2022 has been incredibly dynamic so far and I have been extremely busy building and growing my own consulting business I started early this year. This dividend update is more than overdue, in fact it has been half a year since I’ve published my last passive income update. Sorry about that.

I hope to be able to return to my monthly dividend updates very soon. I’ve been doing so for more than six years, since 2016 when I started this blog to document our Journey towards Financial Independence by 2026.

We are still working towards that goal and in fact having been streamlining our finances and establishing various passive income sources for years certainly played some role in my decision to start my own business.

From January to October, grand total of our our investment portfolio net income was USD 16’000, an increase of 60 % compared to the previous year. That corresponds to a big chunk of our fixed cost block.

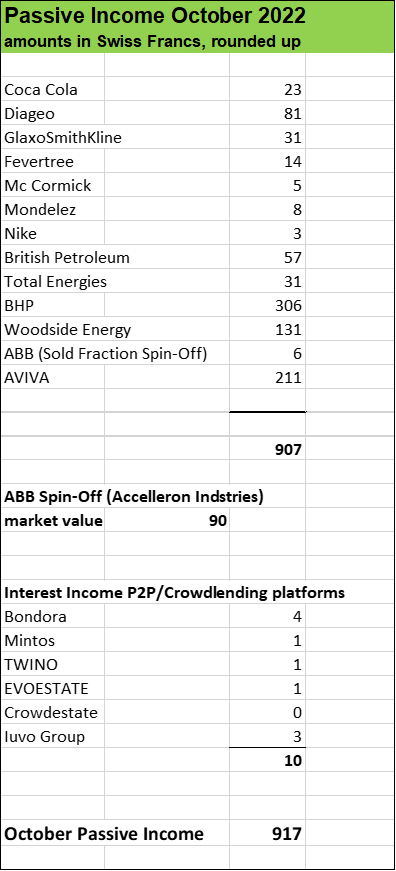

So, without further ado, let’s have a look at the last six months in terms of passive income, starting with October.

October showed a nice 26 % passive income jump on a year over year basis

Compared to the previous year with USD 725 in passive income, October 2022 showed higher amounts due to a combination of

- organic dividend growth

- dividend reinvestments plus

- added or increased stock positions (Nike as well as Woodside Energy, a spin-off of BHP Billiton).

As you can see, commodity, resource and oil businesses (British Petroleum, Total Energies, BHP, Woodside Energy) as well as insurances (AVIVA) make up for the bulk of my passive income contributions not only in particular to this month but with regard to the portfiolio in general.

What’s also worth noting that new shares of existing position ABB – called Accelleron Industries – have entered my portfolio with a market value of around USD 90. Spin-Offs are pretty nice additions, for instance in the case of BHP Billiton, two separated companies – South32 and Woodside Energy – made interesting additional dividend payers.

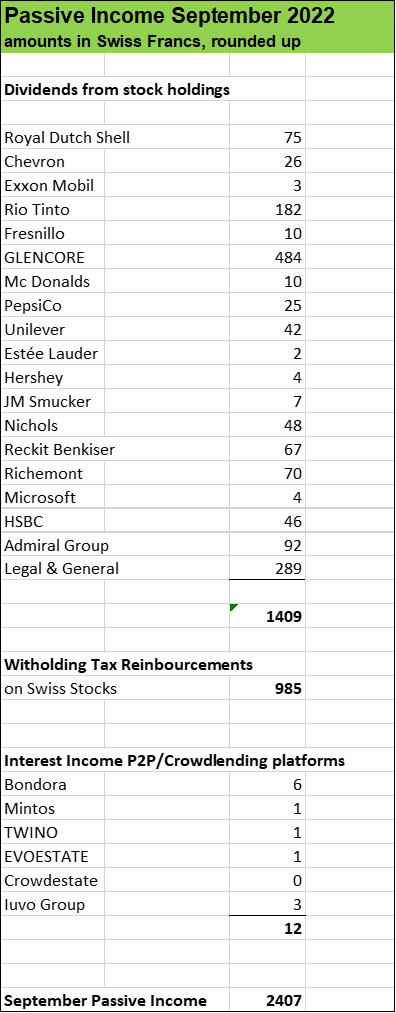

September dividend income in line with previous year

September 2021 was already a strong month with around USD 1’460 in dividend income. This year, it was more or less the same amount generated by dividend paying stock positions.

However, in particular on the back of witholding tax reimbursements in the amount of USD 985on Swiss stocks such as Nestlé, Roche, Novartis etc., September became a particularily strong month.

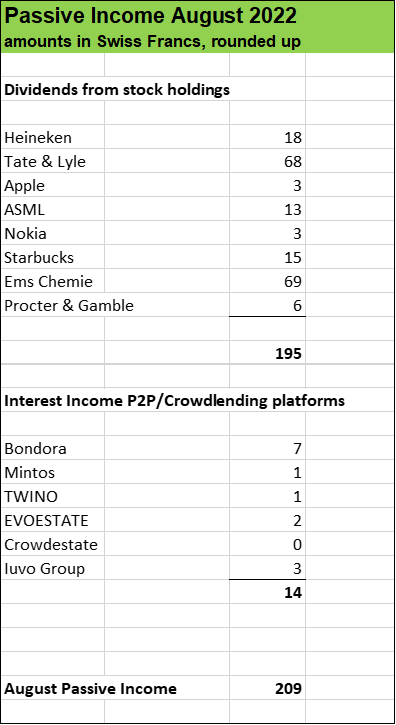

August showed a passive income increase of 38 %

Early in 2022, I added three new stock positions which contributed nicely to our passive income stream:

- Starbucks

- Ems Chemie and

- Procter & Gamble

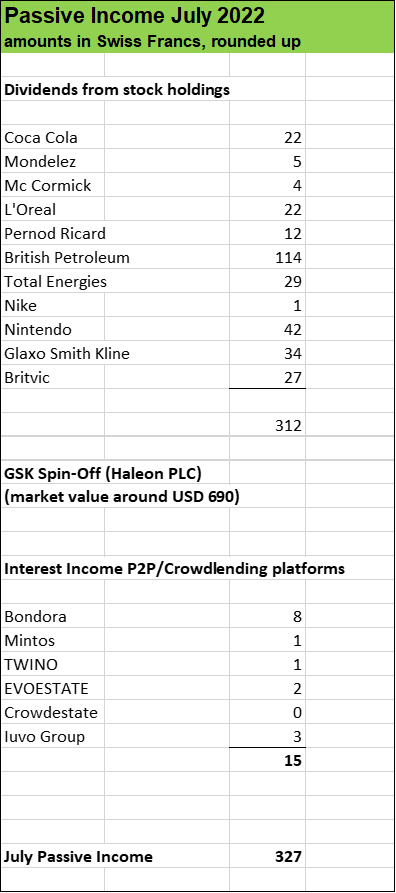

July passive income was pretty in line with the previous year

While there was some nice organic dividend growth in the case of Coca Cola, Mc Cormick and L’Oreal as well as positive effects from dividend reinvestments, overall total passive income was more or less in the same range as in the previous year due to significantly lower interest income from Peer to Peer investments which I have been further reducing for many months.

It’s worth noting that pharmaceutical company Glaxo Smith Kline (GSK) made a spin-off. The new shares of Haleon I received had a market value of around USD 690 at the time of the distribution and I will keep this position. Sometimes, spin-offs can make interesting positions over time (see BHP which separated South32 for example).

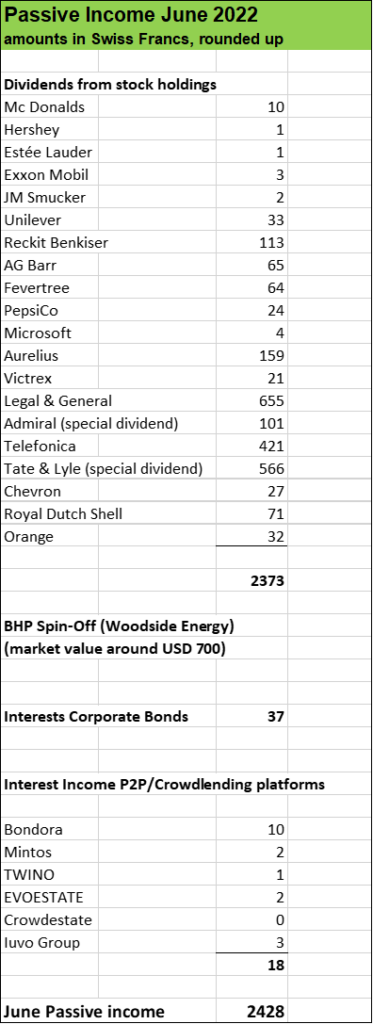

A very cool 100 % passive income jump in June

June showed some very positive effects in form of special dividends (Admiral, Tate & Lyle). Furthermore,

- organic dividend growth (Mc Donalds, PepsiCo etc.)

- dividend reinvestments (Legal & General, Royal Dutch Shell etc.) and

- new stock positions (Hershey, Estée Lauder etc.)

contributed to the overall income jump.

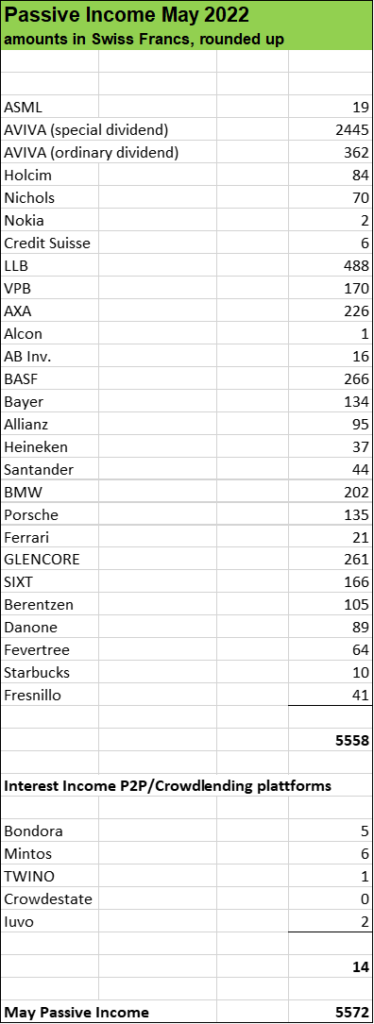

50 % higher passive income in May

On the back of a huge special dividend from UK insurance giant AVIVA in the amount of over USD 2’400, May showed a very strong month. In fact, in that month, my passive income considerably exceeded our household spendings which is always a very nice thing to see.

What about you, fellow reader, have you added some stocks to your portfolio recently? How is your passive income developing

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi “guy in your fourties, with a wife and two children” 😉

I am also a guy in my 40s with a wife and two children. We even have many of the same dividend stocks (BHP, Mondelez, 3M, BMW, etc.).

I totally stopped P2P lending. Tested Mintos and four others. Initially went well, but then 2 of the 5 fell apart, and after years I am still waiting to get back some money.

I stopped working full-time about five years ago, and now help those companies I am invested in wherever I can. Love working from my home office.

Keep up the good work – maybe you can share another update soon!

Cheers from Singapore,

Noah

This