My new created business had a good start and we continue working hard towards Financial Independence

Hey there fellow reader. It’s been quite a while since I’ve published a new posts. In fact it has been four months since I’ve published my last passive income income update. Sorry about that!

I’ve been documenting our journey towards Financial Independence since September 2016 and for over six years I’ve consistently reported on a monthly basis our progress we made in terms of streamlining our finances and establishing passive income sources.

However, the last few months have just been just so incredibly dynamic and it’s just now that I have been able to take a breath and write this post.

As I’ve written in some of my previous posts, I quit my job early this year to start my own business. It was a tough and risky move to leave my well paid position to do something I feel really passionate about and build a company providing e-learning and consulting services.

And I am so glad to say that this was the right move. My company started well and I’ve been able to win clients. I can see a healthy demand for my services.

Of course, there is a massive amount of work to do and to invest, in order to bring my company to the levels I want it to be.

I will continue to document our journey towards Financial Independence which my wife and I want to achieve by the end of 2024 and I will try to resume my monthly passive income updates on my blog MyFinancialShape. I will also continue to write for the investment blog SavyFox which a very good friend and I started last year.

In fact, if I hadn’t followed that path towrds Financial Independence, focusing on a down to earth lifestyle and investing regularily our savings for almost 15 years, my guess is that I would not have had the courage to leave my job and follow my dream. When it comes about Financial Independence it’s that process that is extremely empowering, it is about gaining flexibility in life, creating options and steadily building a strong position to reduce the dependency of a job. And of a boss.

So, without further ado, let’s have a look at the past four months, on how my dividend payers have developed compared to the previous year.

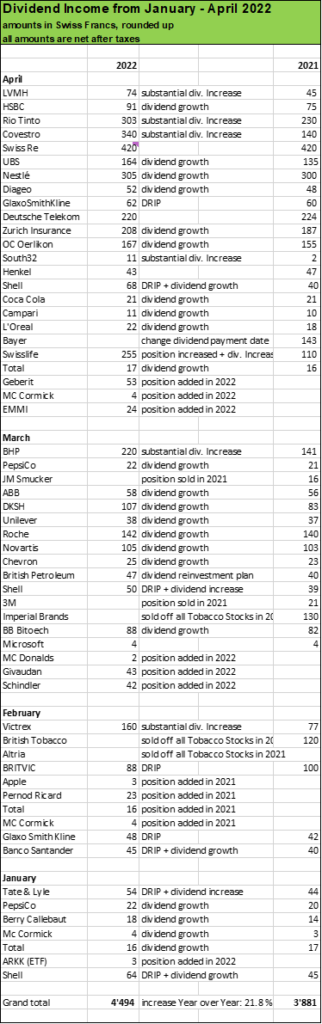

From January to April, our cash flow from Dividends climbed almost 22 % year over year

Over the first four months in 2022, roughly USD 4’500 have been generated from stock holding distributions compared to USD 3’800 in the preivious year. All these numbers in the chart below are in Swiss francs, which trades more or less at parity to the USD. The numbers are all net amounts after taxes. Witholding tax reimbursements are reported separately in my passive income updates.

When looking at the last four dividend months, the picture is very pleasing, showing healthy growth almost across the board.

Mining companies like BHP and Rio Tinto have been particularily strong but also the defensive positions like Nestlé, Unilever, PepsiCo, Coca Cola did not disappoint. Slowly, but steadily, my dividend generating stock portfolio is transforming into an strong cash churning compounding machine.

My plan for 2022 is to achieve at least USD 16’000 which is roughly 15 % higher than in the previous year. This goal should be pretty achievable through a combination of

- organic dividend growth of most of my stock positions

- special dividends in particular from share holdings in the commodity sector

- dividend reinvestment plans (DRIPs)

- addition of new share positions as well as doubling down on existing stock holdings

On the other hand I disposed off all my tobacco shares (Altria, British American Tobacco, Imperial Brands) in 2021 and this move alone reduced my dividend income potential by almost USD 1’000 per year.

Furthermore, exchange rate fluctuations have been a drag. The Euro for instance lost almost 6 % against the Swiss francs in the last few months. The British Pound devalued as well against the Swiss francs.

However, a strong Swiss francs has been good for me, it makes international stocks cheaper. And amid hightened volatility in the stock market to be expected for at least the rest of 2022, there will be several buying opportunities to strengthen our stock portfolio even further.

What about you, fellow reader, have you added some stocks to your portfolio recently? How is your passive income developing?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply