The magic of making money while you sleep

Over the last years, my wife and I have set a strong focus on establishing passive income sources which had a very positive impact on our lives. Shaping our finances and putting money to work set us in a tremendously flexible position.

Today, my wife and I both work part time and have more time for our children. What’s amazing is that we still managed to increase our savings rate which makes it possible to invest even more and boost our wealth accumulation process which makes it possible to reduce our work pensum even further in future. Sounds like magic, but it’s just simple math.

By working less, some costs can be reduced significantly (lower child care costs, less commuting etc.) which cushions the drop in active income (to some extent). Throw in the effect of passive income compounding like crazy over time et voilà: Achieving Financial Independence is just a matter of a few years and perfectly possible.

Passive income really is like clockwork. Once you set up the process, keep the ball rolling, year by year, it’s just amazingly motivating and a lot of fun to see the cash inflows grow and grow.

In my new post, I’m gonna share with you our latest moves to strengthen our two passive income machines (our stock – and peer to peer (P2P) portfolio).

Over the last few weeks,

- we made one stock acquisition in the amount of USD 4’000 in the consumer staple sector and

- have set up two more peer to peer (P2P) platforms (in addition to Mintos and Bondora; see my former post “starting our P2P portfolio“).

Let’s have a look at those investments.

Taking a stake in Scottish soft drink maker A.G. Barr

When you are in Scottland, you should definitively give Irn-Bru a try. It’s a carbonated soft drink which is so popular that it is often called “Scottland’s other national drink after Whisky”.

Irn-Bru is manufactured by the company A.G. Barr, based in Cumbernauld, Scottland. The business, founded more than 140 ago, has a very long and interesting history. Today, A.G. Barr is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

A.G. Barr sells a broad range of soft drinks including fruit juices, bottled waters, energy drinks and cocktail mixers. The company currently has a 3% UK beverage market share.

As my wife and I are alwas keen on investing in strong consumer staple businesses, A.G. Barr with

- its strong brand portfolio,

- healthy financials and

- very solid dividend history

has been on our watchlist for quite some time.

When it comes to constructing our portfolio, we build on „backbone investments“ like Nestle, Unilever, PepsiCo, Coca Cola, Diageo, Heineken or Anheuser-Busch InBev. But in addition to these giants, we are also very open to add smaller players to our portfolio such as British soft drink makers Britvic and Nichols.

So, for us, A.G. Barr definitevely fits the bill as a legit acquisition candidate. The problem, though has for some time been its rich valuation.The shares were valued at a hefty 30x earnings back in July.

Then came August.

August showed global stock market prices come down quite nicely. That‘s exactly when my wife and I get interested because it’s the time, when quality can by bought for less.

Exactly in a very weak stock market, A.G. Barr warned that profits would be lower than expected. The market reaction was pretty hefty, the share price plunged 28 % after the news.

To put things into context.

Last year, in response to the UK sugar tax and after having reformulated some recipes, A.G. Barr cut the prices of its lemonades, ginger beers and other drinks and some month ago lifted the prices back to where they were. Customers however have since been reluctant to buy after prices were lifted back to where they were.

The consequence: first-half revenue fell 10% and the full-year profit performance could decline by up to 20%.

Management sees some market softness and blamed “disappoiting weather”. Well, that’s not very convincing in my view. Just looking at my UK soft drink holdings Nichols and Britvic, their first semester results showed a completely different picture with quite resilient consumer demand.

My guess is that A.G. Barr overestimated its pricing power. In particular Irn-Bru is extremely well positioned especially in Scottland, but the business clearly has to adapt its marketing strategy to find back to a more favourable price-volume-mix.

Quality companies undergoing temporary problems can often become attractive investment opportunities.

And make to mistake, A.G. Barr boasts a quality track record. During the last 40 years (!) for example, the company has lifted its annual dividend by an average of 11% each year. Shareholders have never seen their income cut.

A.G. Barr offers a compelling dividend record backed by decent cash conversion and a balance sheet flushed with cash.

After having seen the GBP coming down against the Swiss Franc in August by almost 8 %, we have been happy to buy almost 40 % more shares of A.G. Barr than we would have acquired back in June or July.

Adding TWINO and Grupeer to our P2P portfolio

Starting roughly six weeks ago with the two P2P platforms Mintos and Bondora, my wife and I decided to add two more platforms to our portfolio. Not only to diversify but also to learn more about the P2P landscape. Each platform is different and there are also very specific business models.

Let’s have a look at the two new consitutent of our P2P portfolio:

TWINO operates one of the larger platforms operating in Europe. It is a Latvian company whose investment platform was launched in 2015, although the company has been operating since 2009 as a loan originator. Since the inception in 2009, TWINO has lent more than Eur 500 million in loans.

TWINO is operating several countries and let’s you invest in unsecured consumer loans from Poland, Georgia, Russia, Kazakhstan and Georgia.

TWINO – in contrast to Mintos – is itself the issuer of the loans. So in this respect, it’s quite similar to Bondora with the major difference, that the loans issued by TWINO have some nice protection schemes (I will describe them lateron in this post).

We initiated our position in TWINO by investig EUR 3’700 so far and putting that amount to work by investing through the Auto-Invest program which diversifies into a broad range of loans according to indivual criterias we set. I also selected some credits manually.

Most loans yield in a range of 8 % to 12 % and and have a buyback guarantee OR a payment guarantee.

These are two quite interesting protection schemes: under the payment guarantee, TWINO ensures that investors receive loan repayments on time, even if a borrower is late with the payment.

Under the buyback guarantee, by contrast, TWINO will compensate both the invested principal amount and interest, as well as pay the accrued interest in case a borrower is late with the repayment for over 30 days.

For an Investor, the payment guarantee allows a slightly more stable cash flow and makes repayment schedules steady and foreseeable.

What about the yield we get on TWINO so far?

Our weighted average interest is currently 9.33 % but I guess it can easily climb in the direction of 10 %.

The split of our loans protected by a buyback guarantee and payment guarantee is around sixty fo tourty and as you can see on the print screen,

- loans with buyback guarantee yield above 11 %,

- whereas credits with payment guarantees have a yield of somewhat above 8 %.

So, just by prioritising loans with buyback guarantee should increase returns quite nicely.

What I really like about TWINO is that that our investments are pretty liquid. First, many loans on the TWINO platform are short maturity from 1 to 3 months. So, you get your principal back in a couple of months. Another advantage of investing on TWINO is that it is possible to sell loans to other investors. So there is a secondary market. It’s not really comparable with the secondary market place on Mintos, where I can see thousand of loans I can buy from other investors. But whenever I want to sell loans from my portfolio, I can do that.

TWINO does not charge investors any fees, the company makes its profit from the spread between the interest rate charged to borrowers and the interest rate offered to investors.

All right. Let’s come to the second P2P platform we recently added.

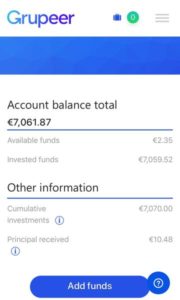

Grupeer is a Latvian P2P platform which started in 2016 and currently has roughly 14’500 investors from over 80 countries.

Grupeer has some similarities to Mintos, acting as a platform that allows loan originators to issue loans (in contrast to TWINO and Bondora, which are themselves the loan issuers).

Currently, all loans offered on the Grupeer platform have a buyback guarantee (on Mintos, “only” 90 % of the loans are “protected” by a buyback guarantee).

That means that the loaners that issue the loans to investors are obliged to buy back loans if no payment has been made for 60 days.

We initiated our position in Grupeer by investig EUR 7’050 so far and putting that amount to work by investing through the Auto-Invest tool which diversifies automatically into a broad range of loans according to individual criteria. I also selected some credits manually.

Grupeer has three categories of investments:

- loan deals,

- development projects and

- a soon-to-be-released product they call the “stability fund”.

Most loans I have seen yield 10 %, 12 %, 13 % or 13.5 %. On average, my investments should return roughly 13% annually which is higher than what I currently get on Mintos (around 11.5 %) and some percentage percentage points more than than what I currently get on TWINO.

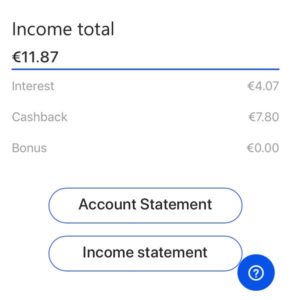

So far, in a matter of just a few days, we’ve collected almost EUR 12.

Grupeer continuously negotiates special promotions called CashBacks with its partners resp. loan originators for Investors which is pretty nice.

With CashBacks you receive 1-2% from your invested sum instantly, or within a month of making an initial Investment which is pretty cool. To some extent it reduces the credit risk and makes more money available for the next investment.

While Grupeer currently offers the highest retunrs in our P2P Portfolio (Bondora Go & Grow: 6.75 %, Mintos: 11.5 %, TWINO: 9.33 %) it also has the highest “liquidity risk”. In contrast to Bondora, TWINO or Mintos, on Grupeer there is no secondary market on Grupeer. So, you cannot sell your loans. My investment on Grupeer are significantly less liquid, in fact they are bound on average for almost 12 months.

For us, that’s fine, we plan to keep our investments into Grupeer below EUR 10’000 over the medium range and are looking forward to collecting the nice 13 % interests which will make more than USD 100 each month.

As it is always when it comes to investing, there is a trade-off between three factors:

- risk

- reward and

- liquidity

And we see plenty of oppertuities, to find a nice mix betwwen these three factors to boost our returns while sitting on ample of cash and keeping risk on a level we feel comfortable with.

I am very excited to share with you our September passive income review in my next post which will show the contribution of our new P2P aditions and of course also our dividend income.

So stay tuned and thanks for reading.

How about you? Did do make some stock Acquisitions recently? Do you also invest into P2P?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Congrats on the great month- keep it up over there!

Regards,

Divcome

Hey Divcome

Thanks for the nice words. Yah, we’ll keep the ball rolling.

Cheers