Since 2009 I have been building an investment portfolio consisting of dividend paying stocks with the purpose of transforming it in an ever growing passive income machine over time.

Today, my stock portfolio consists of over 30 positions and has a market value of almost USD 140’000. But more importantly, since 2009 the companies in my share portfolio have returned a total of USD 20’000 in dividends and will provide at least USD 4’500 in fresh cash for 2017. I expect my annual dividend income to continue to grow by 15 % on a Year on Year (YoY) basis. As in the past, half of that growth will derive from new positions (see My stock investments in 2016) and the other half is expected to come from organic dividend growth and dividend reinvestments (see Passive Income review 2016 and Outlook).

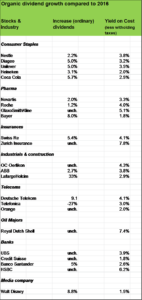

So far, over 70 % of the businesses in my portfolio have published their full year results for 2016 and already given information regarding dividend payments to be expected in 2017. That allows me to make some projections regarding organic dividend growth and my expected Yield on Cost (YoC) regarding each position (see chart above). Of course, most of these dividend announcements are still subject to the approval by the annual general meeting. I calculate YoC on the basis of the net cash payments I will receive this year. For simplification purposes, I do not take into account reimbursements I will receive with regard to witholding taxes. The Swiss witholding tax on dividends for instance is 35 % but I can lower that tax rate to 15 % on the basis of a double taxation treaty which will significantly increase my dividend yield on my holdings in Nestlé, Roche, Novartis, Swiss Re etc.. These reimbursements will likely take place in 2018 with regard to deductions on my stock dividends in 2017.

My financial portfolio is denominated in Swiss franc and I hold major positions in EUR, USD and GBP. So there might be some devations with regard to my projections concerning YoC due to exchange rate fluctuations. Over the long term, these fluctuations will smooth out and of course as an dividend growth investor in the accumulation phase, a strong Swiss franc towards other currencies is a real blessing (see also The day when my portfolio dropped by 15 %).

So far, dividend growth looks fine. As soon as the rest of the businesses in my investment portfolio will release 2016 results and dividend announcements, I will update my chart and briefly cover each of my stock positions.

What about your stock holdings? Have there been some nice dividend hikes? Any dividend cuts?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply