Boum! With October in the books, just two months to go to complete an amazing year.

So, time for my monthly update where I share my cash inflows on my stock holdings plus peer to peer investments plus additional passive cash income. I will also share my latest stock buys.

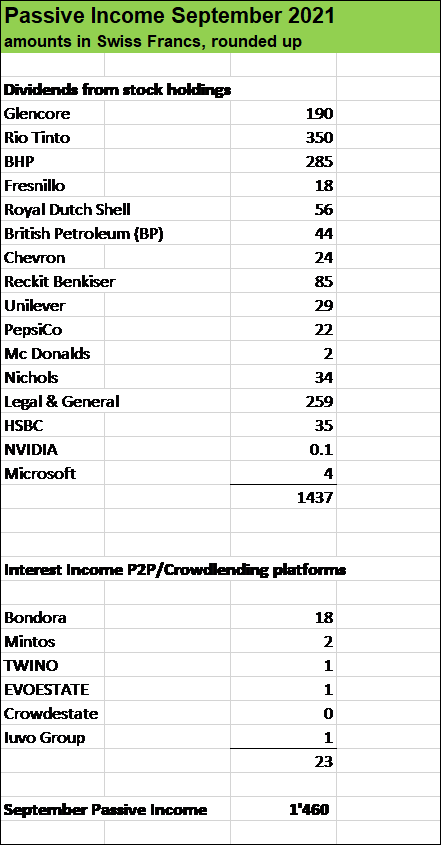

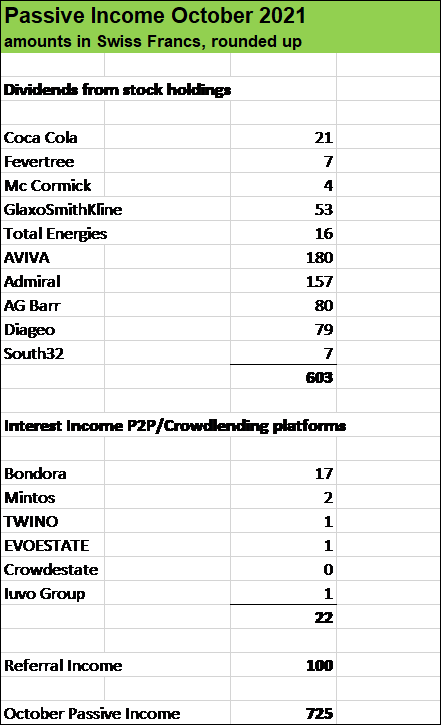

Let’s first right dive into the numbers.

A cool 25 % Passive Income Jump Year over Year.

Last year, October showed CHF 578 or approximatively USD 630 in passive income, so there is a pretty nice uptick this October to Swiss francs (CHF) 725 resp. almost USD 800.

For the whole year, we’ve targeted USD 15’000 in Passive Income and over the last ten months, USD 12’500 have been collected. So, around 17 % still to go in the last two months to hit our annual goal!

Cash flows from dividends have been particularily strong in October.

British soft drink maker Ag Barr has resumed shareholder distributions which had been cancelled last year amid the pandemic.

British car insurer Admiral even made a special dividend in addition to the regular shareholder distribution and mining business South32 (a spin-off of BHP Ltd.) paid out significantly more than last year (USD 7 versus USD 1).

There have been some changes in terms of dividend payment dates, for instance last year in October I received the distribution from Porsche Automobil SE which this year has been made in July. This change on the other hand has been more than offset by a very strong dividend by British insurer Aviva, which boosted its shareholder payout quite nicely (last year, it paid me around USD 136 in September on this year in October USD 180).

Whenever possible, I try to reinvest dividends into the same business and in the case of Aviva it really shows the strenth of the compound effect.

The same by the way in the case of British alcohol giant Diageo (Guiness Beer, Vodka Smirnoff, Johnny Walker etc.).

Interest income streams from Peer to Peer Investments via platforms such as Mintos, Bondora, EvoEstate, Twino and Iuvo have been quite robust but significantly lower than last year, as I withdrew almost two thirds of my P2P investments over the last 18 months to invest heavily into tech stocks which had paid off quite nicely so far.

My stock investments are near all time high and I keep adding

October has shown an amazing stock bull run and both, my Dividend Portfolio as well as my Tech Share Holdings are near all time high.

Our dividend stock portfolio as well as tech holding portfolio plus our P2P and Crowdlending investments and Crypto positions are well over USD 500’0000.

Following positions have been particularily strong in October, pushing overall performance higher:

- German car rental business SIXT

- Italian luxury car maker Ferrari

- French luxury company LVMH

- US snack and beverage giant PepsiCo

- French cosmetic leader L’Oreal

- Swiss food giant Nestlé

- Electric car pioneer Tesla

- Italian spirit jewel Campari

- Pernod Ricard the French alcohol giant

A strong boost also came from tech business such as Cloudflare, Shopify, Etsy, Microsoft etc. (see here company snapshots on my tech holdings).

But of course, as always, there has also been some very severe underperformer, like Peloton for instance which has litterally see its stock price cut in two amid weaker growth dynamics. The position however is rather a small one, for instance in Peloton I had invested “just” USD 500, in contrast in the case of my Nestlé or LVMH for instance we are talking about a market value of over USD 20’000 and over USD 15’000.

Cloudflare has been remarkable. I’ve put around USD 2’000 into that company and that position now has a market value of almost USD 11’000.

Despite the market having been heading from All time High to All Time High, I added quite significantly in October as I saw prices temporarily coming down quite a bit on some businesses.

I invested almost USD 14’000 in October

But I didn’t stop there and added following positons to my tech portfolio:

- USD 2’200 in Dutch semiconductor business ASML and

- USD 3’000 in Latin American e-commerce and fintech company MercadoLibre

ASML Holding N.V. manufactures the machines that are used in the production of computer chips. In these machines. ASML controls about 90% of this market, having a significant role in the semiconductor industry, and its top customers include the world’s top companies like Taiwan Semiconductor Manufacturing, Intel and Samsung.

MercadoLibre is an Argentine company operating online marketplaces dedicated to e-commerce and onine online auctions. MercadoLibre not only has the largest online commerce ecosystem but also the largest payments system in in the region with Mercado Pago.

What I wanted to do was further strengthening my exposure to e-commerce and fintech (I already hold stocks in Amazon, Shopify, Etsy, PayPal, Square etc.) by adding MercadoLibre shares.

And as the chip sector is crucial for so many electronic products, it made a lot of sense to me not only to have a stake in NVIDIA but also in ASML.

What about you, fellow reader, how was your October in terms of Pasive Income? Did you made some investments recently? Thanks for sharing your thoughts in the commentary section below.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action