Hi there, fellow Reader! I wish you a Happy New Year!

I’d like to share with you a look back at our December dividend income, generated by our stock portfolio (the full year passive income review and outlook will be covered in my next post).

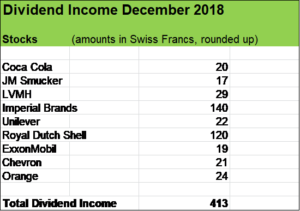

In the last month of 2018, nine businesses paid us the net amount of roughly USD 413 which represents an increase of roughly 23 % compared to the previous year (2017: USD 336).

That income boost in December was mainly due to the substantial built up of our position in tobacco giant Imperial Brands and the “brand new” position in French luxury goods company LVMH.

Compared to December 2017, there were some very nice developments in terms of shareholder returns in form of dividend hikes and/or stock buyback programs:

- Coca Cola: dividend increase by 5.4 % plus share repurchase program

- JM Smucker: dividend increase by 9 %

- Imperial Brands: dividend increase by 10 %, furthermore announcement to sell non-core assets in the amount of roughly USD 2 Billions to deleverage and make additional returns to shareholders

- Unilever: dividend increase by 8 % plus stock buyback program

- Royal Dutch Shell: quarterly dividends kept flat, announcement of share repurchase prorgram

- Exxon Mobil: dividend increase by 6.5 %

- Chevron: dividend increase by 3.5 % plus start of share repurchase program

- Orange: dividend increase by 7.7 %

So, our final dividend month was pretty successful. And what better could we do than putting savings and passive income to work?

Taking a stake in French insurance giant AXA

In December, global stock markets were hit by a correction. In fact, in Europe and the Emerging Markets, stocks of a very large number of great businesses have already been in bear market territory for months.

Well, for us that’s good news. Cash generating assets can be acquired for very reasonable prices. For dividend growth investors in the accumulation phase, these are favourable conditions to build and strengthen a massive passive income machine.

So, we made our last stock acquisition in 2018 by putting around USD 4’000 to work and acquire 190 shares of French insurance business AXA, currently offering a forward gross dividend yield above 7 %.

AXA is the second largest insurance company in Europe, after Allianz. Both businesses just have a massive size of operations all around the world.

To me, AXA currently shows a nice mix of attractive valuation, strong growth prospects and very robust financials. Good conditions to support mid- to high single digit dividend growth for many years to come.

What about you, fellow Reader, did you have some nice dividend income? Did you make some stock acquisitions recently?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

First of all, I wish you and your family a happy new year! I hope you had a great start of 2019.

Looking at your passive income numbers, it looks like you had another fantastic month in December. 23% YoY growth is just an amazing.

What I didn’t recognize until now, is that you own such a large position in Imperial Brands. When did you build that up?

I recently invested heavily in BAT. Although I now have positions in two big tobacco companies (the other one is Japan Tobacco), I still feel like going shopping for other names in this sector, as their current stock prices are just too tempting. What do you think?

– David

Hi David

I wish you and your Family a Happy New Year as well!

Yes, there’s a lot to like about tobacco stocks which play an important role as dividend contributors in our investment portfolio. In March 2018, I topped up my positions in Imperial Brands and initiated a position in British American Tobacco in April 2018 which I increased in November of the same year.

These built ups give a significant income boost to our portfolio. For instance, fourth quarter IMB dividend income was roughly USD 57 and now stands at USD 140. What I’ve just seen by the way is that last year’s fourth quarter dividend was credited to my account in January while this time the received payment was in December.

What I like most about the tobacco companies are their really strong Free Cash Flow IN COMBINATION with their tendency to have undervalued stock prices over long time ranges. Reinvesting dividends let’s the compound effect work really nicely over time. Just looking at the history of Philips Morris/Altria is really amazing, the stock was undervalued for decades which was the CAUSE for outstanding returns for long term investors. Patient shareholders keeping their positions through thick and thin were furthermore rewarded by becoming shareholders of Kraft Foods (today KraftHeinz) and Mondelez.

So to sum up, I think that the future of Tobacco stocks is certainly interesting and you are right, prices are getting really attractive. I set for myself a range of 5 to 8 % of the total market value of our stock portfolio which can be attributed to that sector.

Thank you for stopping by and commenting.

Cheers