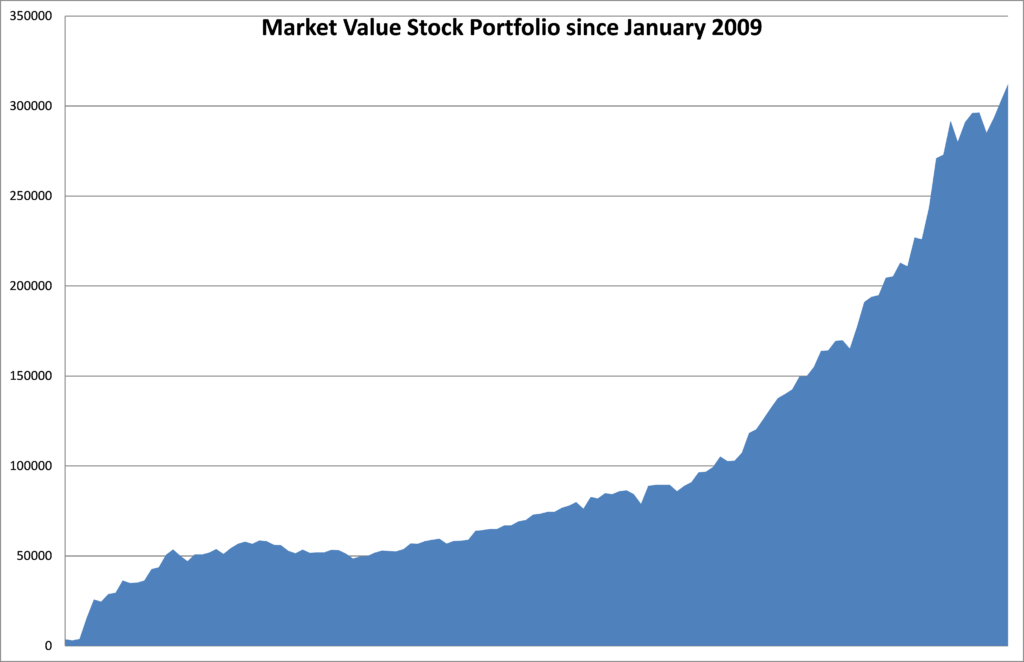

My wife and I started our path as Dividend Growth Investors back in 2009. We follow quite a consequent Buy and Hold Strategy and want to hold our stocks for decades, collect the growing dividends and keep (re-)investing. We embrace market volatility. It’s a very effective, but also unexciting (boring) approach. But so far, we have been rewarded handsomely.

A cash churning machine

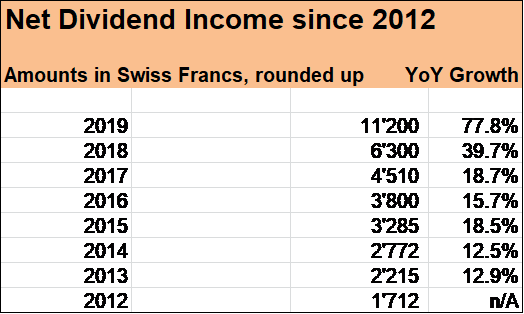

Our share portfolio with a market value of around USD 300’000 consists of almost 70 positions, represents around 35 % of our total assets and churned out over USD 11’000 in 2019 (net after fees and taxes).

Our dividend income has been steadily growing since 2012. In my Monthly Passive Income Updates, I give all numbers in Swiss Francs resp. in USD, which both more or less trade at parity. All numbers are also always net after fees and taxes.

Stock broker and costs when investing

We currently use the online broker/bank Swissquote to acquire stocks. As we follow a Dividend Growth Strategy with a very long time horizon (our ideal holding period for a high quality business is “forever”), we manage to keep our transaction costs relatively low.

It’s extremely important to keep costs low when investing. But even more important is the consequent focus on quality and always keeping a long term perspective.

There are all kind of costs. First, to mention in my view: opportunity costs. The foregone benefit of not investing for instance. The earlier one starts with investing the better. The longer quality assets can produce income which can be reinvested, the stronger the compound effect can be.

And speaking about costs, of course, there is the aspect of taxes. In our case, living in Liechtenstein, there is no specific income tax on dividends or interests, but our total wealth is relevant for our taxes.

And of course don’t let’s forget witholding taxes on dividends from different stocks we own depending on the country.

Witholding taxes are usually deducted automatically from the gross dividend payment amounts. Usually, when there is a double taxation treaty, a portion of the deducted amount is refunded (this requires a file application).

For instance, witholding tax on dividends from Swiss stocks is 35 % which in our case can be reduced to 15 % as Liechtenstein (where we live) and Switzerland have a double taxation treaty. I can file an application and 20 % of the gross dividend amount are refunded to me.

Some Swiss companies pay their dividends from capital reserves which is quite nice, as no witholding tax occur (e.g. currently LafargeHolcim and OC Oerlikon pay out such dividends). This does not mean, that the dividends are not well covered by free cash flow, it’s rather a technical move to benefit from a special tax regime.

British companies in our portfolio don’t deduct a witholding tax and usually also offer a Dividend Reinvestment Plan (DRIP) which means that investors can elect to have dividens being paid out in form of shares of the company. It’s usually a very efficient way to increase the stock holdings and dividend income over time.

Dividends from our Netherland stock holdings such as Heineken have a 15 % witholding tax and in the case uf US-investments (e.g. Coca Cola stocks), witholding tax is 30 % for us. Our French investments (e.g. LVMH, Orange, Danone) have a 25 % witholding tax on dividends and in the case of our German stocks (BASF, Bayer etc.), there is a 25% withholding tax plus a “solidarity surcharge” which is deducted from the dividends we receive.

So, the witholding taxes are an important cost factor, but as said, much more important is the quality of an investment.

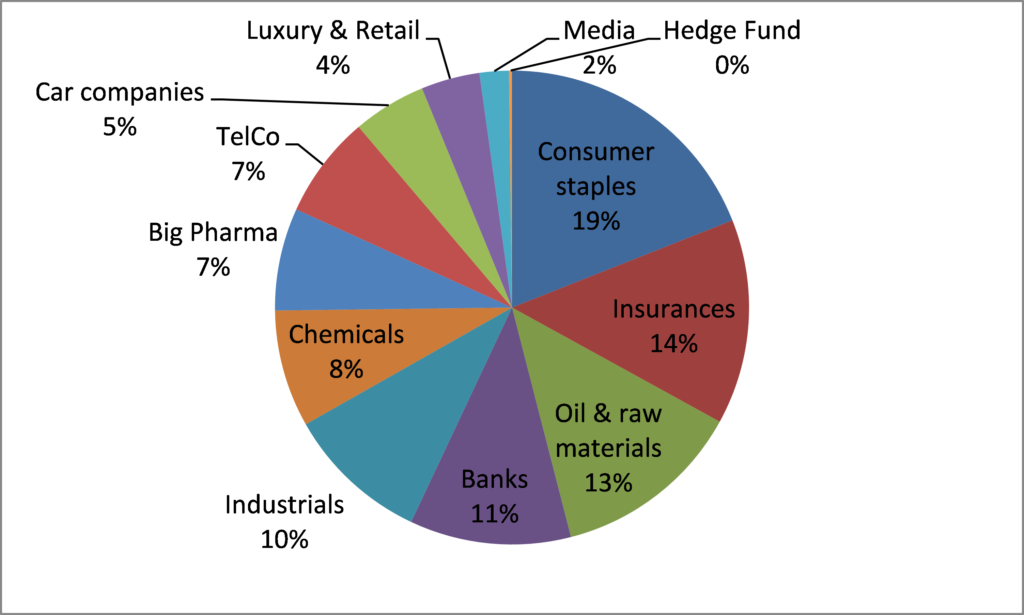

Sector breakdown for our Portfolio

Our stock portfolio has a very strong focus on consumer staple companies. These shares represent the backbone of our investment portfolio.

The next large groups in our stock portfolio is formed by insurance companies followed by oil supermajors and raw material businesses.

The fift largest group consists of bank stocks followed by industrial companies, chemical businesses and “big pharma”.

Telecommunication businesses, car companies, luxury and retail businesses and one shareholding in a media and Entertainment company represent smaller groups in our stock portfolio.

Overview on stock positions

Consumer staple businesses

- Nestlé

- Unilever

- Tate & Lyle

- Coca Cola

- PepsiCo

- J.M. Smucker

- Fevertree

- AG Barr

- Nichols

- Britvic

- Massimo Zanetti (exited in January 2021)

- Reckit Benkiser

- Heineken

- Diageo

- Anheuser-Busch ImBev

- Berentzen

- British American Tobacco (exited in February 2021)

- Imperial Brands (exited in February 2021)

- Altria (exited in February 2021)

- Danone

- Fevertree

- Campari

- Mc Donalds

- L’Oreal

- Pernot Ricard

Insurances

- Zurich Insurance

- Swiss Re

- Aviva

- Legal & General

- Axa

- Swiss Life

Oil and raw materials

- Royal Dutch Shell

- Exxon Mobil

- Chevron

- Total

- British Petroleum

- Glencore

- Rio Tinto

- BHP Billiton

- South32

- Fresnillo

Banks

- UBS

- Credit Suisse

- HSBC

- Banco Santander

- VPB

- LLB

Industrials

- 3M (exited in February 2021)

- Henkel

- OC Oerlikon

- Victrex

- Babcock International

- ABB

- Lafarge Holcim

Chemicals

- Bayer

- Covestro

- BASF

Pharma and Medicine

- Roche

- Novartis

- GlaxoSmithKline

- BB Biotech

- Fresenius

Telecommunication

- Deutsche Telekom

- Orange

- Telefonica

- Nokia

Car maker and car rental company

- Bayerische Motorwagen (BMW)

- Porsche Automobil Holding SE

- SIXT Group

- Ferrari

Luxury and retail

Media and Entertainment

- Walt Disney

Hedge fund

Disclaimer

You are responsible for your own investment and financial decisions. This article/page is not, and should not be regarded as investment or tax advice or as a recommendation regarding any particular security or course of action.