Hey there! Thanks for stopping by!

It’s time for an update on my monthly dividend income.

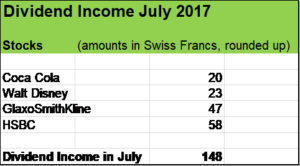

In July, Coca Cola, Walt Disney, GlaxoSmithKline and HSBC provided my with passive income of around USD 150, tripling my dividend inflows for that month year over year.

Well on track for full year dividend goal

Over the last seven months, my stock holdings have paid me the cummulative amount of around USD 3’200 and I’m quite well on track to meet the targeted full year dividend income of USD 4’500.

Since 2009 I set my focus on an annual passive income increase by at least 15 %. I target that growth through a combination of new stock acquisitions, dividend reinvestments and organic growth (dividend hikes).

As the bulk of my investments is in European stocks making their distributions once a year (e.g. Nestlé, Novartis, Roche, UBS, Zurich Insurance Group, Swiss Re, ABB, OC Oerlikon, Bayer, Porsche Automobil Holding SE, Deutsche Telekom, Orange etc.), dividend inflows are highly concentrated on the second quarter (April, May and June).

Compared to the previous three months, my July dividend income of USD 150 looks quite “modest” resp. “unspectacular” but due to the acquisition of the three very solid companies Coca Cola, Walt Disney and HSBC in 2016 my YoY-income for that month litterally jumped by 300 %! Let’s have a look at the positive impact on my portfolio through the acquisition of these great companies (see all My stock Investments in 2016).

My stock acquisitions in 2016 are paying off

In 2017, Coca Cola is contributing USD 80 (quarterly installments) to my passive income, Walt Disney USD 45 (semester dividend payments) and HSBC around USD 280 (four installments, whereas the fourth interim dividend is a larger one). I expect the received total amount of around USD 400 from these three businesses to grow in the high single digit range each year through dividend hikes and reinvestments of the distributions.

I acquired Coca Cola stocks in December 2016 at a price of USD 40.3 (including fees), shares currently trade at around USD 45. My entry price with regard to Walt Disney was USD 91.8, currently the stock is trading at around USD 100. HSBC stocks have been acquired at an attractive price of GBP 4.6 in June 2016, before the Brexit Vote. Currently HSBC stocks are trading at around GBP 7.65 representing an appreciation of almost 70 %.

But most important, I expect my stock holdings to support my passive income generation quite nicely over time.

How was your July in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Very nice YoY Growth! Keep it up 🙂

Thanks! I am happy with the results and will let the ball rolling.

Appreciate you stopping by and commenting.

Cheers

hi,

I am very happy with the dividend income for july, my Vanguard ETF rewarded me nicely, also got dividends from Cisco and Medtronic and something unexpected from Adecco,

however, there will be no dividends at all in August 🙂

must try and change that.

Hi Maximiliane

I’m pleased to read that you had a strong July in terms of dividend income, congrats!

With regard to August: Never mind about a month with no dividends, as long as there is progress year over year, that’s perfectly fine and your dividend growth machine is intact. Your portfolio will grow over time, get more diversified also in terms of passive income sources and inflows will occurr more evenly over the months.

Always appreciate your commentary.

Cheers

hi,

just bought some PSA shares, what is your opinion on Reit’s?

Cheers

Hi Maximiliane

I look at automobile companies from time to time and Peugeot’s latest financial results looked very solid. Good move also in my view PSA’s acquisition of Opel.

With regard to Real Estate Investment Trusts, they can be a good way for investors to generate strong cash flow resp. to diversify passive income streams. I have to say though that I’ve not yet investet in REITs, it seems to me that I have already some exposure to real estate markets via my bank holdings e.g. Banco Santander, LLB, VPB, HSBC etc. In the future I might have a closer look at REITs and would certainly focus on the strongest among their peers with compelling long-term growth prospects, rock solid balance sheet, superior business model and diversification (geographically, rental items etc.) being able not only to wheather economic downturns but also to take advantage of market oportunities.

Many thanks for your commentary.

Cheers

hi,

PSA is a Reit, I don’t think they acquired Opel, I am personally not looking at automobile firms. Next Reit might be Welltower or Realty Income, a monthly dividend payer.

There are so many firms I’d like to own, Starbucks should come a bit more down, still too expensive for me at the moment.

By the end of the year I hope to get 5000 CHF dividends, so we have the same goal, which is nice.

Thanks for your reply

take care

Oops, I obviously confounded the symbols.

I will definitively have a look at the three REITs you mention (PSA, Welltower and Realty Income). Interesting also to learn about companies paying dividends each month.

I am fully with you, there are plenty of great companies I’d be happy to own a piece of. Starbucks is definitively a business I have an eye on.

I am happy to read that you are targetting the same passive income amount for 2017 like me. Let’s work hard to make our “dividend machines” even stronger.

Cheers

Nice update. I’m pretty sure you’re going to crush your $4,500 target.

Hi IH

Thanks! Yes, it’s definitively moving into the right direction. USD 4’500 is a comfortable basis and I’ll work hard for future growth.

As always appreciate your continued support and commentary.

Cheers

Nice YOY increase! I’m a big fan of KO. I’ve only received part of my July dividend income because one of my holdings is in an employee share plan. For whatever reason, the payment is delayed. Nevertheless, I should receive it and get a post up by mid August. It won’t be as much as your July, but it will be an improvement over my June income. Thanks for sharing! I’ve been enjoying your blog and the creative style in which you present it in. Take care ????

Hi Graham

Always appreciate your comment and support.

Glad to read, that you had nice monthly dividend growth. Just great watching our ever growing dividend machines churning out cash, isn’t it?

I am a fan of KO too, it’s just such an amazing company and what a vast product and brand portfolio!

Happy you’ve been enjoying my blog.

All the best!

Nice growth,we have 2 common stocks in CO ,DIS.Some of them acquired 2 years ago.

Hi Desidividend

Thanks for your support. Pleased to have you as fellow shareholder in these two outstanding businesses.

Appreciate you stopping by and commenting.

Freaking love that year over year growth. Especially the statement about how past investments paid off in the current year. Guess what? This will continue to pay benefits for many more years to come. This is the power of dividend investing and why I love playing a role in this game. Take care!

Bert

Hi Bert

Thanks for the kind words and yeah, after having stated the seeds, I can clearly see how the dividend engine is gaining steam. As you say, it’s a great game to play.

Appreciate you stopping by and commenting.

Cheers

Great job with your passive income for the month of July. All very solid companies paying you and as you stated your seeds that you planted in 2016 are really starting to pay off in 2017. Keep up the good work!

Hi DH

Thanks for your continued support! Yes, I really feel comfortable with all four companies (KO, DIS, GSK and HSBC) contributing to my July dividend income as they are very robust businesses. All of them facing some short- and medium term headwinds, but fundamentals remain very strong.

Take care!

Financial Shaper