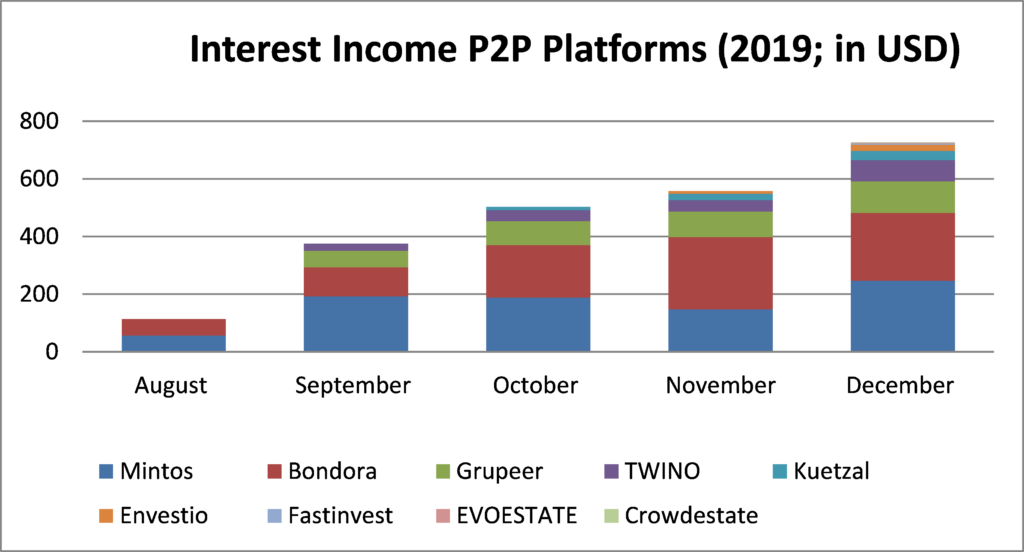

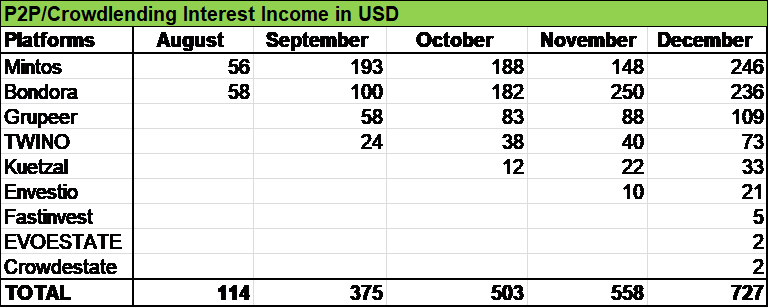

My wife and I started Peer to Peer (P2P) lending and Crowdlending (CL) in August 2019 to diversify our investments and set up a second Passive Income Machine in addition to our dividend paying stock portfolio.

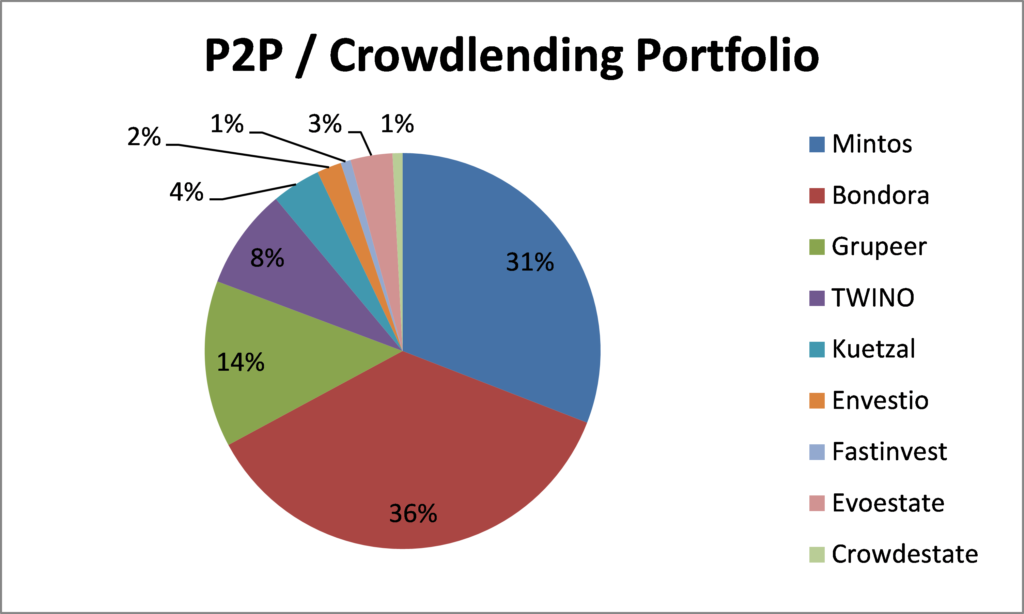

As of 31 December 2019, our P2P/CL portolio generated over USD 700 per month and by the end of 2019, we had over USD 67’000 invested in nine platforms.

The development of our Portfolio

- In August 2019, we started P2P investing with Mintos plus Bondora and added TWINO and Grupeer in September 2019.

- We then added crowdlending platform Kuetzal and late in October made another addition with Envestio.

- Late in November we opened investments accounts on following three platforms: Fastinvest, EVOESTATE and Crowdestate.

An overview on our nine P2P/CL platforms as of 31.12.2019

Mintos is our flagship number one

See my review and my thoughts on that platform here

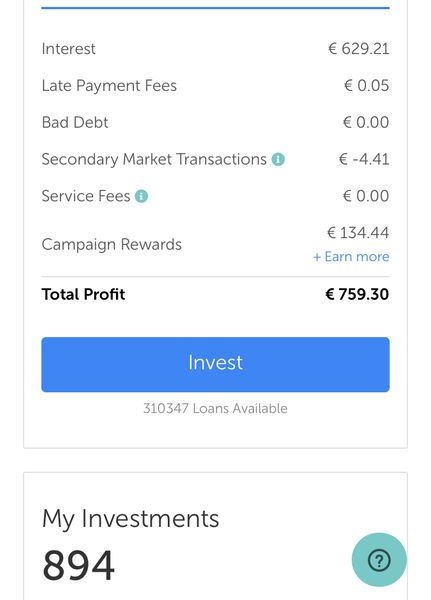

Since August, Mintos has returned almost EUR 760 (USD 840) and had an extremely strong December with USD 246, 66 % higher than the previous month.

As I’ve written in my November passive income review, some loan originators on Mintos are experiencing some specific problems and I took this as an opportunity to invest some time on the setup of my individual Auto-Investment Strategy that I can feel comfortable with from a risk-reward-perspective. Making the switch away from Invest & Acces has shown rewarding. I plan to make a specific blogpost on my Auto-Invest settings.

See print screens of the Mintos dash board as of 31.12.2019:

Bondora is our second flagship

See my review and my thoughts on that platform here

What I really like about Bondora is the great flexibility the platform provides to us investors.

“Go & Grow” combines the advantages of liquidity plus returns of 6.75 %.

The feature “Portfolio Manager” which lets you directly invest in loans makes it possible to make greater returns.

There are even more features, such as “Portfolio Pro”. For sake of simplicity, we only use “Go and Grow” and “Porfolio Manager”.

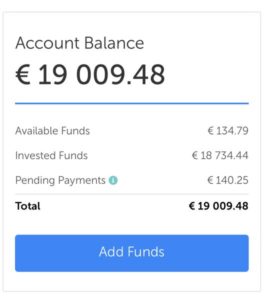

As you can see from the print screen below, we split our investments as follows:

- 2/3 in “Go and Grow” and

- 1/3 via “Portfolio Manager”.

Print screen of Bondora dash board as of 31.12.2019:

Bondora is a very well established P2P platform, offers flexibility, diversification (you can invest up to EUR 1 and there are over 70’000 loans) as well as very attractive returns. There is no buyback guarantee which for instance we see with most loan originators on Mintos but on the other side, Bondora as issuer of loans avoids to add risks on the platform, which is positive in my view.

Grupeer

See my review and my thoughts on that platform here.

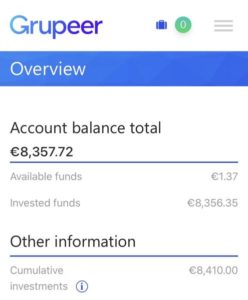

We have roughly EUR 8’000 (USD 8’800) invested and in a matter of just a few month over EUR 300 (USD 330) have been generated in interest income.

Print screen of Grupeer dashboard as of 31.12.2019:

Grupeer is one of the most interest platforms in our P2P/Crowdlending portfolio and offers a nice combinatio of real estate and business loans, attractive yield and most of the projects with buyback guarantee.

TWINO

See my review and my thoughts on that platform here.

Print screen of TWINO dashboard as of 31.12.2019:

Kuetzal

This Estonian plattform focuses on business- and real estate loans.

In the blogger community very serious concerns have been raised about some of the projects of Kuetzal and about the platform itself. The company has so far not given a convincing response to address these concerns and I decided to reduce my exposure.

Update January 12, 2020: The platform turned out to be a scam!

Print screen of Kuetzal dashboard as of 31.12.2019:

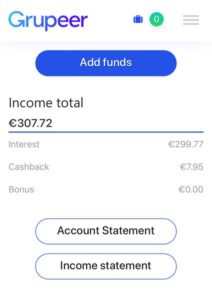

Envestio

This Estonian plattform focuses on business- and real estate loans.

Update January 22, 2020: The platform turned out to be a scam!

Print screen of Envestio dashboard as of 31.12.2019:

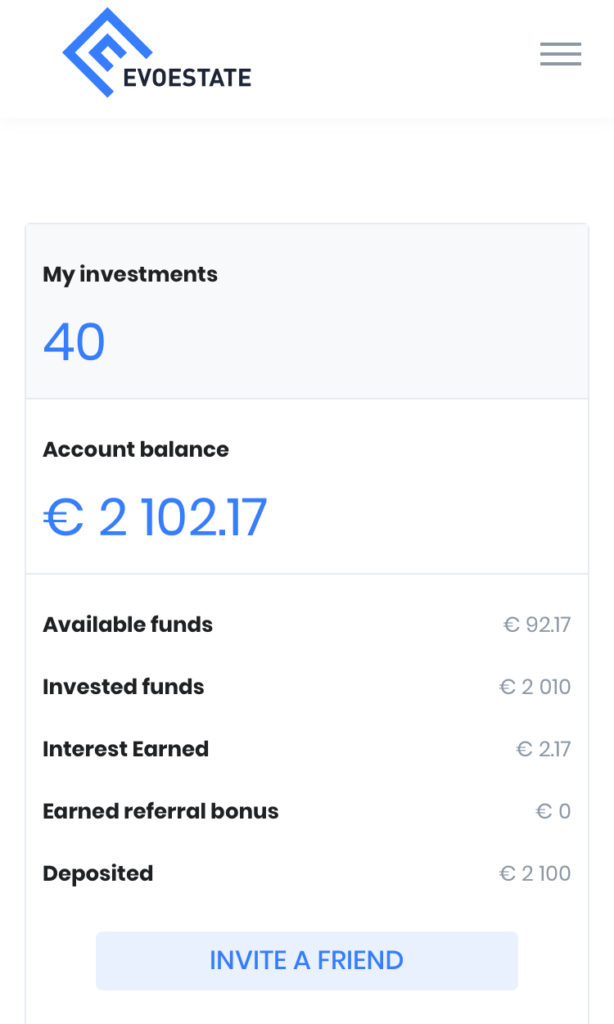

EVOESTATE

EVOESTATE is a very interesting way to invest into European real estate projects. EVOESTATE is a “Plattform Consolidator”, giving Access to Projects on 18 different platforms from 6 different countries such as Housers, Bulkinvest, Reinvest etc.

With EVOESTATE, you can diversify more broadly than for example with Reinvest24.

What’s also very interesting on EVOESTATE is that you can invest up to EUR 50 per project, whereas if you invest directly in houser, the minimum investment amount is higher.

Print screen of EVOESTATE dashboard as of 31.12.2019:

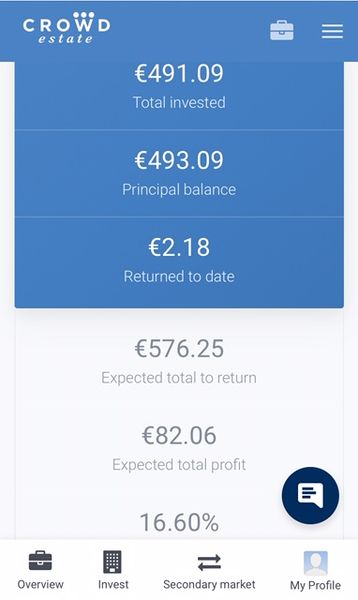

Crowdestate

Founded in 2014, Crowdestate is a well established real estate crowdfunding platform in Europe with 43’000 active users giving access to a variety of investment opportunities (mainly reals estate loans but also business loans).

Print screen of Crowdestate dashboard as of 31.12.2019:

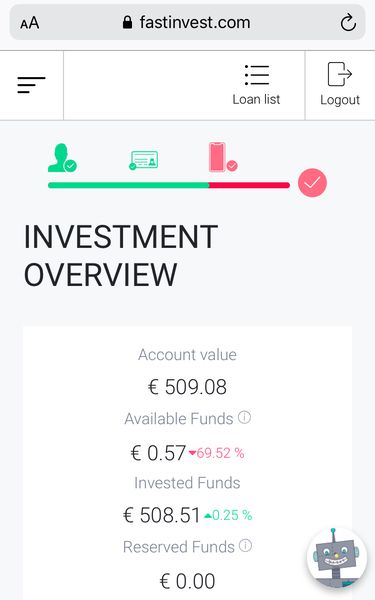

Fastinvest

Fastinvest is another platform giving the opportunity to invest in consumer loans (like Mintos, Bondora and TWINO), most of them yielding 12 %.

Fastinvest offers a buyback guarantee which implies a bigger platform Risk than with Mintos for example.

Many of the loans are in Denmark which gives the opportunity to diversify a bit more geographically.

The platform is extremely user-friendly and the Performance so far has been good.

What I don’t like is the fact that most of the loan originators are not disclosed, Fastinvest seems to be less transparent than for instance Mintos and other platforms.

We decided to try this platform, diversifying our P2P/CL platform further but to cap our investmens on Fastinvest to around EUR 500.

Print screen of Fastinvest dashboard as of 31.12.2019:

Disclaimer

You are responsible for your own investment and financial decisions. This article/page is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi MyFinancialShape.

I just found this page. I am another person interested in Financial Independence in Luxembourg. I am very boring 🙂 I only invest in passive investing.

For curiosity, are you still investing in p2p lending? I remember there were bad news (scams, etc.) some years ago.

Good luck and best wishes!

Hi

I like passive income investing very much, in particular dividend growth investing.

With regard to P2P, in fact I withdrew most of my investments but still have some money left in Bondora, Mintos, Iuvo, Twino .. Yes, there were serious problems and scams in the P2P/Crowdlending industry. I lost money and over all, in the medium run – at best – it has been a zero sum investment. I definitively prefer my dividend investments.

Thanks for stopping by and commenting and all the best.

Cheers