Hey there fellow reader, thanks for stopping by!

It’s time for another dividend income update, so let’s take a short look back at October.

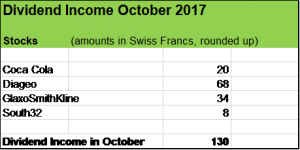

Coca Cola, Diageo, GlaxoSmithKline and South32 together paid me the amount of USD 130, representing quite a nice increase of 27 % compared to my last year October dividend income, putting cash inflows from my stock holdings to around USD 3’850. I am well on my way to hitting the full year target of USD 4’500 and together with interests payments from my bond investments, total passive income amounts to around USD 5’000.

It’s just amazing, each time when I think of that: on average, my portfolio is already pumping out around USD 420 each month! That’s making USD 13.70 a day without lifting a finger. And here’s the funny thing: by reinvesting USD 5’000, my 2018 passive income will increase to around USD 5’150. Withouth adding any new funds, without breaking a sweat!

It’s not just me working hard on my day job, improving my financial shape, increasing my savings rate in order to invest. My investments are now beginning to work for me just as hard.

My stock portfolio, consisting of around thirty businesses is considered to provide me with income for life. That’s why I focus on real cash machines, companies with a broad economic moat. And I want them to grow and pay me more and more money each year.

Coca Cola and Diageo have been among my stock acquisitions in 2016 and I’m particularily happy to have such rock solid consumer staples in my portfolio! Just think of their compelling brands, in the case of Diageo with beer such as Guiness and spirits such as Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Don Julio and so on. And each time someone is drinking a Coke, Fanta or Sprite, he’s supporting my quarterly dividend income I receive from The Coca Cola Company.

My portfiolio definitively has a more defensive shape today than a couple of years ago. I added stocks of strong businesses such as Unilever, Heineken, J.M. Smucker, Henkel, ReckitBenkisser, Imperial Brands. These companies are at the core of my share holdings, and of course there is Nestlé, which is kind of one of my “flagships”. These companies provide me with a reliant and growing stream of income and give my portfolio stability.

In contrast, being a shareholder of GlaxoSmithKline, it’s more like travelling on a bumpy road. GlaxoSmithKline is for very patient income investors being willing to see the quality of that business. Don’t get me wrong! Over the last decade, GlaxoSmithKline has been stagnating, at best. Growth is sluggish, there is pressure from generic competition and the company’s payout ratio is by far too high for my taste. Would I be surprised to see GlaxoSmithKline scaling back its dividend in the medium term? No, not at all. Why do I still stick to that company? Well, first of all, a dividend cut by far does not mean the end of a business. Just take Rio Tinto or BHP Billiton for instance: I am very glad, that I held these businesses despite them slashing their dividends early in 2016. I have been rewarded for being patient.

I can still remember, when I acquired stocks of Zurich Insurance at a Yield on Cost of around 8 % back in 2010. For almost eight years now, I have read and heard again and again that “a dividend cut is just around the corner”. Well, guess what: in the meantime, I collected almost 65 % of the acquisition price in form of dividends and the book value increased handsomeley. Zurich Financial held its dividend payout stable over the years and I wouldn’t be too surprised to see a nice hike next year. Just thinking of all that cash provided by Zurich Insurance to me in order to be invested into new positions, I couldn’t be any happier with that company.

In the end, it boils down to one thing that matters: you have to think for yourself when investing and always make sure that you feel comfortable with your decisions and always know what you are doing. And yes, of course there is a flipside of high yield stocks.

So, looking at the facts, GlaxoSmithKline has traditionally been very generous to shareholders. And man, we are talking about a very well established pharmaceutical company having been successful for over 100 years and always able to adapt to customer’s needs. I just like its high quality assets and strong brands such as Odol, Dr. Best, Sensodyne, Voltaren, Fenistil, just to name a few. These products are not going anywhere. Slow growth of a company really is nothing to lament about.

GlaxoSmithKline still is a cash machine and it offers me a Yield on Cost of well above 5 %. I will put these dividends to work by reinvesting them and adding new shares each quarter. I am looking forward to seeing my share count increasing handsomely over the long run.

So, let’s come to the metals and mining company South32, which is a spin-off of BHP Billiton. Over the last two years, the business has done a very good job, Free Cash Flow has improved significantly, debt level is low for a company in the commodity sector. And most important for me as a dividend growth Investor: the company more than quintupled its payouts to shareholders.

That’s the way I love it. Organic dividend growth, strengthening my passive income machine even further.

How was your October in terms of dividend income?

Did you add some stocks to your portfolio?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Looks like a solid showing for the month of October. KO and DEO have been with me for many, many years with no plans to sell either for the foreseeable future. Keep sticking with those solid consumer staples. It’s my favorite sector overall. Look forward to seeing Nov. results.

Hey DivHut

Yeah, KO and DEO definitively belong to my favourite holdings, together with Nestle and Unilever. These are such solid, wonderful businesses, I’d be happy to hold for decades (or even forever).

Thanks for your support and for commenting.

Cheers

hi,

October was a very good month for me, Cisco, Medtronic, and Diageo, and my Vanguard ETF’s, a total of 677 CHF, November hardly any Dividends, only 43 CHF from Hennes &Mauritz, but….I got my money from taxes (Verrechnungssteuer) and so that was a good month too.

In October I bought Enbridge and stocked up on Fresenius, in November I bought Reckitt Benckiser and stocke up on British American Tobacco,

Next month I will stock up on Zurich Financials or Swiss Re, so nice to see the money come in,

wishing you a lovely Xmas time 🙂

Glad to read, that you had a very solid October in terms of dividend income. Me too, I am looking forward to some reimboursements with regard to the Swiss witholding tax (Verrechnungssteuer) on my holdings such as Nestlé, Roche, Novartis, ABB etc.

Congrats on increasing some stocks positions, I particularily like ReckitBenkisser. I’m thinking about picking up some more shares and also stocking up Imperial Brands quite a bit.

Interesting to read that you have an eye on Zurich Financials and Swiss Re. These are such solid income plays, I have been holding stocks of these companies for some years now and also was thinking of increasing my positions. They are not as cheap as they were a few years ago though, that’s why I focus more on British Insurance companies such as Aviva and Legal & General as they seem a bit less richly valued.

Wish you a wonderful Christimas Time!

Cheers