Note: this is an updated and republished post I initially wrote on April 2, 2017.

In 2009, marking the beginning of my path as a dividend growth investor I had put aside the amount of Swiss Francs 15’000 (CHF; trades more or less at paritiy to the USD) in savings and decided to buy stocks of following companies (CHF 5’000 for each position):

- Deutsche Telekom (acquisition price: around EUR 9)

- Nestlé (acquisition price: around CHF 36)

- Royal Dutch Shell (acquisition price: around EUR 17)

These three investments in very different and unrelated industries (telecommunications, consumer staples, oil & gas) built the fundament of my stock portfolio at that time. Companies with very specific business models, particular strengths and weaknesses and contrasting dividend policies.

I want to show you my returns (2009 – 2021) from Deutsche Telekom, Nestlé and Royal Dutch Shell and share my thoughts on investments in high yield stocks.

(Note: the amounts are in Swiss francs (CHF). CHF 1 = USD 1.1. = EUR 0.8).

Holding Deutsche Telekom, Nestlé, Royal Dutch for 12 years – and much longer

When I made my stock acquisitions in 2009, the dividend yields of Deutsche Telekom and Royal Dutch Shell were well above 6.5 % whereas Nestlé’s was more modest, significantly below 3 %.

Since 2010, Deutsche Telekom has paid me back around CHF 3’000 or over 60 % of my initial investment . As of today, the stock price stands above EUR 17 which implies a book gain of more than 80 %. My engagement in Deutsche Telekom has been pretty rewarding so far, even more if you take into account the strong depreciation of the EUR against the CHF (in 2009 the CHF/EUR Exchange rate stood at 1.5, as of today it is 1.08). My total return (collected dividends & book gain) is around 140 % of the initially invested amount of CHF 5’000.

Nestlé’s dividend returns were handsome as well. So far, I have received around CHF 2’600 in cash, representing 52 % of my initial investment. Nestle’s share price has more than triple since 2009. My total returns on that holding position exceed 350 %.

Royal Dutch Shell has been my top dividend contributor from the beginning with a yield on cost of well above 7 %. I reinvest the quarterly dividends unless the stock price has risen too much (above EUR 30, I take the dividends in cash). My stock count increased from 200 to over 300 since 2009. Including the projected dividends for 2017, Royal Dutch Shell will have returned to me over 60 % (roughly CHF 3’000) of the invested principal amount of CHF 5’000. Today, the stock price stands at around EUR 24.5 which represents more than 40 % book gain. My total return in CHF is around 80 %.

Dividend histories of Deutsche Telekom, Nestlé and Royal Dutch Shell

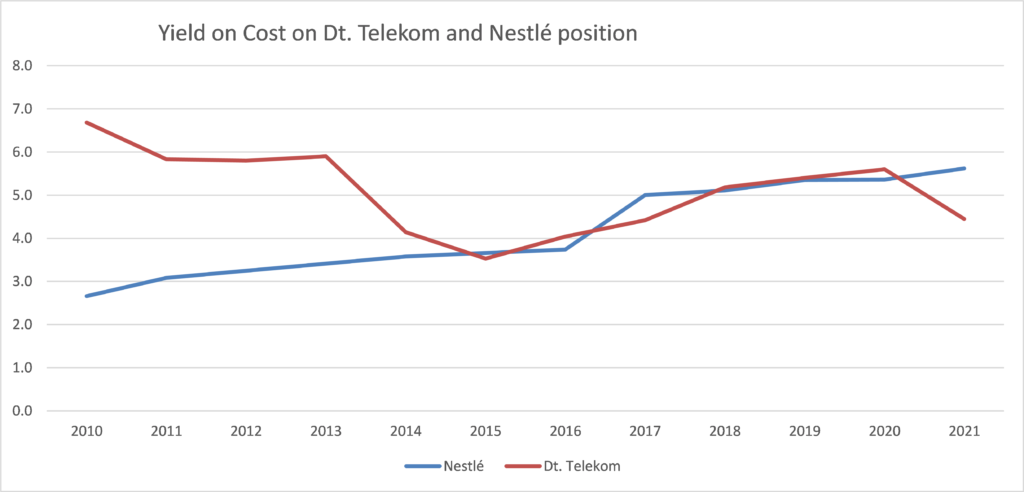

When you take a look at the graph above, showing my yields on cost (YoC; not: net after taxes and fees) with regard to Deutsche Telekom and Nestlé, it is pretty clear, that both companies have completely different dividend policies- and patterns.

Nestlé has consistently increased its dividends since 1988. From 2009 to 2017, my yield at cost slowly climbed from 2.3 % to 5.6 % (after witholding taxes and fees). As can be seen in the graph, between and 2016 and 2017 there was a strong jump of my YoC, as the country where I live entered into a double taxation treaty with Switzerland, resulting in the possibility to get witholding tax reimbursements which reduced the tax burden from 35 % to 15 %.

Deutsche Telekom in contrast shows a much less consistent dividend history, going back just to 1996. There were several dividend cuts in the past. From 2009 to 2015, my yield on cost fell quite significantly from around 6.5 % to 3.5 % in 2015 and has been climbing since then. Without the deprecation of the EUR against the CHF the decrease would have been less dramatic. But nevertheless, my yield on cost has been moving downwards compared to 2009. And yet, my investment has paid off quite nicely and the business outlook is promising. Since 2015, Deutsche Telekom has hiked it dividends by 10 %, in line with the development of the Free Cash Flow (FCF). Cash generation is robust and has been expanding in the last three years. But telecommunication businesses require huge capital expenditures (investments in networks etc.). Regulations (especially in the European telecommunication market) and tough competition put enormous pressure on margins. FCF will certainly not be as predictable and stable as it is with consumer staples and I wouldn’t be too surprised if my yield on cost settled in a range between 3.5 and 4 % in the medium and long term.

Nestlé in contrast already shows YoC above 5.5 %, and it’s very likely to increase year by year.

Royal Dutch Shell has not cut its dividends since World War II, until the COVID-19 pandemic and global lockdowns hit the world economy and oil producers in particular. Royal Dutch Shell slashed its dividend significantly. But still, over the long rund, that business has been an extremely reliable cash machine, making generations of investors smile. Operating in a very volatile, cyclical business, the road to wealth by investing in Royal Dutch Shell has never been as smooth as with Nestlé. The dividend does not go up every year but nevertheless, Royal Dutch Shell has been very generous to shareholders for over 70 years.

Some considerations on high yield stocks

At the beginning of my path as a dividend growth investor I was particularily attracted by stocks with high dividend yields. Investing in Deutsche Telekom and Royal Dutch Shell seemed to me a no-brainer at that time providing nice (immediate and long term) returns and meanwhile showing a moderate risk profile.

Investing in high yield stocks can be very rewarding but only under the condition that

- the purchase price makes sense and there is a sufficient margin of safety,

- the company is particularily well positioned with a broad economic moat and

- business fundamentals and cash generation remain intact for the foreseeable future.

If these criteria are not met, I would certainly not invest in that company as it poses the risk of tapping into a value trap.

High yield stocks are not “to invest and forget”. It’s not like participating in Johnson & Johnson, Hershey, Unilever, J.M. Smucker, Disney, Pepsico or Nestlé. These companies are extremely solid and provide such reliable and strong growth, that you can litterally count on being bailed out over the medium term even if you overpaid.

That’s almost certainly not the case with high yield stocks, even if you invested in the industry leader. Why is that?

Well, because more often than not there is a reason behind the fact that a stock has a high yield (let’s say over 5 %).

A high yield indicates pressure on the stock. There might be a near or medium term challenge e.g.

- the market (over-) reacted to some legal issues

- a transformation process is ongoing with some uncertainties with regard to the future earning power and risk profile of the company

or there might be some longer term headwinds such as

- (new) regulatory requirements putting pressure on the profitability (just think of banks having to fulfill capital requirements)

- dramatically changing business fundamentals (just think again of banks in an ultry low interest environment or just look at oil companies in a “lower oil price for longer environment”)

- etc.

Most of the time, a high yield comes at a price for the investor (higher volatility of earnings, less predictable dividends, higher debt level etc.) and the stock has to be watched carefully.

You can see high yield stocks in sectors like oil and mining, telecommunication, insurances and banking. They are often operating in cyclical and capital intense businesses.

Some people say that a “particularily high yield” is an indication

- for massive problems,

- for low quality of the ompany and

- that a dividend cut is just around the corner.

Well, I don’t think that these three worries are met cumulatively with high yield stocks most of the time and would suggest a more differentiated view on these businesses.

Firstly: There might be massive headwinds, but a strong company is able to adapt and to overcome problems.

Secondly: With regard to the quality of such a business, just think of Chevron, or Altria for instance. I’ve seen their dividend yields well above 4 % several times over the last decade. There are people that hesitated to buy Chevron when its stock price fell below USD 80 in early 2015 just to buy when the price shot up above USD 110. The same people first critized the negative FCF of the company and its massive debt load just to change their position a few months later in order to praise “the high quality of the company and brighter outlook“. Most of them were reluctant to buy because the stock price fell (and dividend yield shot up) and were eager to acquire some shares when the price recovered. Don’t get me wrong: the criticism is fair, Chevron is still funding a big portion of its dividends through debts, even after oil prices have recovered a bit. My point is: the stock price resp. the dividend yield alone is certainly no indicatation with regard to the quality of the company.

Thirdly: Some investors just can’t forgive dividend cuts and dump their stocks as soon as there are signs that payouts might be slashed in the near future. Fair enough. But just bear in mind, that a dividend reduction is by far not the end of the company. Just think of Bank of America, Rio Tinto, BHP Billiton. I am quite optimistic that these companies will still thrive twenty years from now.

Conclusion

Since 2009, Deutsche Telekom, Nestlé and Royal Dutch Shell have returned almost 100 % of the initially invested amounts. Nestlé’s yield on cost has been climbing smoothly to 3.8 % (after witholding taxes, reimbursement not included) whereas Royal Dutch Shell’s has been steady at around 7 % over the years. My yield on cost regarding Deutsche Telekom has been falling from 2009 to 2015 but has recovered quite a bit and currently sits above 4 %.

Investing in high yield stocks can be rewarding but it can be very tricky. It’s important to make sure that there is a sufficient margin of safety and not to rely too heavily on these companies.

I like to have a good mix between lower- and high yield stocks and always try to put rock-solid stocks at the core of my portfolio. These businesses offer me a much lower dividend yield in the near term but provide stability to my portfolio and reliable organic growth for the future. That’s one reason why I just love my positions in consumer staples (e.g. Nestlé, Unilever and Heineken) and pharma companies (Roche, Bayer, Novartis etc.). It’s great to see them grow. Slowly but steadily.

I am not in a hurry at all. I am enjoying my path as a dividend growth investor.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.