, fulfilling job. Salary increases just have not been that important to me. And yet, I am very keen on accumulating wealth. Contradictory? Well, not at all.

We accumulate wealth by controlling our spendings

Having a systematic approach to consistently work on our houesehold’s profitability by keeping spendings under control is the key driver in our wealth accumulation process. It’s that simple. Managing our cost structure, that’s what we can directly have an influence on.

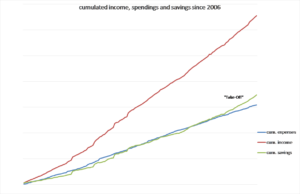

Since 2006, I have been tracking my income (take-home pay, dividends etc.) and our family’s spendings (rent, expenses for groceries, insurances, commuting etc.), as you can see on the chart above.

Income (red line) has been more or less constant over the last eleven years. And yet, since 2011 the monthly savings (green line) slowly but steadily increased and surpassed spendings (blue line) which implies a savings rate higher than 50 %.

It’s pretty simple: jobs provide income, they function as cash engines, but to translate these revenues into wealth, we must focus on the blue bottom line, the cummulated savings of our household. What we want is that green line to be as steep as possible.

In 2015, there was a real “take-off” with regard to our savings rate, climbing steadily from 50 % to well over 65 %. And here comes the thing: before we had children back in 2011, we saved much less than today. We focus on things that really matter in life (time with our love-ones etc.) and tend to be more conscous with regard to our spending habits which increases our profitability. From each Dollar earned we extract 65 % in savings, it’s a real turbo!

Saving to earn more Money

Not only does a high savings rate lead to more flexibility in life, it also creates headroom for investments which will also support our income performance over the medium term.

Currently, our stock portfolio contributes around USD 4’300 in annual passive income. Organic dividend growth is around 5 % and by reinvesting dividends and adding new positions each year, I expect that amount to grow by around 15 % year over year as it did in the past (see Passive Income Review 2016 and Outlook). That’s quite a decent growth rate, doubling my passive income every fifth year.

Over the last ten years, I’ve been consistently been buying shares of robust companies such as Nestlé, Walt Disney, J.M. Smucker, Diageo, Coca Cola, Heineken, Unilever, Exxon Mobil etc., and reinvesting the dividends. I don’t really care too much whether markets go up or down.

The process of building wealth through a down to earth life style makes strong and it is fun. Staying the course, having a long-term perspective and making sure to focus on what’s most important in life, that’s all to keep this wealth accumulation process running.

Well written. The best of all worlds is a high income with a low spending rate. If the $600k family lived on $30k then they’d amass a fortune rather quickly. You are doing an amazing rate of savings. I did fairly well at it, not quite like you, but did manage to early retire quite financially independent although I still earn what we spend doing some entertaining part time gigs. It is a lot of fun not having a JOB and still watching my net worth go up!

Hi there

Yes, earning USD 600’000 for example while consistently tackling lifestyle inflation to keep costs at USD 30’000 would be extremely effective, making Financial Independence possible in an amazingly short time (less than two years).

I like the point you are making with regard to Early Retirement: you are in a position to enjoy life even more as you don’t need to work FOR money. You can align your activities to your interests, pursue your passions AND you are still able to strengthen your financials even further. That’s great!

Appreciate you stopping by and commenting!

Cheers

I argue this same point with people all the time. I don’t care how much someone makes they could be in a horrible position financially. Nice work on that 65% savings rate. You can hang it up quick with that kind of savings.

Hi Grant

Thanks! Yes, it really boils down to the savings rate and I hope that we will be able to keep on track to achieve FI in a couple of years.

Appreciate your commentary!

Cheers