Since 2009 I have been building an investment portfolio consisting of dividend paying stocks with the purpose to transform it in an ever growing passive income machine over time.

Today, my stock portfolio consists of more than 30 positions and has a market value of well over USD 150’000. But more importantly, the companies in my share portfolio have returned a total of USD 20’000 in dividends since 2009 and will provide at least USD 4’500 in fresh cash for 2017. I expect my annual dividend income to continue to grow by 15 % on a Year on Year (YoY) basis. Half of that growth will derive from new positions (see My stock investments in 2016 and My 6 Investments made so far in 2017) and the other half is expected to come from organic dividend growth and dividend reinvestments (see Passive Income review 2016 and Outlook).

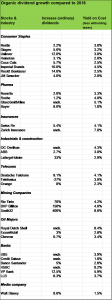

So far, all businesses in my investment portfolio have published their semester 2017 results and given information regarding dividend payments to be expected. That allows me to make some projections regarding organic dividend growth and my expected Yield on Cost (YoC) in 2017 regarding these positions which I sumarised in the chart above.

I calculate YoC on the basis of the net cash payments I receive resp. received from my stock holdings during 2017. For reasons of simplifications, I do not (yet) take into account reimbursements with regard to witholding taxes in the YoC-numbers. The Swiss witholding tax on dividends for instance is 35 %, quite hefty, but I can lower that tax rate to 15 % on the basis of a tax treaty. These reimbursements will take place in 2018.

My portfolio is denominated in Swiss franc and I hold major positions in EUR, USD and GBP so there might be some devations e.g. with regard to my projections concerning YoC due to exchange rate fluctuations. Over the long term, these fluctuations will smooth out and of course as an investor in the accumulation phase, a strong Swiss franc towards other currencies is a real blessing (see also The day when my portfolio dropped by 15 %).

Consumer staples

My 2017 YoC regarding Nestlé is around 3.8 %. After the reimbursement regarding the Swiss witholding tax that yield will substantially increase to 4.9 %. Nestlé hiked its dividend quite modestly by 2.2 %. In my view, slowing dividend growth is nothing to lament about as long as stocks of a solid company have been acquired at a fair price and such investment is held for the rong run.

The British company Diageo is the world largest producer of spirits (Johnnie Walker, Smirnoff, Baileys, Captain Morgan etc.) and of beer (Guiness). Diageo will reward shareholders with a nice dividend hike of 5 %. The company offers a Dividend Reinvestment Program (DRIP) allowing me to get my dividends in additional stocks. I expect the compound effect to work quite well in my favour over the next decades and substantially increasing my position in that wonderful company.

Unilever has been a very solid and reliable dividend payer in the past years and I expect it to be so in future. After the announced dividend hike of 12 %, my YoC will stand at 3.8 %. My holding in Unilever is in GBP which has depreciated quite a lot against the Swiss franc. Without that devaluation, my YoC would be significantly higher (but again to be clear, I am not complaining about a strong Swiss franc). Unilever’s brand portfolio with household names and products such as Lipton Ice Tea, Axe, Rexona, Knorr, Persil etc. is just amazing and – taking a long term view – fundamentals look very bright for that company.

In February 2017, I acquired 45 shares of the world second largest beer producer Heineken at a price of EUR 73. For me, it is the ideal long term investment. In addition to its core brand Heinken, the company has over 250 international and regional brands (Desperados, Sol, Tiger etc.). The business is very well positioned for further growth. Heineken offers a broad economic moat and stable free cash flow of which around 30 % is returned to shareholds each year. Heineken announced to increase its dividend by 3 %.

I am well aware that Coca Cola’s growth is slowing. The company is in the midst of a huge transformation process refranchising its bottling operations and adapting to changing consumer taste.Taking this into consideration, the announced dividend of over 5 % is quite decent. My YoC will stand at 2.5 % (net of taxes) and I expect that rate to climb quite nicely over time. Looking ahead, I am very optimistic Coca Cola to become a leaner and significantly more profitable company with an even bigger brand portfolio and a broader economic moat.

Imperial Brands hiked its dividend by 10 %, putting my projected YoC for 2017 to over 4.5%.

ReckitBenkisser boosted its dividend quite significantly by 14 %, projected YoC lies well above 2.5 %.

The J.M. Smucker Company elevated its dividend by 4 %, YoC currently stands at around 2 %.

Pharma

Like Nestlé and Coca Cola, the two Swiss pharma companies Novartis and Roche showed slowing growth in the past years. My YoC regarding Novartis lies at 3.3. % for 2017 and at 3.8 % for Roche. If I took into account the reimbursement of the Swiss witholding, the yield of Novartis would be 4.3 % and for Roche 4.9 %. So I am really not complaining about the modest dividend increases (Novartis hiked its payout by 2 % and Roche by 1.2 %). As long as the business fundamentals and the cash generation machines stay intact, I am more than happy with these two companies.

The British pharmaceutical company GlaxoSmithKline (with brands such as Voltaren, Panadol, Sensodyne, Aquafresh etc.) offers me a very decent YoC of 5.1 %. In combination with the company’s DRIP my stock count will increase significantly over the years.

Bayer operates in the segments pharmaceuticals, crop science, animal health and consumer health with well-known brands such as Aspirin, Alka Selzer, Bepanthen, Elevit, Supradyn, Rennie etc. Like in the previous years, the company increased dividends again quite nicely by 8 % and I expect it to do so in the future increasing my current YoC of 1.8 % over time.

Insurances

Over the last years, my insurance investments have paid off quite handsomely. Zurich Insurance (7.8 %) and Swiss Re (4.1 %) offer very attractive dividends and very decent YoC (especially when the reimbursement of the witholding taxes is taken into consideration). These cash dividends have provided me with fresh funds to invest into new holdings in the past years and will so in the future.

Industrials & construction

The Swiss technology company OC Oerlikon provides industrial solutions for the efficient production of food, clothing, transportation system, infrastructure, energy and electronics. It’s a very cyclical business facing some headwinds in the near term, so no surprise that there won’t be a dividend increase. Nevertheless, since I entered into my position in that company some years ago, I have been rewarded quite handsomely. Current YoC stands at 4.3 %.

My acquisition of stocks of the the Swedish-Swiss technology company ABB (Asea Brown Boveri) goes back to 2010. My YoC has steadily climbed, currently standing at 3.8 %. ABB is quite well positioned for future growth engaging in robotics and in the areas of power and automation.

From the perspective of a former shareholder of the Swiss construction company Holcim, the new company LafargeHolcim has a lot to prove after the merger with its French rival Lafarge in 2015. The acquisition has been expensive and and debt load has increased significantly. The combined company will have to realise synergies, optimise its cost structure, deleverage and – hopefully – take care of attractive shareholder returns over the years. LafargeHolcim presented solid first Semester 2017 results which looked quite promising to me. The company increased its dividend by 33 % and announced the start of a share repurchase program.

Telecoms

Deutsche Telekom has been a very attractive investment so far, offering me a nice YoC of 4.1 % after a dividend hike of over 9 %. That yield is particularily high taking into account the depreciation of the EUR against the Swiss franc since 2009 when I bought the stocks. At that time, the EUR/Swiss franc exchange rate was 1.4, today it stands below 1.1. Over the last eight years, I have collected dividends representing more than 40 % of my initial investment in that company.

Telefonica’s announced dividend cut is very unpleasant, causing my YoC to fall to 3 %, but was of no surprise to me. In my Dividend Income Review November 2016 I stated that the high dividend payout level in combination with sluggish growth and weak credit profile is a drag to the company. In order to deleverage Telefonica had planned to sell some parts of its businesses and get significant funds through an IPO of its subsidiary O2 UK. After the Brexit vote in 2016, Telefonica scrapped that plan and aims to deleverage organically. This is in my view sensible, Telefonica does not need sell off parts of its business. Over the last years, I collected around 25 % of my initial investment in Telefonica and I am fine with the decision to set the dividend on a much more moderate yet more sustainable level. Over the medium and long term, Telefonica has attractive growth potential given its huge customer base (over 200 Millons) around the globe and strong position in extremely dynamic and attractive markets.

The French telecommunication company Orange reported solid first semester 2017 results and increases its dividend by 8 %. It’s a fine business in my view but I clearly overpaid when I acquired stocks in 2010. A high price in combination with the devaluation of the EUR against the Swiss franc and a hefty French witholding tax leads to a relatively modest YoC of 2.3%. But as said, I like the company and am optimistic about its long term growth potential.

Mining companies are back in the game

What a huge difference eighteen months can make. In spring 2016, amid collapsing resource prices, earnings of BHP Billiton and Rio Tinto came under enormous pressure, both company slashed their dividends quite substantially (in the case of BHP Billiton by around 70%). Streamlined operations in combination with a strong price recovery led to very solid financial performances of all mining companies in 2017. BHP Billiton more than doubled its dividend putting my YoC for 2017 to around 4 %, Rio Tinto’s YoC lies at around 4.2 % after a nice hike of 70 %. Both companies managed to generate enough cash to finance their operations, make investments, increase their payouts to shareholders and to reduce their debt level. South32 has been doing particularily fine since the spin-off of BHP Billiton in 2015, paying very attractive dividends which correspond to around 8 % of the market value of the South32 shares I received at the time of the spin-off.

Oil majors

Royal Dutch Shell acquired the British multinational oil and gas corporation BG Group last year and has made significant progress by improving free cash flow, streamlining the combined company and realizing synergies. It also began to deleveraging and will continue so over the years. I see tremendous potential in that company which is one of my most important dividend payer contributing over USD 500 per year which I consistently reinvest into the same company. Since 2009, my stock count has grown by over 50 %.

ExxonMobil increased its dividend by 3 % and Chevron by 0.7 %. I am quite optimistic that these companies will increase their dividend in the future given the recovery of the oil price and their improving Free Cash Flow.

Banks

UBS is the largest Swiss bank and experienced a deep transformation since the financial crisis shifting the company’s focus on wealth Management while downsizing its investment banking operations. The bank offers me a nice YoC of 3.9 % (last year even higher due to the payment of a special dividend).

The second largest Swiss bank Credit Suisse has been a huge disappointment to shareholders in the last years. The bank manouvred quite well through the financial crisis but significantly failed to take profit of its strong position. Credit Suisse missed to strenghten its core capital, to improve its cost structure and increase profitability. In my view it was very late, when the company finally decided to raise its capital and implement a fundamental transformation process. Over the next five years there is a lot of homework to do for that company. My YoC of 1.8 % is relatively low, and given the low market price I reinvest my dividends into the same company in order to increase my share count and average down the price I paid for the shares in 2010.

In my view the Spanish lender Banco Santander has bright growth prospects over the medium and long term. Three of the quarterly dividends are paid in cash and one payment is made in stocks if the shareholder chooses so. Given the latest solid dividend hike of 5 % I am quite optimistic that stock count and my YoC will steadily rise over the years,

HSBC will hold its dividend payments steady and continue its share repurchase program. The company offers a DRIP and given the high YoC of 8.2 %, my share count will inrease nicely over time.

Besides my stock holdings in financial services giants HSBC, Banco Santander, UBS and Credit Suisse, I have two small regional banks in my portfolio: Liechtensteinische Landesbank (LLB) and Verwaltungs- und Privatbank (VPB). These Liechtenstein banks with a strong focus on retail- and private banking made remarkable progress over the past two years with very solid top line and bottom line growth. LLB hiked its dividend by 6 %, putting my YoC to around 3.7%, dividend growth of VPB was even stronger (12.5 %), my YoC for that investment lies at around 5.9 % for 2017.

Media company

So far, Walt Disney is the only media and entertainment company in my portfolio and one of my favourite stock holdings. Fundamentals and growth prospects look bright despite some headwinds in the near term (see Disney is a wonderful company but is the Price fair?). After a strong dividend increase of 8 %, my YoC will stand at 1.5 % and – hopefully – climb over the years.

What about your stock holdings? Have there been some nice dividend hikes? Any dividend cuts?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Thanks for sharing your recent dividend increases! I appreciate your business-like approach to managing the cash flow of your portfolio. Those drips are gonna do wonders for your portfolio over the next decade. I definitely plan on adding a few of your holdings to my portfolio in the long run. The sooner the better. I recently got increases from CM and RY. Fortunately, I’ve never experienced a dividend cut yet. Thanks again for sharing!

Hi Graham

Yes, I really see a stock portfolio as a small business, growing at a fascinating pace. I think you and I have quite a similar perspective, when it comes to investing and finances in general.

Pleased to read, that you had nice increases from CM and RY. These investments will serve you well, a solid basis for further growth for your stock portfolio.

With regard to dividend cuts I have quite an ambivalent view: on one side, cuts mean significant setbacks, after all, we want passive income sources to become stronger and it is never a good sign, when a company is forced to slash dividends. However, when I look at my mining companies (Rio Tinto, BHP Billiton) for instance I see it quite differentiated. It just took 18 months and these businesses are now stronger than ever before and have recently been re-establishing their dividend payouts. So, I am prepared to “forgive” BHP and Rio Tinto their dividend cuts in early 2016 as I have been rewarded for my patience. But of course, it always depends. I hope, Telefonica will resume its very attractive dividend policy as soon as the company has been able to deleverage significantly.

Always a pleasure to read you commentaries, Graham.

Take care.

Awesome list of companies offering some generous increases! I really enjoyed this article as it has given me more insight into stocks outside of my country. I think it would be an awesome fit for my portfolio if I added a few of these historic names to the holdings. Keep up the great work and you are on a record breaking track!

Cheers

Hey Diligent Dividend

Thanks, I am glad you enjoyed my article about my stock holdings.

Yes, some international diversification can be quite useful. The bulk of my portfolio still consists of Swiss companies, but there are such great US, German, UK businesses. There exist some very few companies which are so unique, that it is merely impossible to find an investment of equivalent characteristics or quality in the respective home market. Just take The Walt Disney Company or The Coca Cola Company; there’s no equivalent media company or such a leading beverage business in Europe. And when it comes to beer for instance, the Netherland Heineken Company is my favourite.

Another aspect is the price. Sometimes, quite similar companies differ quite remarkably with regard to P/E-Ratio and other multiples/metrics from country to country. That’s for example why I chose Unilever over Procter & Gamble as Investment in 2015, as UN seemed to me more attractively priced at that time.

Appreciate you stopping by and commenting.

Cheers