Wow! Time passes so quickly, three quarters are already in the books.

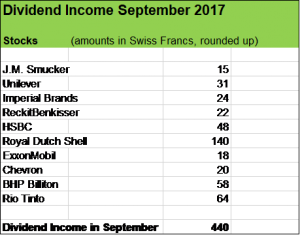

September was a very good month in terms of dividends with ten companies paying me the amount of around USD 440, that’s an increase of almost 20 % year to date, putting my investment income over last nine months to around USD 3’700.

I am well on track to reach my full year goal of USD 4’500 in dividend income.

Organic dividend growth really was the key driver

In my latest post, I gave a summary of stock holdings in my portfolio boosting their payouts. On a year to year basis, my September dividend income from the two mining businesses BHP Billiton increased by 200 % and in the case of Rio Tinto by 180 %. September dividends from Unilever are 16 % higher than last year. These payout hikes contributed handsomely to my dividend growth for that month compared to the previous year.

Royal Dutch Shell and HSBC held their dividends steady, my stock count increased by around 8 % due to reinvestments. It’s just amazing, these two positions will double each decade.

Dividends of Chevron and ExxonMobil are slightly higher than last year.

J.M. Smucker, Imperial Brands and ReckitBenkisser are relatively new positions I added this year. As I’ve stated in my previous blogposts, I want to give my portfolio a more defensive shape over time.

The flipside of a bull market

As we all know, the stock market really has been a raging bull over the past years producing some quite nice book gains in my portfolio as well. One year ago, the market value of my stock holdings was around USD 100’000 and now sits at around USD 162’000. That’s quite a nice increase, even when considering my six investments made in 2017 and my purchases of Disney and Coca Cola stocks late in 2016.

The downside of that tremendous market upbeat?

Well, for an investor in the accumulation phase, new positions become more and more expensive. I only buy stocks I am willing to keep for decades, what I want is to build an ever growing passive income machine. So to allocate my savings effectively and to take profit from the power of the compound effect, more moderate price levels would be favourable.

Don’t take me wrong. I’m certainly not gonna complain about the fact that my stocks are growing in market value. I don’t care too much about market movements.

I look at the profitability of the businesses and will certainly keep some of my powder dry. Keeping some cash makes a lot of sense in order to take profit of a market retreat.

But even with markets at all time highs, there are still some companies that caught my eye, such as consumer staple companies (KraftHeinz, General Mills, Kellog, Anheuser Bush etc) or businesses in the insurance sector.

New stock holding in my portfolio: Legal & General

Early in October, I acquired 950 shares at a stock price of around GBP 2.58.

Legal & General Group plc is a British financial services company headquartered in London offering following products and services:

- life insurance

- general insurance

- pensions and

- investment management

Legal & General has a particularily strong footprint in the UK but also in the United States. The company also has strong investment businesses amongst others in Europe and Asia.

Legal & General shows a hugely profitable business model. Financial fundamentals are pretty sound and I’ve been more than pleased to enter into that interesting position, offering me a forward dividend yield on cost of well above 5.5 %.

How was your September in terms of dividend income?

Did you add some stocks to your portfolio?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Congrats on the awesome month! $440 is a solid amount! And reaching $4,500 this year will be an amazing milestone. My September was good in terms of percentages. It was up over 2016 and it was increased August 2017 as well. But my portfolio is small and still has a long way to go. I’m hoping to earn at least $300 in 2018, $600 plus in 2019, and $1,000 plus in 2020 if I’m being realistic. But hopefully I can reach more sooner through savings and earning more. Thanks for sharing! Keep it up 🙂

Hey Graham

Thanks for your continued support! Yes, achieving my full-year goal of USD 4’500 is an exciting milestone, just can’t wait to put my September dividend income to work.

I like your approach of setting dividend income targets for the next years. We are in that game for the long run. Your goals keep you focused on what really matters. Your savings rate and your investment approach are the perfect ingredients. Great to have you as a fellow dividend growth investor.

Cheers

You had a pretty good month! Those dividend increases are really good indeed and nicely enhance your overall return and portfolio value!

Hi Team CF

Appreciate your kind words! It’s amazingly motivating, how the snowball effect starts to show up. One year ago, my portfolio exceeded USD 100’000, the symbolic threshold. It took me YEARS to achieve. And now, only 12 MONTHS later, the portfolio value is almost 65 % higher. That’s the magic of the compound effect.

Thanks for stopping by and commenting.

WOW! Amazing dividends overall and nice monthly increase. I had about 146$ in dividend for September. You are definitely on your way to financial independence!!

Hey DG

Thanks for your encouraging words. There is some nice momentum, powered by our solid savings rate, growing portfolio value plus incrasing passive income. My path towards FI is become more and more fun.

Appreciate you stopping by and commenting.