My business turned into profit while I kept investing in dividend paying stocks

Hey there, fellow readers. It has been quite a while since I’ve published a new post. In fact, my latest dividend income update was in November 2022.

My full year 2022 dividend review is more than due.

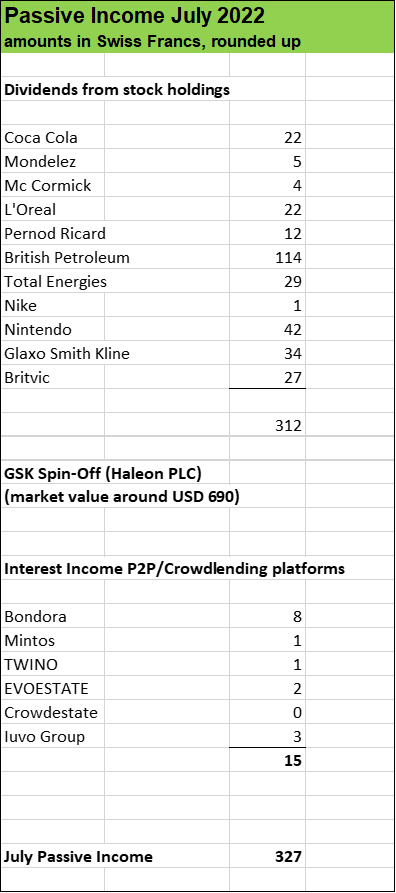

2022 has been incredibly dynamic and I have been extremely busy building and growing my own consulting business I started early last year. I am extremely happy that my company is doing very well. Our savings rate however fell quite significantly. While in 2021, our savings rate stood at around 65 %, it was around 10 % in 2022. My business turned into profit pretty fast, but my income has been lower in 2022 than in the previous years. So, our investment process slowed quite a bit, but I still managed to save a decent amount of money to put to work and last year I bought stocks of strong businesses like Mondelez, Hershey, Visa, Nike, ASML etc. strengthening our investment portfolio further.

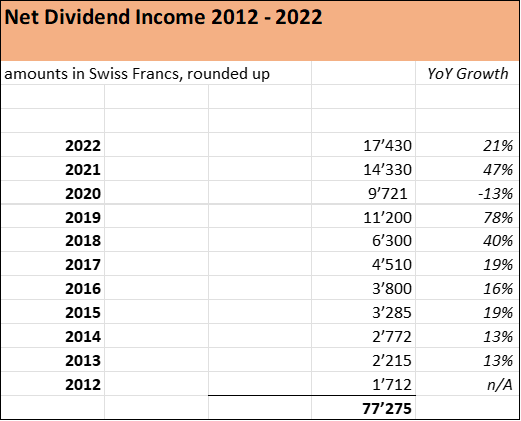

It was in 2016 that I started this blog to document our Journey towards Financial Independence by 2024. Our initial plan back then was to build a sizeable dividend stock portfolio plus further investments covering our annual spendings which range from around USD 50’000 to 55’000 annually. As you can see from this update, there is still a long distance to go. But what’s clear: dividend growth investing really works. After a few years, the power of the compound effect really shows. And our passive income maching slowly but surely is gaining more and more steam.

USD 20’000 passive income in 2022

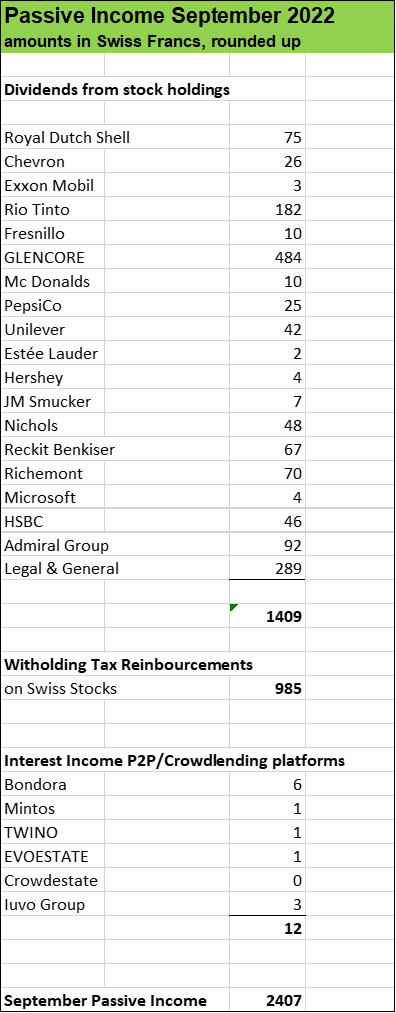

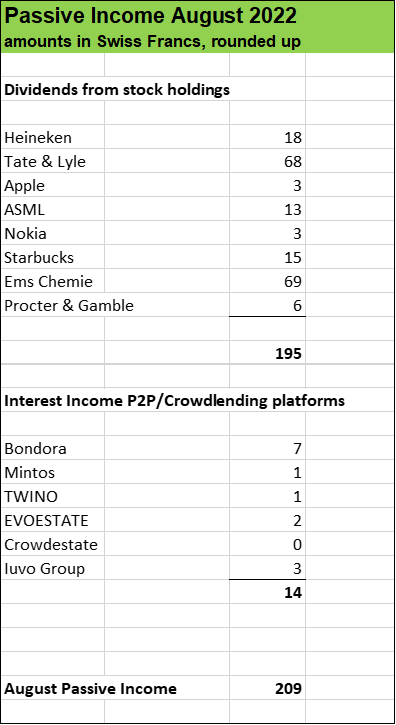

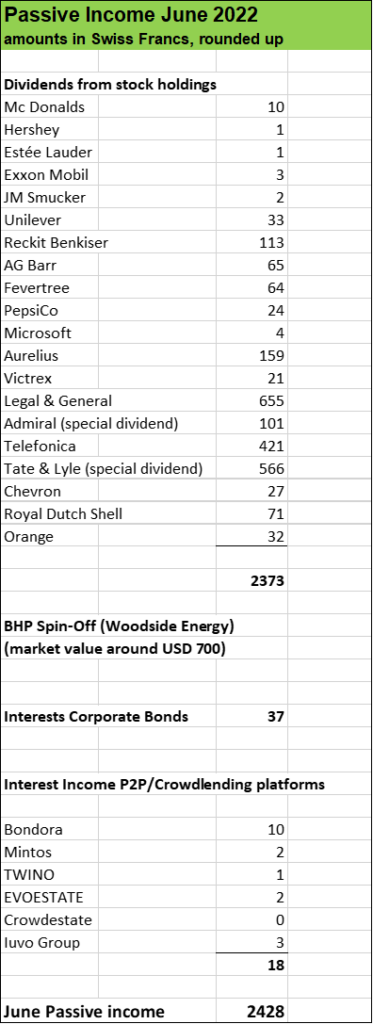

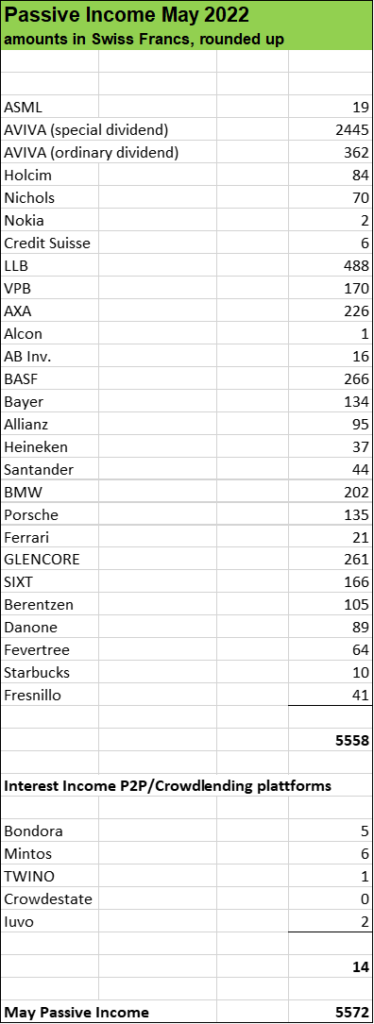

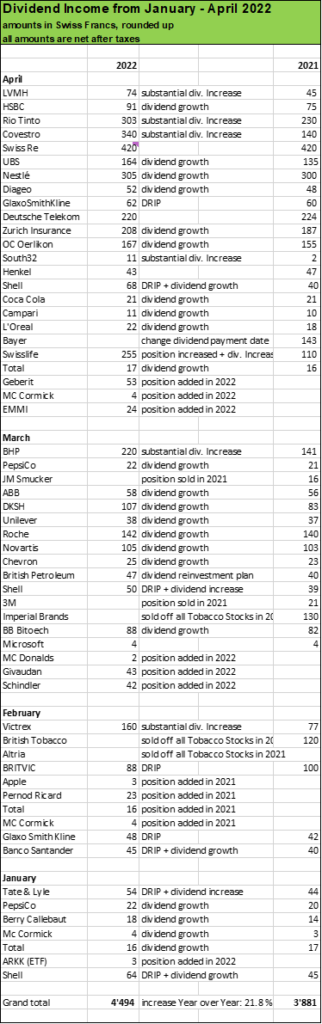

In 2022, total dividend income was 17’430 Swiss francs respectively over USD 19’000 (one Swiss francs corresponds to around 1.1 USD). We also had some additional passive income from Peer to Peer Investments and from corporate bonds plus interests on our savings accounts. Altogether, these interest income streams amounted to around USD 1’000. So grand total, our passive income amount was around USD 20’000. That’s quite significant. Let’s put it that way: one third of our annual spendings of our family of four is covered by passive income!

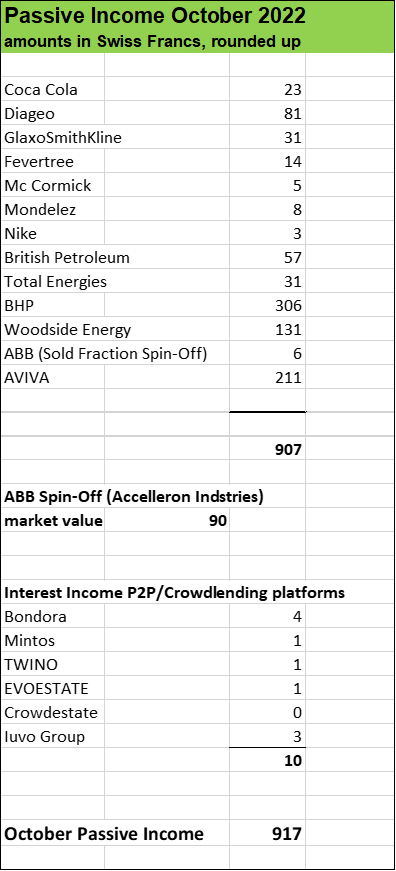

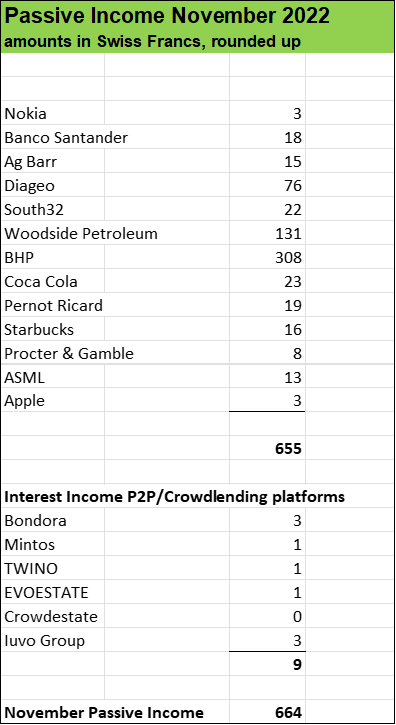

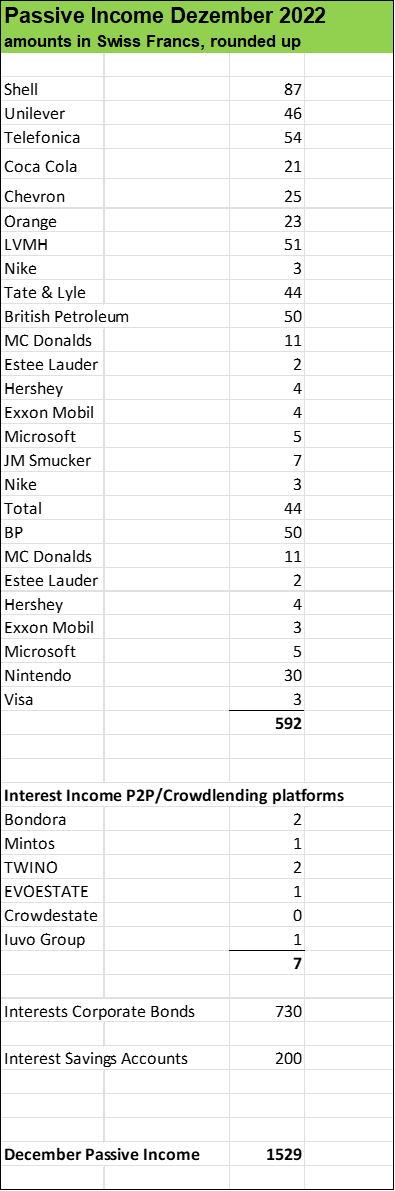

Now, let’s quickly go through some numbers. Here’s the update of the last two months in 2022 (November and December):

Compared to November 2021, there was a massive increase of over 50 % on the back of hefty dividend payments of mining company BHP Billiton and oil giant Woodside Petroleum.

December 2022 was very strong as well.

December Passive Income jumped by around 25 % Year over Year mainly due to new investments made in 2022 plus consistent dividend reinvestments I made through the year.

As my consulting business has turned into profit, I also incrased my salary. And as my income has incrased significantly over the last few months, I am now able to step up my investment process quite significantly.

Targeting passive income of over USD 20’000 for 2023

Since 2012, cash flow generation of our dividend stock portfolio has been growing quite strongl due to a combination of following factors:

- dividend hikes (organic growth)

- dividend reinvestments

- addition of new positions and increasing existing holdings by putting new funds (savings) to work

Over the next months I plan to invest at least USD 50’000 into our investment portfolio which currently has a market value of roughly half a million.

Our initial plan was to achieve Financial Independence by the end of 2023. It might take a few years longer. But that’s completely fine, we keep enjoying our path and we have so much flexibility in life.

For the time being, we stick to our initial plan and continue to work hard, save a as much cash as possible which is fueling our consistent investment process.

The Pursuit of Financial Independence had so many positive effects in our life.

For instance, I left the corporate treadmill and started my own business which has been a dream for quite a while.

We have built a nice portfolio consisting of strong income generating assets and we also a very nice cash pile. It’s great to have options in life and not having to rely on a job or a boss. That’s just a few of the huge benefit of pursuing Financial Independence.

Take care, fellow reader, and thanks for your interest in our journey.