2020 was the year when I made significant changes to my investment portfolio.

I almost invested USD 70’000 into company stocks, mostly to build up a strong Tech Portfolio which since then contributed strongly to my overall performance.

But in 2020 I also invested in dividend paying shares

- in the insurance sector (Swiss Re, Swisslife, Allianz, Admiral),

- in oil and gas producers and mining companies (British Petroleum, Fresnillo etc.) and

- I put money into my favorite sector Consumer Staples by investing in strong businesses like British producer of premium drink mixers Fevertree, Swiss chocolate maker Berry Callebaut and last but not least in Italian spirits maker Campari Group.

Campari Group is one of my favorite alcohol company position in my stock portfolio, along with Pernod Ricard, Diageo and Heineken.

In this article I want to give you some information on Campari Group, which due to its relatively small side is not necessarily on the radar of investors.

Business Snapshot

Davide Campari-Milano N.V. (Campari Group) is an Italian company which is active since 1860 in the branded beverage industry.

The company produces spirits, wines and also soft drinks.

Certainly, the most known products in its brand portfolio is Campari Bitter, an alcoholic liqueur.

But over decades, the Campari Group extended its product range with over 50 brands, including

- Aperol

- Appleton

- Cinzano

- SKYY Vodka

- Forty Creek Whisky

- etc.

Compared to its larger rivals such as Diageo (Johnny Walker, Vodka Smirnoff, Baileys etc.) and Pernod Ricard (Havana Club Rum, Absolut Vodka etc.), we have with the Campari Group a sweet niche-player with annual profits that compare favorably with Brown-Forman of around EUR 1 Bn. resp. USD 1.2 Bn.

But Campari Group is more evenly diversified over its 50 brands and has an astounding global reach for such a small company.

US competitor Brown-Forman for instance has over 40 brands but is highly focused on its two flagship brands Jack Daniels and Forrester. Brown-Forman’s annual net sales are in a range of USD 3.5 Billion and an operative income of above USD 1 Bn.

With sales of roughly USD 14 Bn and an operating income of roughly USD 2.5 Bn, British giant Diageo is much larger than Brown-Forman and Campari Group.

But Diageo also has lower operating margins than Campari Group or Brown-Forman. Diageo has a different product portfolio and another strategic approach with a strong focus also on beer brands (such as Guiness beer) which have lower margins than spirits.

Campari Group came out of the pandemic stronger than ever

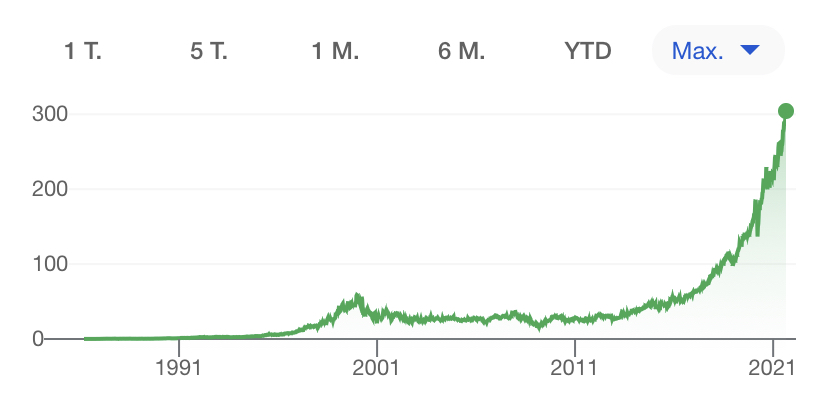

Looking at the stock price dynamics, it is obvious what an exceptional wealth creating factor Davide Campari stock must have been for its long term oriented shareholders.

Campari Group has been on the stock exchange for 20 years and has increased its market capitalisation 15 times to EUR 13 billion which means that we are speaking here about returns of 16 % since the company IPO. Now, that is a significant outperformance of industry peers such as Brown-Forman and Diageo etc.

During the pandemic in 2020, Campari Group worked hard strengthening its competitive position, having an eye on cost discipline and on deleveraging while at the same time ensuring future growth mainly through bolt-on acquisitions.

For instance in June 2020 Campari Group acquired a 49 % interest in Tannico, a leading e-commerce platform for wines and premium spirits in Italy. The investment amounted to around EUR 24 Mio. and is an interesting move given the fact that the world was in lockdown amid the COVID-19 pandemic and most businesses focused on preserving cash to survive. Not so Campari Group. Also in June 2020, the company acquired French Champagne Lallier for over EUR 48 Mio.

In February 2020, before the pandemic hit, Campari Group had already acquired the Baron Philippe de Rothschild France Distribution S.A. for EUR 60.

What’s also interesting, is that amid heavy investments to grow the business, Campari Group also managed to cut debts.

The first half 2021 results highlights show how nicely Campari Group recovered from the pandemic.

Quote:

• “Strong business momentum confirmed, driven by the consumption bounce back in the on-premise channel

upon its gradual reopening in Q2, sustained home consumption driving the off-premise channel, and a favourable comparison base.

• Reported net sales of €1,000.8 million, +37.1% organic growth vs. the first half of 2020 (+30.2% on a reported basis), and +22.3% organic growth vs. the first half of 2019.

• EBIT adjusted of €223.2 million, +88.7% organic change, +640 basis points accretion (+33.3%, +190 bps margin accretion vs. the first half of 2019).

• Group net profit adjusted of €156.8 million, up +101.9% excluding the net positive adjustments of €2.8 million.

• Net financial debt of €1,064.8 million as of June 30th, 2021, down €39.0 million vs. €1,103.8 million as of December 31st, 2020. Recurring free cash flow at €141.6 million, up +117.7% vs. H1 2020 and +64.2% vs. H1 2019.”

Now, Campari Group is not a dividend aristocrat such as Brown-Forman with a more than 25 years long streak of rising dividends. And given the fact that Campari Group stocks almost always trade at a market premium (most of the time over 35 Price Earning Ratio), investors have to be prepared to enter into a modest starting yield of around 1 to 1.5 %.

Campari Group held its dividend payout stable through the pandemic. The company has been paying out dividends since 2001 and there has not been an increase every year. But still, over the years the dividend has grown by 120 % over the last 20 years. Campari clearly gives the preference to growth and acquisitons.

Campari Group has a healthy dividend payout ratio which has been in a range of around 30 % on average since 2001.

As a fast growing niche player, Campari Group has plenty of opportunities to increase its top- and bottom line over time which should find its reflection in attractive dividend growth over time.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.