Hi there. I hope you all had a GREAT START INTO THE NEW YEAR!

I want to share with you a brief look back at the passed year, especially on our achievements in terms of passive income as well as our financial goals we set for 2019.

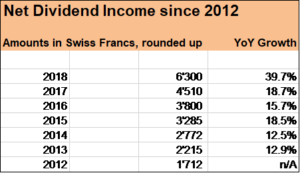

Roughly USD 7’000 passive income in 2018

At the beginning of 2018, my wife and I set the goal to achieve at least USD 6’000 total cash returns from following sources

- dividends from our stock holdings and

- interest payments from corporate bonds and on savings accounts

Effective cash flows from our investment portfolio and from savings accounts eventually came in at USD 6’950, marginally lower than the targeted USD 7’000.

The reason behind that slight “earning miss” is the fact that we focused on investing in European stocks as many of them saw a nice correction in 2018, several months earlier than their US peers.

As European companies usually pay dividends just once a year (in contrast to quarterly payments of US businesses), the majority of investments we made in 2018 will be accreditive in 2019.

Apart from that “technical aspect”, good progress has been made in terms of strengthening our dividend portfolio which will churn out significantly more cash in future.

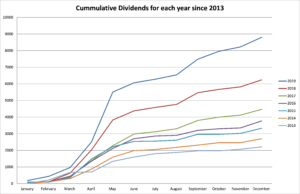

You can see from the graph below the effect of 2018 investments on currently projected dividend income 2019 (blue line on top).

The graph shows the cummulative received dividends (net amounts, after taxes) for each year since 2013 including a current projection for 2019. Even if no additional investments ocurred in 2019 and under the assumption of constant cash payments from our 50 stock holdings, projected net dividend income in 2019 stands at around USD 8’800, which already is 40 % higher than the received payments from our investment portfolio in 2018.

Keeping momentum in our Investment Process

Our passive income machine is gaining steam and we will keep the ball rolling by consistently investing “surplus” cash (savings).

Over the years, my wife and I managed to boost our savings rate to well above 50 % (2016: 57.5 %; 2017: 66 %; 2018: 53 %), despite reducing our work pensa.

Working on increasing the savings rate enables us to invest on a regular basis in order to generate passive income which puts me and my family in a position where we are not only financially well, but also gain more and more (financial) flexibility in life.

The savings rate stands at the center when it comes to one’s financial shape and it is the basis of our investment process.

When it comes to increasing our savings rate and to investing, our approach is very simple, in a nutshell, for each cost position or investment idea, we ask ourselves:

“(How) can we get (the same) QUALITY of a product/Service or investment FOR LESS?”

With regard to grocery spendings for instances, things are quite intuitive. Buying at superdiscount chains like Aldi and Lidl provides the possibility to buy quality for less money. Or when some products are on sale, we tend to buy more resp. in bulks.

As said, we tend to apply exactly the same approach when it comes to investing. Long term oriented conservative dividend growth investors should embrace falling stock prices. Lower stock prices of quality businesses reduce risks and enhance long term performance. That’s why we feel good about buying more stocks of quality businesses when they are in bear market territory.

Dividend growth investing requires some dedication and a lot of patience, the whole process takes time. Our strict buy and hold approach is sometimes a “bit boring” but also tremendously powerful. You have to appreciate small improvements. We want to see it like a wonderful game with Domino Pieces. Each month is one Domino Piece which has to throw down the same month in the next year. And each year, the Domino Pieces have to be larger. That’s visualising the power of the compound effect which keeps us motivated.

USD 10’000 passive income goal for 2019, and much more to come

For 2019, we target

- a savings rate of well above 50 % and

- total passive income of CHF 10’000 (which represents a 43 % increase compared to 2018)

Interest income on our savings accounts and from bonds will be lower in 2019, we expect the amount of roughly USD 400.

So again, dividend payments will drive our passive income growth also in 2019. We expect these inflows to reach at least USD 9’600. As current projected 2019 dividend income stands at USD 8’800 (as shown in the graph above), our full year passive income target looks well achievable due to

- organic dividend growth

- dividend reinvestments and

- acquisition of new positions

The attribution of new funds clearly will drive passive income growth in the short and medium term.

Over the years, my wife and I had accumulated a nice cash pile we had initially designated as down payment for our real estate projects. It was in October 2018 when my wife and I took a major financial decision to skip the plan to buy a house and instead reduce our cash pile by USD 60’000 and use it in addition to our monthly savings to invest into the stock market.

Since October 2018, we have reduced our cash pile by USD 25’000 by investing in businesses, which leaves USD 35’000 ready to put into the Stock Market.

We will keep our systematic investment approach. And when stock prices fall, we are more than happy to deploy more cash in order to transform it into productive assets.

That’s why every Dollar, Swiss Franc or Euro earned passively, distributed to us by strong businesses makes us feel good. We can see an ever increasing cash flow string and an underyling investment process that’s gaining significant momentum.

And we are pretty optimistic to make an even more substantial jump next year with a PASSIVE INCOME GOAL 2020 in the amount of USD 15’000.

What about you, fellow Reader, how was your 2018 in terms of passive income? Which goals did you set for the New Year?

Thanks for reading my post and for sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Fantastic work. I think you’ll smash the 10k USD received. That is fantastic. Keep up the great work!

Thanks for the kind words! Yes, we will definitively keep that momentum to set the bar higher and higher.

Appreciate you stopping by and commenting!

Cheers