Lifting my passive income target to USD 7’000 in 2018

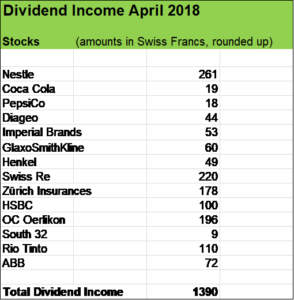

April was a very strong month in terms of dividend income. In fact, for me it was the strongest month ever. Year over year, cash inflows increased by 30 % to roughly USD 1’400 (all amounts are net after taxes).

Compared to April 2017, there are four additional positions: PepsiCo, Imperial Brands and Henkel.

I am particularily pleased about several very high dividend hikes that contributed to that strong passive income growth (just have a look at the list with businesses in my portfolio that increase their payouts in my previous post).

The combination of

- organic dividend growth,

- dividend reinvestments and

- the acquisition of new stock positions

really makes us benefit from the magic of the compound effect.

And my wife and I continue to set a clear focus on keeping our savings rate well above 50 % which is our cornerstone for a consistent and constant investment process.

It let’s us take advantage of market fluctuations. With strong names, not only in the consumer staple sector, being down quite nicely over the last months (just look at KraftHeinz, Procter & Gamble, Anheuser Busch etc.), I took the decision to take some additional exposure in the tobacco sector and also to pile up some more insurance stocks bringing forward dividend income for the year to almost USD 6’300.

And I want to put it even further, now aiming for a total passive income of at least USD 7’000 in 2018 !

After the two stock buys made in April and early in May, the market value of our investment portfolio now stands at almost USD 200’000 and it grows stronger month by months as it produces more and more income.

Now let’s have a look at the stocks I recently bought.

Taking a stake in British American Tobacco

I acquired 75 shares of Britsh American Tobacco at around £37 a piece in April. Over the next twelve months, these stocks will provide around USD 250 in fresh cash to reinvest. Combined with an expected dividend growth rate of 10 %, that position will strengthen our passive income machine even further over time.

Tobacco stocks have declined quite significantly over the last months due to threats of regulations, falling cigarette volumes and some uncertainties with regard to the success of so-called “Next Generation Products” (vapour products like e-cigarettes and heated tobacco products). The sector recently took another hit due to “disappointing first quarter results of Philip Morris“.

Well, I have been following the financial performance of the five largest tobacco companies for several years now, and my impression is that these businesses are still very profitable despite huge headwinds. Over the past decades, they made attractive investments due the combination of

- low or even pessimistic future expectations,

- low valuations and

- strong and stable profits (enabling high dividend payouts, stock buybacks and make bolt-on acquisitons).

It was some time ago that I took the decision to attribute between 5 and 7 % of my portfolio’s market value to that sector. I want to take more exposure to consumer staples and become more diversified. And British American Tobacco as the largest company in that industry with a very strong global footprint looked very attractive to me.

Topping up in existing position in British insurer Legal & General

At the beginning of May, I acquired 1’050 shares of Legal & General at a stock price of around GBP 2.65. I have initiated a position back in September 2017 which I have now more than doubled.

I have been a shareholder of Zurich Insurance and Swiss Re for almost a decade now and have been rewarded handsomely by collecting all the nice dividends year by year. Last year I decided to take some additional exposure in the insurance sector by buying stocks of Legal & General and Aviva. These businesses are true “capital light” cash machines.

Legal & General offers following products and services:

- life insurance

- general insurance

- pensions and

- investment management

Legal & General has a very profitable, diversified business model. Financials are very strong. My latest investment offers me a forward dividend yield on cost of well above 5.5 % and I expect it to climb up handsomely over time.

What about you, fellow Reader? Any nice stock picks made recently? What do you think about my recent stock acquisitions?

Thanks for reading and sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

hi,

great months for you, congrats! really nice to become paid for doing absolutely nothing 🙂

April 2018 has been my best month ever, I had doubled my positions in Swiss Re and Zurich Financials before,

I newly aquired some BASF shares and this month I have not yet decided what to buy, would love MMM, also BMW, maybe I am topping up on Reckitt Benckiser or Henkel, also I want to get some Apple shares, just missed the last dip.

Really enjoy reading your blog, keep up the good work!

Hi Maximiliane

Glad to read that April was a great dividend month for you as well. I like your acquisitions, BASF has been on my watchlist for quite a while now, would love to pick some stocks when prices come down a bit. The same with 3M and Apple. I have already topped up my position in Reckit Benkisser and increasing my position in Henkel is just a matter of time I guess.

Happy you like my posts. Thanks for reading and commenting.

Cheers

Hey MFS. Very strong portfolio, and I think you have made some excellent recent additions. Lots of things are on sale right now. I also like your insurance positions – those should be steady and strong.

I own Coke and Pepsi and have been looking at ABB. I am short on capital for the next few months, however, and thus I am hoping the low share prices last through the summer.

Keep up the good work! I enjoy reading these updates, and I think you are well on your way to your goal for 2018.

Hi Dividend FIREman

Thanks for the kind words!

Yes, there are many great businesses whose stock prices have come down quite significantly, just thinking of KraftHeinz, Anheuser Bush etc. Like you, I hope these price levels to last some time.

Appreciate you stopping by and commenting.

Cheers