Hey there, fellow readers, I wish you all a HAPPY NEW YEAR!!

First, I have to apologize for my late monthly Passive Income Updates. The last few months have been incredibly dynamic.

I have started my own business

In December, I made the jump and resigned from my job.

Currently I am building my own consulting business and am also working part-time for my former employer in order to ensure a smooth hand-over to my successor.

It’s a win-win I guess, as I have still a few months where I get paid while at the same time I can get my business going.

It’s super exciting and so inspiring, but also a lot of work! I’ll certainly keep you informed about how things are developing.

A brief look at the financial numbers

More than USD 100’000 wealth accumulated in 2021

The previous year has been an amazingly strong one in terms of wealth creation.

Our savings rate hit almost 70 % in November and December and over the year, total market value of our investments surpassed USD 550’000 with USD 600’000 in liquid assets plus corporate bonds. Unfortunately, once again, due to the COVID-19 pandemic we have not been able to realize our major real estate project abroad and deploy our cash pile.

Very strong performance of backbone stock positions

On the back of very strong performance of my largest positions such as Nestlé, Roche, LVMH, SIXT, L’Oreal etc. but also of medium-sized holdings such as Campari, Ferrari, Pernod Ricard and Diageo my dividend portfolio grew handsomely.

As I have always been quite heavily invested in insurance businesses (Swiss Life, Zurich Insurance, Swiss Re, Aviva, Legal & General, Axa, Allianz etc.) and still have some exposure in bank stocks (HSBC, UBS etc.), my investment portfolio has been a beneficiary of rising interest rates.

Positions in oil supermajors and miners (Shell, BP, Total, Chevron, BHP, Rio Tinto, Glencore etc.) did particularily well in the past months while my tech portfolio came down quite a bit. There is clearly a secor rotation going on which is fine, as this always provides nice buying opportunities.

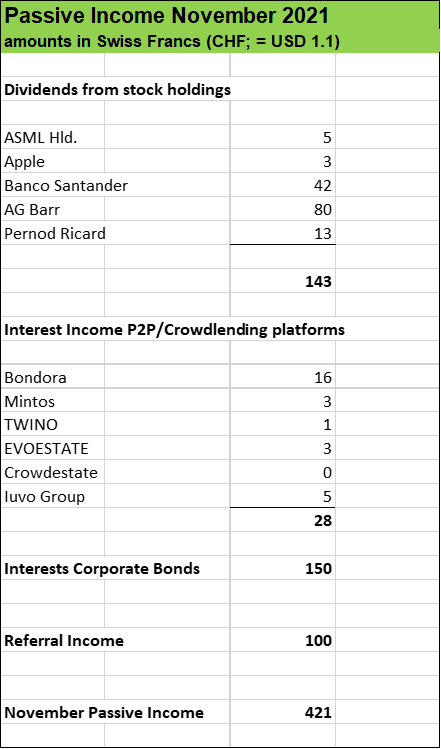

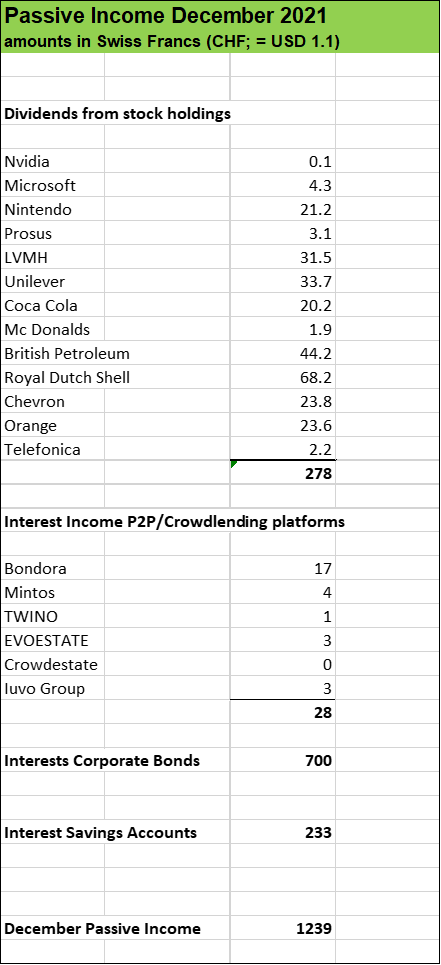

December passive income + 345 % YoY

While November 2021 passive income was pretty in line with the same month in 2020, I finished December with a big jump: Swiss francs (CHF) 1’239 resp. almost USD 1’400 which was roughly 3.5 times higher than in the previous year.

Main December passive income contributor has been our “parking money”, some portions of our relatively large cash pile we put into corporate bonds and on savings accounts to generate interest income.

A total of USD 14’330 passive income in 2021

For the previous year, I had set a goal of USD 15’000 which we slightly missed.

But still, it’s significantly higher than the USD 9’721 in 2020, we are speaking here of a + 47 % passive income jump YoY.

The main reason for the “earning miss” was the fact that I sold off my tobacco stock positions (Altria, Imperial Brands, British Tobacco) early in 2021. Without these disposals, the USD 15’00 passive income target would have been easily achieved.

But what clearly showed as a drag in terms of passive income generation has been great in terms of wealth accumulation as with the free cash from stock disposals I had bought shares of L’Oréal, Pernod Ricard, Ferrari and French oil supermajor Total early in 2021. All these investments had an excellent run so far and I am very confident in the growth potential of these stocks.

So, despite the “passive income earning miss”, 2021 has been an excellent year and I am looking forward to what the new year will bring.

What about you, fellow readers, did you achieve your financial goals in 2021? Thanks for sharing your thoughts below in the commentary section.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action

Good luck on our own business. For my own goals, 1 achieved, 1 failed.

Achieved: reduced the employee stock percentage in the total portfolio from 81% to 59%. Target tough is 20%, reducing this will take another 5 years since the way to go is not selling but regular purchase of shares.

Missed: Savings rate of 53% could not be kept up, it’s now 44%. One reason being increased vacation budget, other decreased salary payouts which are converted into a time account. Still fine for a family of 4

Hi Andre

Many thanks for stopping by and commenting.

These are strong achievements, congrats. 44 % savings rate is strong, absolutely.

Let’s keep it up and let’s have a fantastic 2022.

Cheers

Hi Financial Shaper,

congratulations for your numbers and having the courage to work part-time for your previous employer and start a new business. Great, good luck!

By the way, I found your blog via the FIREhub.eu website. You are listed there as related to Luxembourg. However, you wrote somewhere in your blog that you are currently living in Liechtenstein. I am looking for bloggers in Luxembourg, that is the reason for my interest 🙂

https://firehub.eu/blogs/country/luxembourg/

Cheers.

Hey there

Thanks for reaching out and for commenting.

Yes, I am so excited to have started my business, thanks for your kind words.

Ok, I will check with regard to FIREhub, as I am from Liechtenstein, not Luxembourg.

Cheers

All the best with your new business adventure, Ive got a feeling it will be worth putting the extra effort at the beginning for you. Keep us updated 🙂

Many thanks Tony, yes, I will keep you update. For sure. Starting my own business has so far been an extremely rewarding venture. From a personal level in particular, I have so much more freedom now and can try new things and learn a lot. It’s tough on one side, extremely hard and long work days, but hey, it’s for my own company 🙂 which is pretty amazing.

Cheers