Robust passive income result for the month despite change of dividend payment dates

I consider dividend growth investing as one of the best ways to build a very strong and growing source of passive income. As time passes, it is possible to earn A LOT OF MONEY just from dividends alone.

I run my small investment portfolio (current market value slightly above USD 200’000) like a mini-enterprise. I see investing as a hobby AND as the perfect business model to generate income for the future. I enjoy working at my day job WHILE my stock holdings are churning out cash without me breaking a sweat. That’s pretty cool!

So, let’s take a look at the current month in terms of dividend income.

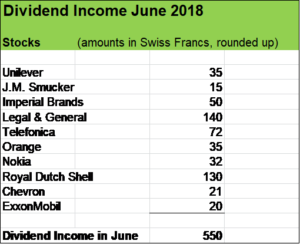

In June, ten companies from four different sectors paid me the amount of around USD 550.

- consumer staple businesses: Unilever, J.M. Smucker and Imperial Brands

- telecoms: Telefónica and Orange

- energy: Royal Dutch Shell, Chevron and ExxonMobil

- insurance: Legal & General

Last year, my June dividend income was at around USD 640, 16 % higher. However, there is a “technical effect” to consider, as two businesses in my portfolio changed the payout month.

Deutsche Telekom (paying me USD 251) and Porsche Automobil Holding S.E. (my 2018 income: USD 105) , having distributed their dividends last year in June for whatever reason decided to make their payouts in May.

Without that “technical effect”, my June 2018 dividend income 2018 would be USD 906, showing an increase of over 40 % compared to the previous year!

That improvement was due to following four factors:

- good organic growth with some very nice dividend hikes (Unilever: + 12 %; J.M. Smucker: 4 %; Imperial Brands: + 10 %; Porsche Automobil Hldg.: + 74 %; Orange: + 7.7 %; Nokia: + 11.7 %; Exxon Mobil: + 6.5 %; Chevron: + 3.7 %);

- one new stock position: in 2017 I acquired 950 stocks of Legal & General contributing for the first time to my passive income;

- dividend reinvestments in existing position of Royal Dutch Shell;

- favourable exchange rates: compared to 2017, the EUR/CHF exchange rate is roughly 7 % higher, the USD and GBP have also strengthened against the CHF quite a bit, leading to higher passive income denominated in CHF.

Over the first six months, my investment portfolio generated roughly USD 4’500 which is almost 50 % higher than last year. And I am well on track to meet my full year goal of USD 7’000 in passive income.

And I want to keep building that dividend income stream by putting money to work whenever possible.

Participating in Bayer’s capital increase

Early in 2016, I bought 30 shares of Bayer. In May of that year, Bayer publicly disclosed to make an all-cash offer of USD 62 Billion to acquire the agriculture company Monsanto. Over 85 % of the offered amount has to be financed by a combination of debt and equity through a capital increase where existing shareholders receive for each share one subscription right. For every 23 rights, 2 Bayer shares can be bought at a price of EUR 81 which represents quite a nice discount (current market price stands at around EUR 97).

I bought 16 additional subscription rights allowing me to buy 4 Bayer shares for EUR 81 each resulting in an average stock price (including fees and the costs for the purchase of the subscription price) of around EUR 91. All in all, I am investing EUR 365 to increase my Bayer position by over 10 % which will lead to increased future dividends from that holding.

What about you, fellow Reader, how was your June in terms of dividend income? Did you make a nice stock buy recently?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.