That’s exactly how I like it!

My dividend stock growth machine is gaining steam.

Slowly and steadily.

Compared to 2016, my projected dividend income will be 10.5 % higher, climbing from USD 3’800 to USD 4’200 largely due to dividend hikes and by adding two positions.

I am pretty sure that by the end of 2017, my dividend income will be well above USD 4’500.

Strong and reliable dividend growth

My goal is simple:

increasing dividend income by at least 15% year over year through organic growth (dividend hikes), reinvestments and by adding new positions (see my Passive income review 2016 and outlook and my Stock Investments in 2016).

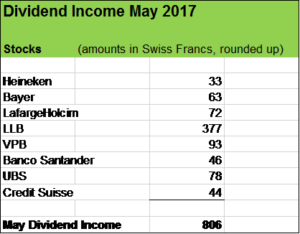

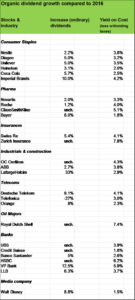

In my blogpost Dividend increases regarding my stock holdings I made a first overview regarding organic dividend growth of my stock investments. The list above shows you an update. As you can see, 26 of my stock holdings announced their 2017 dividends so far, 6 companies will report their 2016 results in a few weeks resp. have not yet published information on dividend increases for 2017.

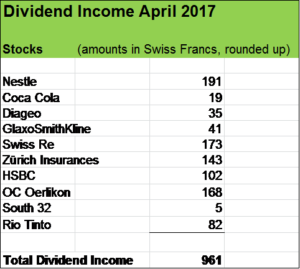

Most of my holdings show nice dividend hikes. “High yielder” in my portfolio such as Royal Dutch Shell, HSBC and GlaxoSmithKline offer dividend reinvestment plans. My stock count will develop quite nicely over time.

Slow dividend growth is nothing to lament about! Nestlé’s dividend hike for example was relatively small. But here’s the thing: my yield on cost less witholding taxes is 3,8 %. Taking into account the reimbursement on the basis of a double taxation treaty lowering the Swiss witholding from 35 % to 15 %, my yield will be substantially higher, being at around 4.5 %. Over the last 8 years, Nestlé has steadily increased its dividend payments and returned to me well over 30 % of my initial investment.

I love reliable and stable businesses. Nestlé made generations of investors a fortune just by taking a long term view, sticking to their holding and by letting the company doing its work.

More dividend income increases expected

So far, I’ve added two new positions in 2017:

- beer producer Heineken (see A refreshing investment) and

- tobacco company Imperial Brands (Davidoff, Cohiba, Montecristo etc.).

My investment portfolio is getting more defensive and these two position will add USD 160 to my dividend income in 2017. I expect future growth to be at a high single digit rate.

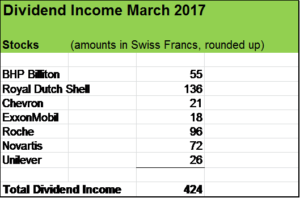

And there is more growth to come during the year. As said, 6 companies of my investment portfolio have not yet announced their dividend increases. Among them oil supermajors ExxonMobil and Chevron. I am pretty sure that there will be dividend hikes albeit significantly lower than in the past years. Oil prices recovered quite a bit since the terrible drop in 2015 and of course these companies are streamlining at an amazing pace and ramping up huge projects which should show improved operative cash flow quite significantly.

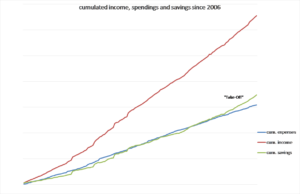

Given the strong boost of our savings rate, now being well above 60 %, I expect my investments into new positions to be a bit higher than in the previous year (2016: USD 16’000).

I don’t mind market fluctuations and have been investing on a regular basis for almost a decade now. But with stock indices at record highs and mushroomed share price valuations, I am gettting a bit more cautious. In my view it’s sensible to be extremely selective and to keep additional cash just to take profit when there is a market retreat which makes it easier to identify suitable investment oportunities. Either way, my portfolio will be doing just fine over the long term.

My journey as a dividend growth investor is becoming more and more fun.

Have you added new positions to your portfolio lately? Have there been some dividend hikes?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.