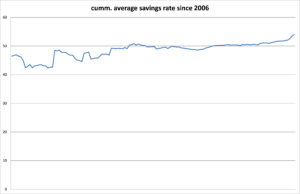

Slowly, but steadily increasing.

October was an extremely successful month in terms of our finances. We increased our savings rate well above 65 %, the best result ever (see page savings rate)! Our average rate for the current year now stands at 55.2 %.

But most important, my family and I have a great time. Being more conscious regarding our resources and our spending habits intensified our focus on meaningful things in life and gradually transforms it even to the better. Over and over again we are making the experience that a down to earth lifestyle makes much happier than costly habits.

How we increase our savings rate

As you can see on the chart above, we have a relatively high savings rate of approximatively 50 % for quite a while. After having read several great and inspiring articles (Mister Money Mustache, Mrs. Frugalwoods etc.) I feel that it is time to take the efficiency improvements of our household even further and target a monthly savings rate of 65 %.

So, how do we proceed to take the leap from a 50 % to a 65 % savings rate?

The first and most important step is to tackle our fixed cost block.

Fixed costs are to the detriment of the financial flexibility of a household, as it takes some time to influence them. However, once being reduced, the realized savings occur repititively. That’s extremely effective and motivating, the realized savings become kind of an annuity, paying us back every year.

Tackling fixed costs requires a longer term view. We started by the end of last year with the first course of actions by making a list with our fixed costs. For each position we took then a set of following decisions and measures: compare – negotiate – substitute – slash. In a nutshell we always asked “how can we get at least the same quality of the services for less?”.

Rent: This is by far our largest cost position. We live in a nice 100 m2 apartment which is very practical and near to our offices (my wife works part-time). Our flat is in an older building but it is in a very good condition. The current rent compares very favourably toward other apartments of the same size and location. We are happy where we live – for the moment (We are looking for our Dream House) – so we decided not to make any change in this respect for the near term.

Home insurance: I compared our insurance police with some offers and we finally switched to another insurance company. The real funny thing: we now even have better services and get more protection offered (higher quality for less). Savings per year: CHF 100.– (CHF stands for Swiss Francs, trades more or less at parity to the USD).

Travel insurance: Our new home insurance offers some protective elements in relation to travelling. So I could not see any sense in keeping that seperate travel insurance and cancelled it. Savings per year: CHF 155.-

Health insurance: Liechtenstein and Switzerland have a great health system I appreciate a lot. But the costs for the health insurance are really substantial, depending on the protection grade betweend CHF 350 and CHF 500 per month! By the end of each year, adaptations can be made. I crunched the numbers and made some of them taking care that this is not to the substantial detriment of my protection. Savings per year: CHF 270.-

Car insurance: I compared the police with some offers and finally switched to the same insurance company where we now have the house insurance. Due to the consolidiation of several insurance polices we got an additional discount. Savings per year: CHF 140.-

Membership”breakdwown services”: When I entered into the contract with the older car insurance, I was also offered a membership in a club which offers breakwown services. The fact is that I never needed it. So I cancelled the membership. Savings per year: CHF 130.-

Fixnet: Although my wife and I each have a cell phone, we continued our fixnet contract for some years. We very rarely used the fixnet, though. People contact us on our cell phones or by e-mail. So we cancelled the fixnet contract. Savings per year: CHF 120.-

Mobile subscription: My wife and I switched to a more favorable offer of another company. Again here the funny thing: we now get better services offered for lower costs. That’s the way we like it. Savings per year: CHF 160.-

Memberships from my study time: although it is important in my view to keep in touch with the university and some organisations, I don’t consider all memberships as useful and necessary. Small as individual amounts, they started adding up over time. So I cancelled some of them. Savings per year: CHF 120.-

Bank fees: I consolidated some bank accounts. Savings per year: CHF 40.-

So far the results regarding the fixed costs. These savings in the amount of around CHF 1’200 will pay us back every year without any additional effort. Let’s put it that way: with just a few decisions and measures, additional funds can be invested every year!

After tackling the fixed cost block, we had a look at another large position: the grocery costs. We used to spend around CHF 600 per month for our family of four. In my view not high, but certainly some room for improvements. How to proceed? Again, it is quite simple. Whenever possible, we grocery shop at Aldi or Lidl. It’s a nobrainer and the results were really compelling. And man, we really eat well (cooking at home makes us strong). We were able to easily slash our grocery spendings to around CHF 500 per month which increases our yearly savings by CHF 1’200.-

So far (year to date) we realized CHF 2’400 in additional yearly savings without any sacrifice. We even get more services and better quality for less money. We just analysed, took some measures and adapted our spending habits.

Hindsight, I could kick myself for not having set these simple measures before. Just make the math if you compound that amount by 4 % annually for ten years.

Of Course we still have “weaknesses” in our household budget, and that’s ok. We will gradually improve them over time, step by step and never forget the fun-factor.

So, what did we do with the amount we saved in 2016? Well, make a guess (Disney is a wonderful company, but is the price fair?).

Are there major successes regarding your budget for the year, this quarter or this month?

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Awesome job boosting your savings rate up to 65%.

After we paid off our mortgage we started to really accelerate our savings. At first we started at 10% but we’ve been trying really hard this year and have hovered around 70% for most of the year.

I don’t know if we can get it much past 80% though because we tithe and we still need to eat 🙂

Wow! That’s great, after having paid off your mortgage you can take profit of a much lower fixed cost block. Congrats!

I think that we can keep our current 65 % savings rate quite consistent for the medium term. And as you write, there is a point or level where it does not make any sense to decrease spendings even further.

Thanks for your comment and for stopping by.

Cheers