Over the first six months of 2017, my stock holdings have paid me the cummulative amount of USD 3’000 in dividends and I’m quite well on track for my full-year goal of USD 4’500.

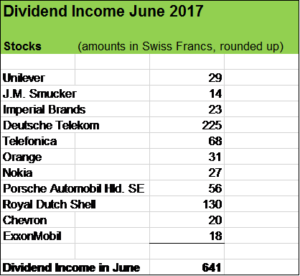

In June, following eleven businesses from four different sectors paid me dividends in the the amount of USD 640 :

- consumer staples: Unilever, J.M. Smucker and Imperial Brands

- telecoms: Deutsche Telekom, Orange and Nokia

- automobile: Porsche Automobil Holding S.E.

- energy: Royal Dutch Shell, Chevron and ExxonMobil

Consumer staples providing stability to my portfolio

I consider consumer staples and pharma companies (such as Roche, Novartis, Bayer, GlaxoSmithKline) as the backbone of my “stock holdings collection” and I focus on giving my portfolio an even more defensive shape over time. I want to participate in companies that have strong brands, great long-term growth prospects and a broad economic moat.

Unilever, the Dutch-British consumer goods company is one of my favourite positions (together with businesses like Nestlé, Coca Cola, Heineken and Diageo). Just think of that: 2.5 billion people use resp. consume Unilever products each day from one of its four segments:

- Foods (Knorr, Rama, Lätta, Maizena etc.)

- Refreshments (Lipton Ice Tea, Magnum, Ben & Jerry’s etc.)

- Personal Care (Dove, Axe, Rexona, Dusch Das, Signal etc.)

- Home Care (Omo, Persil, Coral, Cif, Skip etc.)

Unilever increased the quarterly dividend by 10 %, putting my forward didend yield on cost (YoC) to around 3.8 %.

Imperial Brands and J.M. Smucker are two positions I added recently to my portfolio.

The J.M. Smucker Company operates in three segments with strong brands:

- Coffee (Dunkin’ Donut, Folgers, Café Bustello)

- Foods (Jif, Pillsbury etc. )

- Pet Foods (Milk Bone, Meow Mix, Pup-Peroni etc.)

At least one of J.M. Smucker’s products can be found in 93 % of all U.S. households! I like the company’s strong position in these three very attractive sectors and of course the stability of a non-cyclical consumer company with a very strong Free Cash Flow and a dividend payout ratio of just around 30 %. My entry point for my J.M. Smucker position was at around USD 125, roughly 25 % below the all time high of USD 157 the stock marked in summer 2016. I am fine with that price, offering me a stake in a high quality company. Based on the low end of the full year guidance using an adujusted EPS of 7.85, I entered into my position at a P/E-Ratio of around 16.

J.M. Smucker is facing some headwinds such as increasing price pressure, changing consumer behaviour and moreover J.M. Smucker is still “digesting” the Big Heart Brands acquisitions made in 2015. Over the long haul however, I see attractive catalysts for growth. J.M. Smucker has a strong cash generation machine laying the ground to to invest into its businesses, realize synergies and cost savings programs, making innovations and bolt-on acquisitions (such as the recent purchase of Wesson Oil from its peer Conagra for instance). J.M. Smucker will pay down debts in order to reduce financing costs and the company is committed to increase dividends in high single digit range and repurchase stocks (around 3 % decrease of stock count). I expect the quarterly dividends to grow quite nicely over time.

Now let’s turn to the second acquisition I’ve recently made.

The British company Imperial Brands is the world’s fourth largest cigarette producer with brands such as Davidoff, Gauloise, West, Winston, Kool. Imperial Brands is also the world’s largest producer of cigars (Montecristo, Cohiba, Golden Virginia), fine-cut tobacco (Drum), and tobacco paper (Rizla, the world’s best-selling rolling paper). Imperial Brands has a 50 % stake in Habanos with its legendary cigar brands and the company also owns a logistic business which services tobacco and non-tobacco customers. I like the diversified business model and the strong financial fundamentals. Based on my purchase price of around GBP 35, forward P/E-ratio is below 14. My projected YoC is above 4.5 % and I expect my dividend income to grow by 10 % annually. Payouts are made quarterly (two smaller payments and two are larger ones) and the company also offers a dividend reinvestment program (DRIP).

Telecoms: interesting but tricky investments

Deutsche Telekom has been a very attractive investment so far, offering me currently a nice YoC of 4.5 % after the company hiked its dividend by 10 %. When I made my stock acquisition of Deutsche Telekom stocks in 2009, the dividend yield stood well above 7 % and the payout pattern has been quite bumpy, causing my YoC to fall to around 3 % in 2015 and then to “creep back” to around 4.5 % . Deutsche Telekom has returned to me around CHF 2’400 or almost 50 % of my initial investment of CHF 5’000 and together with a nice book gain of 50 % that position has been compounding 10 % annually over the last years.

Telefonica’s announced dividend cut early this year is very unpleasant, causing my YoC to fall to 3 %, but was of no surprise to me. In my Dividend Income Review November 2016 I stated that the high dividend payout level in combination with sluggish growth and weak credit profile is a drag to the company. In order to deleverage Telefonica had planned to sell some parts of its businesses and get significant funds through an IPO of its subsidiary O2 UK. After the Brexit vote in 2016, Telefonica scrapped that plan and now aims to deleverage organically. This is sensible, Telefonica does not need sell off parts of its business. Over the last years, I collected around 25 % of my initial investment in Telefonica and I am fine with the decision to set the dividend on a much more moderate yet more sustainable level. Over the medium and long term, Telefonica has attractive growth potential given its huge customer base (over 200 Millons) around the globe and strong position in extremely dynamic and attractive markets.

The French telecommunication company Orange reported solid results for 2016 and will increase the dividend by 8.3 % in 2017.

My investment in Nokia goes back to 2008, when I acquired the stocks at a price of around EUR 9. At that time, the company was the world largest producer of mobile phones. But as we all know, Nokia lost its competitive edge, revenues and profits dropped dramatically leading to huge losses and plummetting stockprice, leaving my position with a temporary book loss of almost 80 %. Nokia finally made a dramatic turnaround, sold its handset business to Microsoft in 2013 to focus on network products and services. In November 2016, Nokia completed the acquisiton of its rival Alcatel-Lucent in a all-stocks transaction making the combined company a real heavyweight in the network business. Nokia’s financial position has improved significantly and long term growth prospects look good, but the company is also facing tough competition and sluggish demand with regard to infrastructure products and services. Nokia has a great patent portfolio giving the company tremendous opportunities. For instance, in May 2017, Nokia and Apple announced that both companies had entered into an agreement in regards to a number of Nokia’s patents. Nokia will be providing certain network infrastructure products and services to Apple and Apple will carry Nokia digital health products in Apple retail and online stores. My stock position has recovered over the last few years and as of today, the price stands at around EUR 5.5 which still represents a hefty book loss of around 40 % but when factoring in the dividends collected since 2008, it looks less dramatic.

Porsche Automobil Holding S.E. offers investors a stake in multiple car companies

I have been shying away from investments in the auto industry for many years due to its high capital intensity and cyclical character. Trading at single digit P/E-ratios (just look at GM, Ford, Daimler Chrysler, BMW etc.) I still don’t see these company stocks as cheap especially when you consider the threat of industry disruptions (Tesla has the potential for a real technology revolution my view). But of course investments in the auto industry can be rewarding and I have to say that I am always fascinated by the strong brand loyalty people have with regard to cars. Just look at China for instance, where people are keen on German luxury cars such as BMW, Porsche, Audi and Mercedes Benz.

In my view, investments into the car industry require the widest possible margin of safety which I saw in 2015 in the midst of the Volkswagen Diesel Scandal in September 2015, putting automobile stocks under tremendous pressure.

I had an eye on Porsche Automobil Holding S.E. some time before when the stock price (for preferred shares) was around EUR 70 and amid the Diesel Scandal I saw my acquisition target getting slashed. I finally bought stocks for a very attractive price of EUR 35 representing a huge discount towards book value.

Porsche Automobil Holding S.E. is the major shareholder of Volkswagen AG, holding 31.5% of the bearer shares and of the majority of its voting rights (50.7%). Besides of that stake, Porsche Automobil Holding S.E. has around Bn. 1.5 USD in cash, it has practically no debt and litterally no overheads. In essence, Porsche Automobil Holding is holding Volkswagen stocks and cash. The company’s income derives from dividends it receives from the Volkswagen and of which a portion is returned to shareholders.

The Volkswagen Group is huge, besides the core brand Volkswagen it includes:

- Porsche

- Audi

- Lamborghini

- Bugatti

- Bentley

- SEAT

- Daccia

- Ducatti

- MAN

- Scania

Royal Dutch Shell, Chevron and ExxonMobil are real cash machines

These three oil giants have been streamlining their operations and lowering capital spendings leading to significantly improved cash generation.

Royal Dutch Shell has been my top dividend contributor since 2009 with YoC of 7.5 % providing each year over USD 500 in cash resp. the equivalent in stocks (as I usually reinvest the quarterly payments). Last year, Royal Dutch Shell acquired the British multinational oil and gas corporation BG Group. That step already shows significantly improved free cash flow. Royal Dutch Shell has been able to start deleveraging and will continue so over the years. I see great potential in that company which is much more resilient to price fluctuations than before.

I see Chevron in a much stronger position now than for example one year ago as extremely capital-intensive projects such as Gorgon and Wheatstone start production in 2017. This project ramp-up will have a huge impact on capital spendings and revenues and consequently boosting Free Cash Flow.

ExxonMobil increased its dividends by 3 %, that’s decent growth amid huge price pressure. Over the last years, ExxonMobil has been a very solid investment and I appreciate the company’s consistency with regard to its strategy and operations. And of course its sound financials.

How was your June in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Almost 650 in a month is fantastic, keep marching forward, great seeing what my friends over the pond are investing in 🙂

Hey Duncan

Thanks for those encouraging words. I’ll let the ball rolling, slowly and steadily my little passive income machine is gaining steam. I had a look at your stock portfolio, very solid companies and strong names. Glad to have you as fellow shareholder in KO, XOM, RDS, RIG.

Thank you for stopping by and commenting.

Brilliant month mate! Solid companies with a solid return.

Keep that up

Thanks mate! I’m very happy with my monthly passive income results so far and hope to be able to keep on track.

Appreciate your commentary.

Cheers

Congrats, really solid month! I like the company list too.

Thanks SLM, for the kind words.

Cheers

Looks like you brought in a nice amount for the month of June. Look forward to your July update. I see a lot of very solid names paying you last month. Build up that portfolio with the known dividend payers and you mitigate your risk or dividend cuts. Keep up the good work.

Hi DH

Thanks! Yes, I set my focus on giving my portfolio a more defensive shape by adding some solid businesses (such as Heineken, JM Smucker, Imperial Brands, Henkel, ReckitBenkisser) over the last months when I saw some nice entry prices.

Cheers