Strong first quarter, and much more cash flow to come

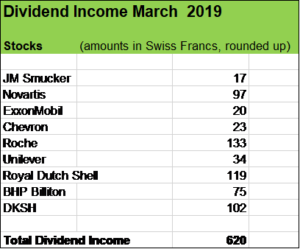

With March 2019 over, the first quarter of the year closes as well.

I am always excited about the first quarter in which the majority of dividend increases are announced. As I’ve shared in my last blogpost, the majority of our stock holdings increased their payouts to shareholders.

Our steadily growing stream of passive income requires good organic growth and regular investments in quality stocks while the whole process is underpinned by our robust savings rate above 50 %.

Currently, our investment portfolio has a market value of over USD 280’000 and consists of around 50 stock holdings. So far,

- 36 companies have already announced to boost their payouts,

- 11 businesses keep their shareholder distributions flat,

- 2 enterprises slashed their dividends (beer giant Anheuser-Busch InBev and car producer BMW) and

- 1 company (Exxon Mobil) will make its dividend announcement in the next weeks.

As we already know the dividend announcements of almost all of our stock holdings, we can project our current passive income for the year, which stands at around USD 9’500 (2019 full year goal of USD 10’000 is in full sight).

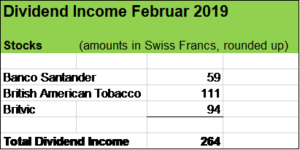

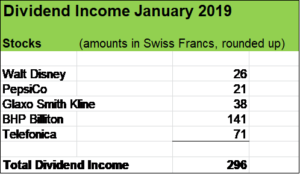

Over the last three months, 17 businesses sent us dividend payouts, adding up to USD 1’200.

Let’s have a brief look at these dividend payments in the first three months (all amounts are net after taxes, in Swiss Francs, which trades more or less at parity to the USD)

The first quarter shows an increase of more than 100 % compared to the first three months in 2018 (from USD 575 to USD 1’200).

So, there is significant progress on a year over year basis, and we are looking forward to the cash flows we receive in the next months, when most our European holdings will make their distributions (in contrast to US companies, their European peers mostly make their dividend payments once a year).

And my wife and I focus on strengthening our portfolio further. Let’s have a look at our latest stock buy we made in March.

Aurelius is definitively a different kind of investment in our stock portfolio

My wife and I took the decision to acquire some stocks of Aurelius Equity Oportunities SE for roughly USD 3’800 (for around EUR 40 per share).

While my wife and I like to put blue chip companies with a long record of growing dividends at the core of our portfolio (businesses like Coca Cola, PepsiCo, Nestlé, Unilever, JM Smucker, Novartis, Roche, Chevron, Exxon Mobil, Heineken, Disney, LVMH etc.), we are also open to spicing our investment portfolio a bit up from time to time.

Aurelius is a small cap business with annual revenues of around EUR 3.5 Billion. Founded in 2006, it is also a relatively young company.

The German private equity firm Aurelius has a pretty interesting business model. It acquires, restructures and eventually sells companies in special situations, e.g. corporate spin-offs and privately held companies.

Since it’s formation, Aurelius made over 100 company transactions, buying business entities from companies like Goldman Sachs, Bayer Crop Sciences, Daimler etc. to actively developing these entities and eventually exiting them. As Aurelius‘ track record shows, they usually sell their holdings at a very nice profit which is to the benefit of Aurelius shareholders.

Currently, Aurelius has around twenty businesses in its portfolio, and I wouldn’t be too surprised to see a few of them being sold in the next months.

Aurelius has an interesting dividend policy. The payouts to shareholders consist of

- a basic dividend (of EUR 1.5 per share) and

- a so-called participation dividend, distributed to shareholders in the event of successful company sales.

So, the received dividend payments from Aurelius will fluctuate year by year, but even the basic dividend above 3.5 % is attractive. And on top of that “minimum” payment comes the participation dividend which can be seizable.

In our view, Aurelius is definitively a business that suits very well into our stock portfolio, offering attractive long-term prospects and rewarding us both in form of juicy dividends and growth.

What abot you fellow Reader, have you added some new positions to your portfolio? Did you see some dividend increases of your stock holdings?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Just found your site, looks like you’re doing really well!

I’m a bit interested in dividend investing, but the small diversification is something that would hold me back. Why do you chose dividends over a super boring world wide index fund?

Hi B

I like your point, a world wide index fund (e.g. Vanguard world stock index) is a great investment, offering diversification at low costs and the possiblilty to practically become one with the global economy. So, there is really a lot to like about such a fund or ETFs in general.

And yet, for me personally, the do-it-yourself-investment-approach is more suitable. As a dividend growth investor, I love to study company reports of great businesses, I want to learn and make my own experiences. I acquire pieces of companies like Pepsico, Disney, Nestle etc. and want to hold them for decades, I want to have the perspective of a “mini-business-owner”. I find it motivating to see a rising stream of cash dividends entering my bank account, ready to reinvest. Dividend growth investing litterally let’s you see the compound effect. It’s a wonderful, extremely rewarding process.

But again, if one does not want to study individual companies or does not have an interest in business ownership, then a Vanguard ETF is a no-brainer approach to build substantial wealth. And in my view, index- resp. ETF-Investing does not rule out a dividend growth investment approach. For instance, I also have a small portion of my assets invested in funds too (Swiss Performance Index and Euro Stoxx).

Appreciate you stopping by and thanks for commenting.

Cheers

It’s amazing to see how well your portfolio is doing! I’m not only talking about the fantastic YoY growth of 100%, but also the fact that most of your stocks increased their dividend payout once again. Congrats!

Aurelius seems like a somewhat exotic, but well-chosen addition to your existing portfolio.

However, although it looks like the company has a sound business model, I’m still a bit skeptical about an own engagement.

I remember too well, how Aurelius’ stock price tanked within a matter of days due to an attack by a hedge fund called Gotham City in 2017. This was definitely too much action for my taste.

– David

Hi David

Thanks for your kind words and your continued support! Yes, organic dividend growth has been a very reliable driver of our passive income so far and in the long run that factor will even be more important than the addition of new stock acquisitions.

With regard to Aurelius, I completely agree, that new position is pretty different from the core of our portfolio with its strong focus on consumer staple businesses such as Coca Cola, PepsiCo, Nichols plc., Diageo, Britvic, Unilever, Heineken, Anheuser Busch, J.M. Smucker etc. Interestingly, the first time I heard about Aurelius was in the midst of the financial crisis (2007/2008) when that hedge fund company acquired BERENTZEN, the German spirit and soft drink producer with a very long tradition and several brands I like very much. In 2016, Aurelius brought the acquired shares to the stock exchange and I followed the development of both businesses (Aurelius and BERENTZEN) quite a bit. There are several “business cases” that give an insight of the way, Aurelius is operating and there is now doubt, they have huge expertise in acquiring companies for a good price, streamlining operations and selling at a profit after a few years. Their “business cases” are not always successful, but the majority of their deals led to very nice profits. What I like in particular are their pretty conservative financials, usually such companies are way more leveraged. Aurelius operates in a very lucrative niche, their acquisiton targets are quite small, they are taking calculated risks to take control of companies. But even as a 100 % shareholder, it requires tremendous know-how to make the acquired businesses more profitable and more attractive in order to sell them.

When financial analysis firm Gotham City made its short attack against Aurelius, they made some very valid points. I’ve read their reports and followed the reaction/replies from Aurelius with great interest. For me, there were two main issues: transparency and valuation of asses (acquired businesses). With regard to the first point, some progress has been made although further improvements would be desirable in my view, and with respect to the valuation of assets, well, I think they prove their critics wrong through some very profitable exits (sale of businesses at attractive prices) after the short attack. Of course, a company like Aurelius is tremendously hard to value. But that’s always a challenge. Just thinking of KraftHeinz for instance, which I still consider as a fine business, but today, it is pretty obvious, that their brand assets have been quite severely overvalued.

Thanks for stopping by and commenting!

Cheers

Nice portfolio you’re building up here!

How much commission do you pay to when you buy individuals shares? Is it a flat fee per trade? Are the dividends automatically reinvested or you take the cash payouts?

Incidentally, we are very close to each other in the Rockstar Finance directory of net worth tracking blogs!

Hi NWA

Thanks for the kind words!

I pay around USD 40 per share purchase which in my case corresponds to around 1 % of the invested amount per position.

With regard to the reinvestment process: that’s kind of depending on the stock price, around 50 % of my dividends are reinvested into to same positions and the rest is used to buy stocks of new holdings.

Glad to read that we are very close to each ther in the Rockstar Finance net worth tracking.

Cheers