August has been an amazingly interesting month. My wife and I have been looking for some real estate projects. We have been searching for our DREAM HOUSE for some months now and we are also considering investing in rental properties.

BUT PRICE LEVELS MAKE US EXTREMELY CAUTIOUS.

More often than not, house prices, in particular here in central Europe, have gone crazy!

It is alway the same, when it comes to investing: IT IS ONLY ATTRACTIVE, UNLESS YOU OVERPAY!

So with regard to real estates, my wife and I have not yet taken any decision. I plan to give a specific update in one of my next blogposts.

With respect to stock investments, I made nice buys this year but to some extent decided to stay at the sideline. STOCK PRICES ARE HIGH! It seems sensible to keep some powder dry to take advantage in case of a substantial market retreat (man, I wish I had bought much more stocks early in 2016 or before the BREXIT vote when prices were very attractive).

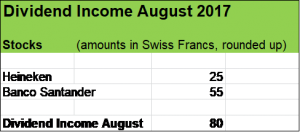

Now, let’s have a look at the dividends received in August.

Heineken and the Spanish lender Banco Santander provided the amount of USD 80, putting my passive income for the last eight months to around USD 3’100. And there are very strong months ahead with solid inflows from my oil and mining stocks as well as from some of my consumer staples holdings. So I’m pretty well on track hitting my dividend income goal of USD 4’500 for 2017.

Received dividends of USD 80 in August does not look much, and in fact it is by far the weakest month in respect of passive income. Compared to last year though, my August dividend income doubled! USD 25 of the YoY-increase is due to the acquisition of Heineken stocks in 2016 (that business provided me with total dividend amount of around USD 60 in 2017) and around USD 15 came from organic growth (dividend hikes) and dividend reinvestments in Banco Santander.

So, pretty nice income growth YoY.

THAT’S EXACTLY WHAT I WANT TO SEE AS A DIVIDEND GROWTH INVESTOR!

Heineken: solid beer Investment with robust growth ahead

I can only think of one more beer company with such a strong presence like Heineken. Each time when I go grocery shopping, pay at the gas station or walk through a duty free shop, Heineken and its brands are always on the shelves. Whether it’s the core brand Heineken, Amstel, Desperados, Tiger Beer or Strongbow Apple Ciders, you can see at least one of its 250 national or international brands!

I know, Anheuser Bush is significantly larger but in my view, Heineken has done many things perfectly right, especially when it comes to marketing.

Don’t get me wrong, Anheuser Bush is a fine company and of course on my watchlist. But Heineken just seems slightly more attractive to me.

Heineken ist growing quite nicely, organically and through acquisitions. For the first semester 2017, the business showed good performance with solid 5.7 % organic revenue increase and a handsome profit boost by 10.5 %.

I think there are some nice catalysts for growth. For instance, Heineken is leading innovations and new products in cider. Also interesting, that Heineken is seizing the low and no alcohol opportunity with double digit growth especially in Europe.

In late 2016, Heineken acquired Punch Taverns with almost 2’000 British pubs for around GBP 300 Mio., that purchase will be fully earnings enhancing from 2018 on.

Heineken announced to increase its dividend by 3.8 % and I expect further annual growth to be more or less in that range. With Heineken you don’t get a high dividend yield on costs when you enter into the position, neither strong annual dividend growth. As a dividend growth investor you patiently look at the dividends to increase, quite slowly, knowing that you are holding pieces of an extremely solid business and one of the most successful beer companies in the world.

Heineken sets its priority on organic growth, reinvesting into the business and making bolt-on acquisitions. The company targets a dividend pay-out ratio of around 30 – 40 %. Dividends are paid twice, in form of an interim dividend and a final dividend. The Interim dividend is fixed at 40 % of the previous year.

Spanish lender Banco Santander enhances top line growth and profitability

I like Banco Santander’s profitability (its cost to income ratio is below 50 %) and its diversified business model, both geographically and in terms of operations. Banco Santander always kept a clear focus on retail banking (services to individuals such as mortgages and loans etc.). The bank’s history goes back 150 years and the company showed compelling growth in the past, mainly driven through a number of larger acquisitions.

Banco Santander has been growing quite nicely organically over the last quarters. In the first Semester 2017, Banco Santander earned EUR 3.6 Bn. in profit, an increase of 24 % compared to the previous year. Dividends were hiked by 5 %.

There is no doubt, that Banco Santander has a track record of sucessfully acquiring and integrating companies and I was not particularily surprised when the bank announced in June that it will buy the struggling Portugese lender Banco Popular for a symbolic price of EUR 1. Banco Santander carried out a share capital increase of approximately EUR 7 Bn. to cover the capital and the provisions required to reinforce the balance sheet of the group. Banco Santander shareholders got preferential subscription rights in the share capital increase. I had the possibility to acquire the issued stocks for a very attractive price.

Banco Santander expects that acquisition to enhance its earnings growth profile substantially and to be earning enhancing from 2019 on.

Early in August, Banco Santander announced to sell 51 % of the real estate assets of Banco Popular to Blackstone for around EUR 10 Bn. This transaction not only reduces the risk position of Banco Santander but it will also have a positive impact on the core capital of the Santander Group.

So there is good new from Banco Santander and I’m looking forward to some nice dividend increases in the future.

How was your August in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Grats 80 bucks usd in a month aint bad! Great year over year increase too. I like heineken so its a good stock. Heh! Keep it up

Hi PCI

Yes, USD 80 is an amount I am happy with especially when considering YoY organic growth. Every dollar counts to fuel my passive income machine.

Heineken really is a cool company, like its products and business fundamentals.

Thanks for stopping by and commenting.