With only few days left in 2017, my November passive income review is more than due. So let’s have a quick look at the numbers.

Dividend income over the last eleven months stands at around USD 4’000, interest income from bonds and on my savings account in that period amounts to over USD 500 resulting in a total passive income of roughly USD 4’500.

Almost 90 % of my full year target of total USD 5’000 has been achieved and the final month is running. I have strong dividend payers on my December list, so I am pretty well on track to hit my goal.

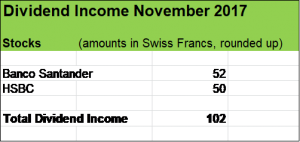

Solid bank dividend income

In November, the Spanish Banco Santander and the British HSBC paid me USD 102.

Last year in November showed a higher dividend income of around USD 158. This difference is due to changes of the timing of some dividend payments; for whatever reason, this year my semester dividend income from Telefonica was credited in December while in 2016 I received the payout in November. On the other side, my HSBC dividends were credited already in November in contrast to last year, when I received the payout in December.

So, there where some minor changes in terms of timing of some cash inflows but these effects don’t matter when taking a full year perspective.

Both positions, Banco Santander and HSBC showed nice growth in terms of dividend contributions. In the case of Banco Santander, income was 13 % higher due to a combination of

- a dividend hike of 5 %,

- an increase of the share count (one of the quarterly dividend instalments is paid out as new stocks and

- a favourable development of the EUR-Swiss franc exchange rate

Dividend income from HSBC is around 6.5 % higher. The company holds its dividend payments steady and continues its share repurchase program. HSBC offers a Dividend Reinvestment Plan (DRIP) and given the high yield on cost, my share count will inrease nicely over time.

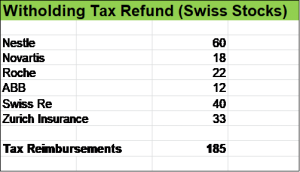

Tax witholding refund on my Swiss stock Holdings

In my monthly dividend reviews, I show the net after taxes amounts of the payments I receive from my stock holdings.

The Swiss withholding tax on dividends is 35 % and in case of a double taxation treaty with the country of the investor, twenty percentage points can be reimbursed to that investor to lower the tax rate to 15 %. With regard to dividends from six of my Swiss stock Holdings in 2017, I will get a refund of CHF 185. That amount will be credited to my bank account in 2018.

Taking these reimbursements into account, my 2017 Yield on Cost with regard of following holdings are very attractive:

- Nestlé: 4.9 %

- Novartis: 4.3 %

- Roche: 4.9 %

- ABB: 3.8 %

- Zurich Insurance: 7.8 %

- Swiss Re: 4.1 %

What about you, fellow Reader? How was your November in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply