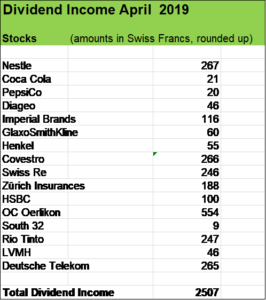

USD 2’500 – our strongest dividend month ever

April showed a very nice 65 % passive income jump. However, compared to April 2018, there were also some favourable factors significantly supporting that dividend income boost:

- Special dividend from Swiss industrial conglomerate OC Oerlikon, adding roughly USD 360

- Special dividend from mining giant Rio Tinto, adding around USD 140

- Change in timing of Deutsche Telekom dividend payment, which usually has been made in May and has added around USD 265 to our April passive income

Special dividends are great, but of course they cannot be seen as “regular passive income”.

On average, organic dividend growth of our portfolio income contributors in April was around 3 %. That’s below the average dividend growth rate of our overall stock holdings.

On average, the dividend hikes of our 50 stock positions have been in a range of 6 % and 7 % so far.

Within the group of our April passive income contributors there are some businesses that have slowed their dividend growth like Coca Cola (+ 2.56 %) and PepsiCo (3 %) for instance. But slowing dividend growth of high quality stock holdings is nothing to lament about.

Clearly, the special dividends from Rio Tinto and OC Oerlikon gave a significant boost to our April passive income and it will be challenging to replicate that progress.

My wife and will keep our investment process running, underpinned by our robust savings rate above 50 % and by consequently reinvesting the dividends.

Over the last four months, we’ve collected around CHF 3’500 in dividends ready to reinvest. And in April, we took the decision to put that money to work by acquiring a new stock position to our investment portfolio, strengthening our passive income machine further.

Investing in UK defense contractor Babcock International

Established around 1890, Babcock International provides highly-specialised engineering support services on complex and sensitive equipment and infrastructure, including assets owned by the British Ministry of Defence which include military and naval bases, submarines and jets.

For instance, Babcock International

- provides aircraft maintenance and operations for the Royal Air Force,

- trains the London Fire Brigade,

- operates a fleet of medical helicopters and

- refits the entire fleet of submarines in UK and Canada.

The UK Ministry of Defence accounts for about 40% of revenues and more than 80% of Babock International’s business is linked to the public sector, governments, ministries, and agencies are customers.

Over the last years, Babcock diversified its operations internationally but UK still accounts for more than half of the company’s profit base.

There are a couple of factors I like in particular about Babcock International.

- The company operates in areas with high barriers to entry,

- often Babcock International is the only outsourcer with the capability to provide specific services in Britain which gives the business a broad economic moat,

- that unique market position (particualarily) in Britain protects its robust margins and strong Free Cash Flow generation

- which is paramount for the company’s conservative financials,

- putting Babcock International in a position to handsomely reward its long term shareholders.

And last but not least: Babcock International looks attractively valued.

There are several reasons why the stock of the business has come under enormous pressure.

- UK is due to leave the European Union and during that Brexit uncertainty, many investors tend to avoid UK stocks, in particualr thoses operating on the domestic market.

- Another reasons Babcock International’s stock got hammered is because the investment public is assuming that the company is about to face similar troubles as several struggling British outsourcing companies have been over the last two years.

- Apart from the Brexit uncertainty, a lucrative contract for Queen Elizabeth Aircraft Carriers Project is about to end.

Babcock International has to navigate through some challenges which had an enormous impact on the stock price. Early in 2014, the stock of Babcock International hit an all time high of around GPB 13 per share and early in April 2019, the price stood at around GPB 5.

Interestingly, Babock International has shown very robust development of its underlying profits over the last two decades. So far, Babcock International has been a resilient company amid a very tough environment.

The dividend history of the company is quite impressive: from 2000 to 2019, the company payout escalated from 2.24 pence per share to 30 pence.

Babcock International pays dividends twice a year and has a policy of maintaining dividend cover between 2.5 and 3 times.

Clearly, there are challenges and uncertainties Babcock International is facing, but a robust and still growing business with a “discount” on the stock price offering a dividend yield above 5.5 % was too tempting for us.

So, we pulled the trigger and acquired some stocks of Babcock International, which will bring our total forward dividend income for the year another step closer to our USD 10’000 PASSIVE INCOME GOAL.

What abot you fellow Reader, have you added some new positions to your portfolio? Did you see some dividend increases of your stock holdings?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi FS,

First of all, congrats to your record-breaking month! More than $2,300 in dividend income is really something to be proud of!

I’m really surprised that you regularly present companies, which I’ve never heard of before. Babcock International is such an example. I will definitely have a look at it and see how it performs in my stock screener.

Our investment income in April was negligible. Other than your experience with Deutsche Telekom, two of our top dividend paying companies postponed their annual payout from April to May (Daimler and Munich Re).

Best wishes from Hamburg

– David

Hi David

Thanks, yeah these strong April results really are very motivating and my wife and I are looking forward to the next months, we have our eyes on some nice acquisition targets but have not yet pulled the trigger.

Babcock International is our first position in the defense sector, there are some UK sectors that are under huge pressure due to some uncertainties and we think that there is value which is not appreciated by the market. Uncertainties will remain for quite some time, so I expect it to be a bumpy ride and there is no need to rush in by investing a significant amount. So yes, we are glad to have initiated some positions in UK businesses that are not well known but have a very strong position in their specific markets (e.g. soft drink makers Nichols plc, Britvic etc.).

Yeah, Daimler and Munich Re changed their dividend payment date (payout month), such technical factors have of course some influence on the YoY-comparision. But as long as the dividend incomes in sum are marching up each year and as there is good organic growth, that’s fine. These two businesses (Munich Re and Daimler) in your portfolio really are companies I like, in particular Munich Re has been on my watchlist for quite some time. As shareholder of Swiss Re, I have to say that the (re-)insurance sector really has a lot to like from the perspective of dividend income investors.

Always appreciate your comments and thanks for stopping by.

Cheers

MFS,

Excellent month! You’re right about special dividends. They aren’t as great as dividend increases. But man are they nice. Hopefully you can DRIP those shares and add a nice jolt to the dividends you’ll receive from the company next quarter. Baxter looks great as well based on your write up. Congrats on the purchase!

Bert

Hi Bert

Thanks for the kind words!

Oh yes, special dividends are so sweet, but not as good as ordinary dividend hikes. I will put that extraordinary cash income to work, that’s for sure. Rio Tinto for instance offers a DRIP, but with the stock price pretty elevated, I decided to pool the cash dividens and acquire a new stock position.

Appreciate you stopping by and commenting.

Cheers

Wow, you’re absolutely killing it. Keep up the great work!

Hi BHL

Thank you very much for your kind words and your continuous support!

Appreciate you swinging by and commenting.

Cheers

Pingback: April Dividend Income from YOU the Bloggers! - Dividend Diplomats