Boom! We are almost through November and there is just one month left in 2019. Time really is flying by.

It has been an amazing year, my wife and I had a terrific time with our two children and we have also been

- working very hard on our day jobs,

- shaping our finances further,

- investing consistently with the right level of risk for us.

There is a lot of momentum going on, my wife and I have been able to hit several important financial milestones and we will keep the ball rolling. And we are fully committed to significantly speed up our path towards Financial Independence.

2024. That’s very ambitious!

But it’s also very inspiring for us. When it comes to making dreams come true, we need to remain focused and set BIG GOALS. The rest is hard work.

Two factors are essential: our savings rate and our ability to generate Passive Income.

When it comes to achieving Financial Independence underpinned by a high savings rate, everything above 60 % really is like a turbo. And in 2019, our savings rate stands at 65 %! What helped us a lot was using the concept of Jaws Ratio to tackle Lifestyle inflation and improve our cost structure.

The second pillar, our Passive Income Generation has been strengthened as well. Over the last eleven months, we have collected almost USD 13’000 in form of dividends and interests (compared to around USD 6’000 in 2018). On average, we are now receiving more than USD 1’000 per month without breaking a sweat! Ain’t that cool?

And after having smashed our USD 10’000 Milestone already in September, we raise the bar higher and are now targeting USD 20’000 by the end of 2020!

We see a lot of potential, there is definitively much more to come over the next years.

We have the financial muscles (cash pile) and strong income generating assets helping us.

Currently, there are two Passive Income Machines making money for us:

- A stock portfolio, diversified in over 60 positions with a market value of well above USD 300’000 and

- Peer to Peer (P2P) resp. Crowdlending investments (CL) in the amount of roughly USD 57’000

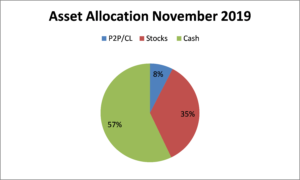

Our stock portfolio makes 35 % of total assets and P2P/CL Investments 8 %.

The lion share (57 %) is still in cash resp. bank accounts. Holding such a cash pile comes with opportunity costs, of course, as that money is not working for us. But hey: having a nice cash pile provides us with huge flexiblity in life.

It let’s us taking advantage of market opportunities. And we have specific plans to use our resources as effectively as possible. In fact, we are considering to build a nice real estate portfolio over the next two years which will provide us with rental income.

I will keep you updated in my next blogposts. What I can currently say is that we have our eyes on buying several apartments.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply