Welcome to the monthly Passive Income Update on My Financial Shape,the blog where I document the journey of our family of four to Financial Independence by 2024 through a combination of savings and investing in particular into

- dividend paying share positions as well as

- tech growth stocks.

In this article, I want to share with you

- the progress we made in terms of passive income generation,

- how our stock investments have been recovering from the COVID-19 pandemic hit

- and also give you some insights on our July dividend contributors.

Annual passive income goal in full sight

For 2021, we set the target of at least USD 15’000 in total dividend and interest income.

Over the first seven months of 2021, over Swiss francs 9’000 resp. USD 9’000 have been generated by our stock holding positions and Peer to Peer investments, which means that we achieved already 66 % of our annual passive income goal!

That’s quite good progress, compared to the first seven months in 2020, when our dividend portfolio experienced severe headwinds amid the COVID-19 pandemic and global lockdowns. In the comparable time period in the previous year, the sum of our passive income stood at USD 6’700. So in the current year passive income generation is significantly higher with + 47 % whereas a write-down of roughly USD 2’500 on our P2P in 2020 has to be taken into account.

Robust recovery on all fronts

In 2020, strong businesses had to cut or even eliminate their dividends, such as

- French luxury giant Louis Vuitton Moet Hennessey (LVMH)

- The Walt Disney Company

- German car rental company SIXT etc.

I held all our share positions through 2020 and was even buying quite aggressively, adding many new stock holdings, in particular in the tech sector.

Going with great businesses through thick and thin and having a long term vision pays off handsomely. Investors are quite unforgiving when businesses cut their dividends.

But just look at the stock price dynamic of LVMH, The Walt Disney Company and SIXT:

LVMH slowly and quite silently has become on of my largest stock holdings. Yes, in March 2020 the share price fell quite strongly, but just look how nicely it not only recovered, but has been littterally shooting up. LVMH truly is a diamond, certainly an expensive one, but definitively a wonderful business worth holding pieces of for the long haul.

While LVMH has eventually been a beneficiary of the pandemic, acquiring competitor Tiffany at a very attractive price, The Walt Disney Company has been another winner.

But even some smaller companies in my stock portfolio have been able to capitalize on market disruptions amid the pandemic, such as German rental company SIXT.

Tough timesreally made SIXT a winner.

Our portfolio not only has seen a very robust recovery in terms of book value, but also with regard to dividend payments.

LVMH for instance not only re-instated its shareholder distributions in 2021, but also hiked the dividend by 50 %.

Oil giant Royal Dutch Shell which drastically reduced its shareholder payouts in 2020 by a whopping 60 % is working hard to resume its dividends by increasing the distributions by 15 % and then by another 37 % in two consecutive quarters. We are still below the level of 2020, but things are moving into the right direction when it comes to the oil supermajors.

Fellow blogger European Dividend Growth Investor made a very interesting video plus post with the title Big Oil is back? A comparison of the 5 oil majors which you should check out if you are interested in the topic.

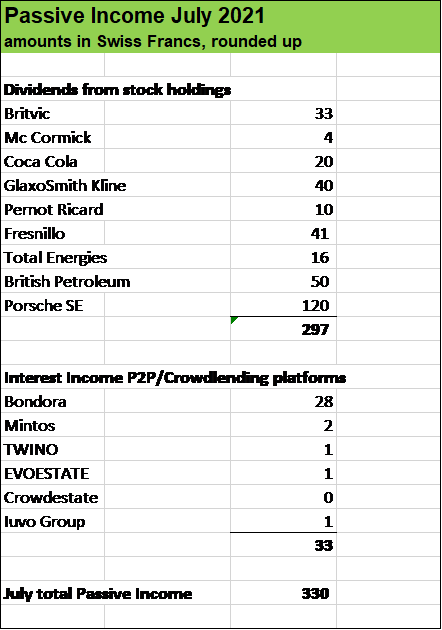

A brief look at our July Dividend Contributors

In July, nine businesses paid us the amount of CHF 297 resp. roughly USD 330.

British softdrink maker BRITVIC was hit particularily hard from the lockdowns and eliminated in 2020 its dividend but resumed its payout in 2021 which is definitively a good thing to see. Its stock price has recovered also nicely.

Let’s look at our other July dividend contributors.

McCormick is an American multinational food company, manufacturing and distributing spices and seasoning mixes. The business was relatively resilient through the pandemic and even managed to hike its dividend by 10 %. McCormick is a so-called Dividend Aristocrat, a exquisite group of businesses that managed to increase their shareholder payouts for at least 25 consecutive years.

The Coca Cola Company has been for years in my portfolio and of course has been hit by the global lockdowns. Consumption of beverages has been much lower in 2020 amid the closure of restaurants, bars, parks etc. But the giant is back on track and Free Cash Flow Generation has improved significantly. Another positive is the fact that The Coca Cola Company is further diversifying its product range.

Pernod Ricard is a French alcohol producer with a very strong brand portfolio, including Absolut Vodka, Havanna Club Rum, Malibu, Mumm Champagne, Martell Cognac etc. Due to its amazing grobal footprint and excellent management, Pernod Ricard navigated quite well through the international lockdowns and supply chain distributions, which is reflected in the stock price.

Mexican Fresnillo is the world largest producer of silver and Total Energies and British Petroleum (BP) are two of my oil supermajor positions. Total Energies has been particularily robust. BP has always shown an instable cash flow generation pattern but let’s not forget that this giant is still “digesting” the huge fine it has to pay for the oil spill in the gulf of Mexiko in 2010. In my view it’s quite probable to see BP’s cash generation stabilizing and grow in the years to come, which combined with a very attractive stock price and dividend reinvestments should make it a very interesting investment case.

Porsche Automobil SE is the main shareholder of the Volkswagen Group which itself has following ten car companies under its umbrella: Porsche, Audi, Lamborghini, Bugatti, Bentley, SEAT, Daccia, Ducatti, Man and Scania. I acquired stocks of Porsche SE years ago, in the midst of the so-called Diesel Crisis. Buying stocks of a solid business when it is experiencing some strong but not lethal pressure can pay off handsomely. The stock price has been climbing up through the years from around EUR 35 to almost EUR 100, and what’s best: Porsche Automobil Holding has been a very generous dividend payer through the years. Porsche Automobil Holding in essence just holds stocks of the Volkswagen Group plus a lot of cash. The shares trade at a discount to the market value of its holding position which can often be seen with that kind of businesses. See the Beauty of Holding Company Stocks.

What about you, fellow reader? How was your July in terms of investing and dividends?

Thanks for sharing in the commentary section below.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.