While the Jaws Ratio is commonly used in corporate finance and security analysis, you rarely hear or read about that measure in the context of personal finance. This is to some surprise, as households – like businesses – have to manage their economic resources and taking into account various financial risks and (life) events. Almost everyone has money issues – companies and people alike – so why not use that concept to increase your personal savings rate to put you in a position to make more of the money you earn?

First, I want to show you what that Financial Ratio stands for, how it is calculated and then – and this is most important – how you can benefit from knowing that concept.

Definition and interpretation of the Jaws Ratio

The Jaws Ratio (JR) indicates changes of the profitability of an economic entity, such as a company or a household. It shows, to which extent the income growth rate (IGR) exceeds the expense growth rate (EGR). So the basic idea is quite simple, the calculation is as follows:

Jaws Ratio (JR) = Income Growth Rate (IGR) – Expense Growth Rate (EGR)

As you can see, the Jaws Ratio is not really a ratio as one value is not divided by the other. It is commonly expressed as a percentage (%). For example if the income (revenues) of a company grows by 5 % the expenses by 4 % resulting in a Jaws Ratio of 1 %.

The Jaws Ratio can either be positive or negative depending on whether the income increase surpasses the expense increase or not. A positive result means that income grew stronger than expenses and therefore profitability increased. In case of a company, it puts that business well ahead of ist competitors. And what happens to a household, when you consistently spend less than you earn? The answer is simple: an increasing personal savings rate is the way to get rich over time. A negative Jaws Ratio on the other side means that costs rise more than income and consequently profits are eroding over time. Or put it simple in the context of a household: you are trapped in a ratrace needing to earn more and more just to pay your bills.

The Jaws Ratio in the context of corporate finances and security analysis

Financial reports of successful companies unveil their striking ability to consistently increase their profits over time by growing revenues faster than costs which implies a positive Jaws Ratio. Some enterprises can tackle stagnant or even decreasing revenues by slashing their costs to a faster pace. A positive Jaws Ratio is an important indicator for profitabiliy gains and increasing shareholder value. Companies consistently delivering positive Jaws Ratio offer high returns on equity which leads to long-term wealth creation for their investors.

A negative Jaws Ratio over a longer time period is more often than not a reason for concern. It either demonstrates poor cost management and inefficiencies or significantly declining revenues. A negative Jaws Ratio might also be a sign that the company is losing its competitive edge. Business in capital intense industries with high fixed-costs blocks sometimes show negative Jaws Ratios due to cyclical factors e.g. companies in the mining or oil industry. Many of these companies, however, have proven to be very resilient and being able to adapt to their economic environment quite quickly and significantly boosting their profitability as soon as market conditions improve. But in any event, a persistent negative Jaws Ratio will destroy shareholder value over time.

In my view, you can quite easily reveal the financial quality and strength of a company if you look at its Jaws Ratio in combination with its cost-income ratio resp. profit margin. This brings me to a critical point: The consequences of a negative Jaws Ratio for instance highly depends on the profit margin of the enterprise. Strong and highly profitable companies can tackle a negative value whereas business with a low profit margin experience significant profit losses when their Jaws Ratio is negative.

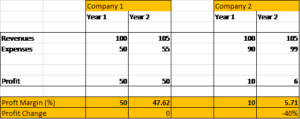

For example, let’s look at two companies with the same revenues but different cost basis and consequently with a different profit margins. Now assume revenues increased by 5 % and costs by 10 % resulting in a negative Jaws Ratio of – 5 %.

As the example shows, companies with a narrow profit margin resp. a high cost-income ratio experience a substantial profit squeeze when their Jaws Ratio turns negative. On the other side, companies with a strong market position and a lower cost-income ratio are less impacted by a negative Jaws Ratio. A business with a profit margin of 50 % can even boost its spendings (e.g. for a new product launch or marketing campaign) by a rate exceeding their revenue growth and still hold their profit more or less steady. This puts them in a tremendously powerful position, being able to invest in new business oportunities year by year.

How a positive Jaws Ratio substantially improves your personal finances

I am a big fan of putting a philosophy in place to make positive things instead of sacrifices. A down to earth lifestyle allows you to set you appart from those who focus on convenience and luxury. You gain freedom and financial flexibility. Work for example is a lot better, when you actually don’t need the money to pay the bills for the next months. Being able to save is the key, the more the better.

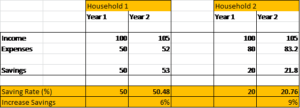

Now, let’s take two households with the same income but different cost structure and consequently different savings rates. Assume that both got a pay rise of 5 % and increased their spendings by 4 %. The Jaws Ratio is 1 % which does actually not seem to be much. The implications for the financial situation of the households however are substantial.

You can see the benefit of a positive Jaws Ratio of “just” 1 %: the savings rate of household climbs by 6 % and “jumps” by 9 % at household 2. The example shows that especially households with a lower savings rate can significantly boost their savings.

Focusing on their Jaws Ratio would serve many people well to improve their financial wellbeing as it helps tackling Lifestyle Inflation. Almost every household is confronted with that phenomenon. Lifestyle Inflation means that costs rise with income, all too often disproportionally. The problem with Lifestyle Inflation? It decreases the profitability of a household. There is nothing wrong per se with consuming or enjoying an increasing salary but it is often a tricky one as increasing spendings are more often than not accompanied by massively growing fixed cost blocks (e.g. renting a larger apartment leads to a higher rent, higher costs for house insurance as new furniture is bought etc.). Fixed costs are to the detriment of the financial fexibility and stability of a household. Let’s put it simple: how fast could you slash your spendings for your rent and insurances if you lost your job or earned substantially less from one day to another?

Eroding profitability of a household due to Lifestyle Inflation enhances its risk position and makes people stuck in a rat race having to work more and more just to pay their bills.

The lesson is that you can quite easily tackle Lifestyle Inflation if you are conscious of your Jaws Ratio. Many good things happen in a financial sense if you hold costs steady (or only marginally increasing) while boosting your income.

The jaws ratio might be easier to manage for personal finance use than for corporate use, as the business’ cash flows are subject to higher volatility

Hi Cyrill

Thanks for stopping by. You’re making a great point, even more, this speaks for the benefits of using the concept of the Jaws Ratio in the context of personal finance.

Cheers,

Financial Shaper