A cool 100 % YoY passive income boost

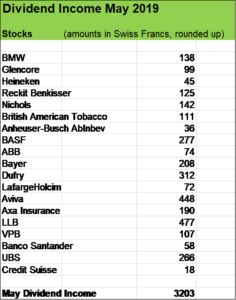

May was just an amazing month in terms of dividends, topping even our very strong April results in the amount of USD 2’500.

Year over year, dividend income in May doubled, jumping from 1’600 a year ago to over USD 3’200.

Receiving all these nice cash amounts from strong companies is just awesome. USD 3’200 without breaking a sweat, what’s there not to like!

In fact, the amount of USD 3’200 matches our spendings for our family of four in May. So, for that month, we are kind of FINANCIALLY INDEPENDENT.

OK. There is still a long way to go, but we just love the process and it feels so good that our efforts slowly but clearly start paying off. My wife and I will keep the ball rolling and continue to work on increasing our savings rate and we will keep putting money into cash generating assets on a regular basis.

Our strong passive income growth in May was mainly driven by a step up of our investment process especially by the end of 2018 and early in 2019. My wife and I have been working hard to add new positions to our stock Portfolio over the last months.

Here’s the list of our new May passive income contributors paying us dividends for the first time:

- mining giant Glencore

- British American Tobacco

- British soft drink maker Nichols plc

- Anheuser Busch InBev, the world’s largest beer maker

- German chemical company BASF

- the world’s largest duty free retailer Dufry

- Axa Insurance

Furthermore, over the last twelve months, my wife and I increased our positions in Bayer and Reckit Benkiser and also have been topping up our holdings in UBS and British insurer Aviva.

New positions and holding increases added around USD 1’900 to our May dividend income whereas on the other hand, changes of dividend payment dates (Porsche Automobil Holding and Deutsche Telekom) had an unfavourable impact on our May passive income in the amount of around USD 400.

Excluding the impact of

- changes of dividend payment dates,

- the addition of shares to our investment portfolio and

- dividend reinvestments,

the amount of around USD 100 has been added to our May passive income solely trough dividend hikes, implying organic growth of over 6 %.

That’s the kind of growth we focus on. We want to build a stock portfolio having the ability to “automatically” grow its cash generation by more than 6 % year by year.

And looking at our May dividend contributors, there have been some nice (recent) boosts to shareholder payouts:

- Heineken: + 8.8 %

- Nichols plc.: + 15.3 %

- Reckit Benkiser: 3.9 %

- British American Tobacco: + 4 %

- Aviva: + 16.4 %

- Axa Insurance: + 6 %

- BASF: + 3.2 %

- ABB: + 2.56 %

- LLB: + 5 %

- Banco Santander: + 4.5 %

- UBS: + 7.7 %

- Crédit Suisse: + 5 %

While Glencore, Bayer and VPB held their payouts steady, unfortunately, BMW slashed its dividend by roughly 14 %. Quite a bumper and a drag on organic dividend growth in May.

For us dividend growth investors, holding stocks of car companies is a bit tricky as they are operating in an extremely cyclical and capital intense environment and technical disruptions make it even tougher. These businesses show a bumpy dividend history but they also have the potential to “spice our portfolio a bit up”.

My wife and I want to keep some exposure (2.5 to 3 % of total portfolio value) to the auto industry through our participations in BMW and Porsche Automobil Holding, participating in strong car brands including Audi, Porsche, Maseratti, Bugatti, Bentley, Volkswagen, Bentley, Rolls Royce and BMW.

And while BMW cut its dividend in 2019, Porsche Automobil Holding once again boosted its payout, this time by a whopping 26 % which more than offsets BMW‘s unfavourable move. So, we are looking forward to that nice increased dividend payment from Porsche Automobil we will receive in June.

Now back to our May passive income: my wife and I took the decision, to immediately put the collected cash dividends to work and of course topping up our monthly savings to that invested amount.

So, we pulled the trigger twice in May, adding stocks of two very interesting consumer staple businesses to our passive income machine.

I’ll share with you our two recent stock buys in my next blogpost coming soon. In the maintime, I wish you a great time and thanks for reading.

What abot you fellow Reader, have you added some new positions to your portfolio? Did you see some dividend increases of your stock holdings?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Awesome month! Nice job, that kind of percentage increase is crazy with those values. Looking to make some buys in June.

Best regards.

HOLY OW! Financial Shape – Unbelievable. I don’t know what else to say. Look at the dividends your portfolio’s reshaping produced. A 100% YOY growth rate over an already insane amount of dividend income. SICK.

Bert

Hey Bert

Many thanks for your kind and motivating words! Yes, it’s extremely encouring to see the cash flows from our investment portfolio.I think we’ve built a robust plattform from where we can push further. And the best about dividend growth investing is that’s awesomely interesting to learn about businesses and to work with my wife towards our dream to one day live off our dividends and achieve Financial Independence.

Thanks, Bert, for stopping by and commenting.

Cheers

WOW, nice work! That’s a lot of fantastic European companies you’ve got paying you! Congrats and I look forward to following your journey!

Hi DP

Many thanks for the Kind words. Yeah, we are really happy to see that progress of our “passive income machine”.

Thanks for swinging by and commenting.

Cheers