Our passive income machine gets stronger and more diversified

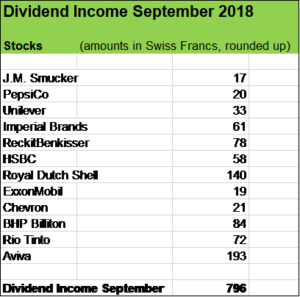

My wife and I received almost USD 800 in dividend payments in September, that represents a year over year increase of roughly 80 %.

The third quarter ended quite strongly considering the fact that the bulk of my passive income is heavily concentrated on the second quarter due to my exposure to European companies, many of them making their payments to shareholders once a year and in general in April, May or June.

When I think back to 2012 for instance, almost 80 % of my dividend revenues came in the second quarter. At that time, I “only” had 15 stock positions (I heavily invested in my “home-marked” Switzerland) compared to over 50 different holdings today. My investment portfolio is now much less concentrated on particular countries and widely spread over different sectors (consumer staples, oil and mining companies, pharma companies, banks, car producers, telecom businesses etc.). And I always keep a strong preference for defensive stocks such as Nestlé, Heineken, Diageo, Unilever, Britvic, Nichols, Imperial Brands, British American Tobacco, Coca Cola, PepsiCo, J.M. Smucker and of course my favorite two pharma companies: Swiss based Novartis and Roche. These are the kind of businesses rewarding their shareholders for being patient, holding the stocks for the very long run.

Now let’s get back to the current dividend income update. I am very pleased to see my passive income being more evenly diversified throughout the year and I am very happy that September shows another nice passive income jump from around USD 440 in the previous year to almost USD 800 in 2018.

It looks like my full year dividend income goal of USD 6’500 (resp. USD 7’000 in dividends plus interest income) is well acheavable.

I’ve been topping up quite significantly on existing stock positions through the current year, acquiring additional stocks of tobacco company Imperial Brands and consumer goods business Reckit Benkisser. Furthermore, I invested in PepsiCo (at the beginning of 2018) and doubled down in insurance giant Aviva (I made my first buy at the end of 2017). These mentioned share investments in the amount of roughly USD 16’000 gave my September a significant passive income boost.

But just as important: on average, around 8 % of the Year over Year passive income growth in September was due to dividend raises.

There was good organic dividend growth of my stock holdings

Putting my savings to work on a regular basis by investing in high quality cash generating assets and consistently reinvesting the divends have been center pieces of my investment strategy for the last ten years. But of course I also need dividend hikes to making full advantage of the compound effect.

And my September passive income contributors really are strong businesses knowing how to reward their shareholders with good dividend hikes. And some of these companies also increased their returns through share repurchase programs.

Let’s have a look at the company specific developments in 2018 in terms of shareholder returns:

- J.M. Smucker: dividend increase by 9 %

- PepsiCo: dividend increase by 15 % plus launch of new share repurchase program

- Unilever: dividend increase 8 % plus share repurchase program

- Imperial Brands: dividend increase by 10 % plus announcement that proceeds from asset sales will be used to pay down debt and for additional returns to shareholders

- Reckit Benkisser: dividend increase by 6%

- Exxon Mobil: dividend increase by 6.5 %

- Chevron: dividend increase by 3.70 % plus announcement of start of share repurchase program

- BHP Billiton: dividend increase by a juicy 42 % (!) plus anncouncement that oil assets have been sold to British Petroleum (BP) and that proceeds will be returned to shareholders

- Rio Tinto: dividend increase by 15%, repurchase program is ongoing

- Aviva: dividend increase by 10% plus share repurchase program

British bank giant HSBC and oil company Royal Dutch Shell on the other hand held their payouts flat. For me, that’s fine, my Yield on Costs for the two positions is well above 8 % !

Furthermore, Royal Dutch Shell has started a share repurchase program. HSBC just ended a share repurchase program that has been operated over almost two years and the company now sets a clear focus on investments into the business to step up future organic growth which is perfectly fine for me as well.

My September passive income contributors represent healthy and dynamic businesses that have me handsomely rewarded so far and will hopefully do so in future.

What about you, fellow reader, did you have a successful month in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi FS,

First of all, I like being a member of your email list, as your texts are always very thoughtful. I really enjoy reading them!

Just like you, we had a very good September in terms of dividend income. Furthermore, after having learned the basics of low-risk option dealing, we sold our first puts last month, which should hopefully accelerate our passive income a bit in the future.

Now, I’m thinking about initiating a new position in one of the big tobacco companies. I’ve read a good article on SeekingAlpha, which concluded that Altria is currently the best option. However, I personally favor BAT.

What do you think? If you had to choose, which one would you buy at the moment?

– David

Hi David

I am glad you like my texts I e-mail to my frequent readers. I’m grateful for your continuous support!

Options trading is something I would be highly interested to start with myself, will certainly keep an eye on that. It’s cool you had a good September too in terms of dividends, our cash churning passive income machines are growing nicely.

With regard to your question, whether I prefer BAT or Altria, well that’s an interesting and not easy one. First, it’s important to note that I’ve already initiated a position in BAT in March of that year. From a valuation perspective, BAT really was compelling at that time and has become even more attractive since then.

Altria’s multiples (P/E ratio, dividend yield etc.) show a premium in comparision to BAT. But Altria clearly deserves such a premium. It’s much less leveraged and also has the better earning quality. We have to bear in mind, that Altria produces and sells with it’s flagship product Marlboro by far the strongest cigarette brand. It’s the uncontested market leader in the world’s most lucrative market, the US. BAT is of course much more geographically diversified, it has more growth prospects in terms of its top-line and bottom-line. But Altria has a lot of possibilities too, to grow its profits. Its products really are high margins and it shouldn’t be a problem to reduce working capital over time to increase FCF even further. Another thing I really like about Altria is its shareholding in Anheuser-Busch AbInv, the world largest beer maker. Altria is in the comfortable position to get dividends from the strongest business in the alcool business.

So, all in all, Altria seems to me the less “risky” investment case while BAT is more attractive in terms of P/E and dividend yield.

So far, I have myself not taken a decision, whether I will top up my position in BAT and/or initiate one in Altria.

Thanks for stopping by, always glad to read your commentaries.

– Cheers, FS