Earning some money without breaking a sweat really is a cool thing.

And compared to last year, my portfolio grew significantly stronger, transforming into a real cash machine. It’s just great so see the passive income snowball growing at a faster pace.

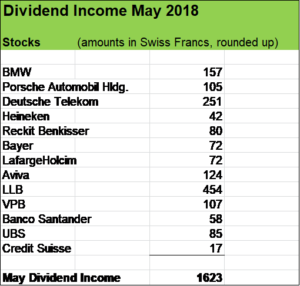

Now, let’s have a look at my monthly dividend update

May was great month in terms of cash payments received from thirteen companies. Year over year, my passive income for that month doubled, increasing from 806 in May 2017 to over USD 1’600.

That boost was due to following four factors:

- Very robust dividend hikes from the great majority of my stock holdings. Organic growth of shareholder distributions from positions I already held in May 2017 was over 12 %;

- The addition of following new share positions now contributing to my dividend income in May: BMW, Reckit Benkisser, Aviva;

- Favourable exchange rate movements (e.g. EUR/CHF is roughly 7 % higher than last year), leading to stronger cash dividend inflows credited on my bank account which is denominated in Swiss Francs;

- Change of dividend payment dates of Deutsche Telekom and Porsche Automobil Holding SE (last year, I received these dividends in June)

A brief look at my Dividend Contributors in May

Germium premium car maker BMW boosted shareholder distributions by 14.3 % and Porsche Automobil Holding even hiked the dividend by an amazing 74 %. In my post “Let’s talk about cars and investing” I wrote about the specifics of stock investments made in the sector. I am pretty fine with my holdings in BMW and Porsche Automobil Holding offering me attractive Yields on Cost and good growth prospects. But of course I am also well aware that such companies operate in a highly capital intensive and very cyclical industry.

Deutsche Telekom increased its dividend by 8.3 % and I have to say, that over the last 8 years that stock position has been a very good cash contributor (see also my post “The flipside of high yield stocks“).

Dutch beer company Heineken increased the semester dividend by a healthy 9.7 %. I really love refreshing investments!

Reckit Benkisser hiked its distribution by 7 %.

Bayer’s 2017 full year results and 3.7 % dividend increase were lower than I’d expected. The company has a wonderful product portfolio with brands such as Aspirin, Alka Selzer, Bepanthen, Elevit, Supradyn, Rennie etc. and a very strong and diversified business model operating in the four segments pharmaceuticals, crop science, animal health and consumer health. I would have preferred the focus on organic growth instead of acquiring Monsanto. Bayer takes on a lot of debt and is selling some very lucrative assets, e.g. it significantly reduced its stake in Covestro which has been a real cash cow for Bayer for years. Time will tell how the merger with Monsanto will turn out over the medium and long run.

LafargeHolcim held the annual dividend payout steady. Fair enough, from 2016 to 2017 the company boosted its distribution by 30 % and I wouldn’t be too surprised to see a nice upbeat next year.

British insurance company Aviva increased its semester dividend by 18 %.

Liechtensteinische Landesbank (LLB) boosted its annual payout by 17 % and the Verwaltungs- und Privatbank (VPB) even by 22 %. Over the past years, small regional banks with a strong focus on retail and private banking clearly overtopped their much larger peers in terms of profitability and dividends, offering me very attractive Yields on Cost (LLB: 5.5 %, VPB: 6.8 %). UBS hiked its annual dividend by 8 %, Banco Santander’s quarterly dividend payout climbed once again by 5 % and Credit Suisse in contrast slashed its dividend.

Putting more money to work, topping up my stock Position in British insurer Aviva

Over the last five months, my investment portfolio has been churning out almost USD 4’000 in cash ready to reinvest in order to grow my passive income machine even stronger.

I took the decision to more than double my position in Avivia by adding some 520 additional shares which will increase my forward dividend income to around USD 6’400 for 2018 (my passive income target (dividends & interests) for the year is USD 7’000).

I have been following the progress of Aviva mady over the last years, the company has substantially improved its profitability. And Aviva pledged to increase its top- and bottom line results even further and return cash to shareholders in form of nice dividends and share repurchases. British insurer Aviva is a high profile company whose stocks clearly fit into my investment portolio very nicely.

What about you, fellow Reader, how was your month in terms of Dividends?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hey MFS. Congrats on the excellent month! Your portfolio is turning into a money machine. I own DTEGY and have been very happy with its performance.

After buying in 2012, I sold my Monsanto shares for a nice profit earlier this month. My price was just below the target sales price in the Bayer transaction, and I figured there was very little upside (and a lot of downside if the sale does not goes through) in holding on to the stock. I am not sure about buying Bauer however. Would you buy now if you do not already have a position?

I’m looking forward to your next update!

Hi Dividend FIREman

Many thanks, I am very happy with the strong dividend growth.

With regard to Bayer: I bought my stocks some months before the management announced their plan to acquire Monsanto and was a bit surprised, my rationale to invest was to take a position in a defensive company with a very good track record in terms of organic EPS-growth, a very decent dividend policy and relative moderate debt Level. The combined company (Bayer & Monsanto) will have another risk-profile in my view, there will be more cyclicalicy and of course much more leverage. The price resp. premium Bayer was willing to pay for Monsanto seems not overly high but they are acquiring a massive business, by far the largest takeover they have made and I wouldn’t be too surprised if the integration would be tough and synergies take several years to effectively materialize leading to good accreditive growth. But also to be clear, both are fine businesses and the combination could lead to very attractive results. But it will take years. So, for me personally, it is a position I am willing to hold for the long term but as said, “Bayer combined” is not the kind of company I had initially planned to acquire. If had known about their plan to buy Monsanto, I’d be kind of hesitant.

Thanks for stopping by and commenting.

Cheers

Hi FS,

Amazing to see what progress your portfolio has made in recent months. It‘s truely a real cash cow by now!

Our dividend income in May was not as high as yours. Nevertheless, it was our best month in 2018 so far, as we almost reached €500. This has mainly to do with the dividend policy of German companies, since – as you might know – most of them pay out their dividend only once a year in May.

Surprisingly, it seems like the two of us only have one German company in common and that’s BMW. I also doubled my position in the premium car maker in March. However, it‘s (unfortunately) still one of my smaller holdings.

– David

Hi David

Thanks, it’s really cool to see my portfolio generate these cash flows.

Glad to read you had a very successul month too, your YoY-growth is very impressive and I like your stock holdings. Very solid names such as Munich Re, Japan Tobacco etc. and of course BMW. Happy to have you as fellow shareholder in that strong German premium car company. I also like your move having doubled your position and strengthened your cash inflows from BMW.

Thanks for swinging by and commenting.

Cheers

Financial Shaper,

What an excellent month. Over a 100% increase. Are you kidding me?? Keep up the great work and keep up the hustle my friend.

Bert

Hi Bert

Thanks mate, I’ll definitively keep the ball rolling, building on that strong momentum.

Appreciate you stopping by and commenting!

Cheers

Congrats on that awesome doubling of your income year over year. That’s a pretty insane growth rate. Keep adding those top quality dividend payers and watch that snowball continue to produce for you. I wish I has some exposure to Reckit Benkisser. That’s a company with so many strong brands under its belt. Thanks for sharing.

Hi Keith

May was just an amazing month in terms of dividends. I am particularily pleased with the good organic growth, I hope these holdings keep their dividend growth rate.

With regard to Reckit Benkisser: yes, it’s such a great company, I see it like a combination of Unilever, Henkel and Nestle; just with superior growth prospects and more attractive margins.

Thank you for commenting!

Cheers

Pingback: May Dividend Income from YOU the Bloggers! - Dividend Diplomats