Hey there, fellow reader!

The end of the year is the perfect time, to reflect on achievements of the year.

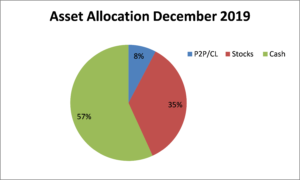

In this post, I want to share with you our asset allocation as of 31.12.2019.

Our wealth consists of

- two Passive Income Machines (a stock portfolio and Peer to Peer plus Crowdlending (P2P/CL) investments) and

- a nice Cash Pile.

An exceptionally good year in terms of wealth creation

In December alone, our wealth grew by USD 30’000 from USD 848’400 to USD 878’600 (+ 3.6 %).

2019 really was an excellent year. Over the last twelve months, our wealth increased by over USD 90’000!

This was possible through a combination of our continuous focus on shaping our finances, constantly working on increasing our savings rate and of course there was a huge boost from our investments in form from of book gains, dividends and interest income (I’ll give a full year passive income review in my next blogpost).

Cash generation in December was particularily strong, due to gratifications/boni which were paid in December in addition to our paychecks. Our active (work) income is more or less comparable with the previous year but we have reduced our work pensa (pay rises are so sweet … :)).

In 2019, we worked hard on Fighting Lifestyle Inflation and managed to lower our fixed cost basis quite a bit. (I plan to give an overview on our cost cutting measures in a separate blogpost).

In December, our savings rate was almost 70 % and for the whole year it stands at over 65 % !! For us, these are “magic numbers”, because they really speed up our Journey Towards Financial Independence.

Asset allocation as of 31 December 2019 is as follows:

Stock holdings (we have around 60 positions) represent around 35 % of total wealth. The market value of our stock portfolio was driven by very strong performance in December and throughout the year as well as by reinvested dividends. These factors resulted in an increase from USD 300’000 to over USD 312’000 (+ 4 %) in December alone. That’s pretty cool, in just one month USD 12’000 wealth added!

I have to say, though, that compared to Major indices like the Dow Jones for instance, our stock Portfolio lagged quite a bit. Not dramatic, but worth to go into the numbers. What I found was currency fluctuations for the main reason. As our stock portfolio is denomitated in Swiss Francs (CHF) and has EUR, USD, GBP exposures, devaluations of these currencies against the CHF have been a drag for our performance (3 to 4 percentage points).

Our P2P/CL portfolio represents around 8 % of our wealth. As of 31.12.2019 the total amount of USD 67’000 is invested in loans on nine platforms. I will give a detailed overview on our platform positions in my next passive income review.

Our Cash Pile (deposits on bank accounts) makes around 57 % of our wealth and grew to almost USD 500’000, even after having made quite significant investments into our P2P/CL portfolio. As stock markets had an exceptionally good run, we refrained from putting New Money into our stock portfolio but we always try to reinvest all the dividends received.

As shared in my previous blogpost, a large portion of our cash pile will be invested into real estate as we want to build a third Passive Income machine which will generate rental income for us.

I will share a full year passive income review in my upcoming blogpost, so stay tuned.

Thanks for reading and HAPPY NEW YEAR!

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Wow congrats on the excellent year! I agree, fighting lifestyle inflation can be a huge challenge in the path to FI. And that cash position is massive – reminds me of Warren Buffett’s company Berkshire cash balance! You’ll be well set for whatever this market brings.

Have a great 2020!

Divcome

Hey Divcome

Thanks for the kind words. Haha, Warren Buffet, well yes he really is sitting on a huge cash pile. We hope of course to bring that cash to work in the next 12 months and you are of course right, it sets us in a position to take advantage, whatever the market brings.

Have a fantastic 2020 and looking forward to reading your next moves.

Cheers

F.S.