Dividend Growth Investing really is like clockwork

Hi there, fellow Reader! It’s time for my first dividend income update in 2018.

Dividend Growth Investing is a great way to build passive income which can substantially improve your finances over time. It uses the full power of the compound effect. I just love buying pieces of strong companies and holding them through thick and thin (unless the fundamentals deteriorate dramatically). I collect all that cash I receive and put that money to work. I repeat that process again and again. I strictly follow a buy and hold approach. What I want is to spend time in the market and not to “time the market“.

For 2018, I am targetting a passive income of USD 6’000 , wheareas around 5’500 will derive from dividends and USD 500 from received interest payments.

That 20 % increase compared to the previous year will come from three factors:

- organic growth of the cash payments from businesses I am a shareholder of,

- the systematic reinvestment of these dividends and

- the allocation of new funds (savings) into new reliable stock holdings.

It’s just amazing how that passive income climbs year by year when following such a systematic approach: in 2012 my stock portfolio generated around USD 1’700 in dividends and with regard to 2018, we are already talking about CHF 5’500.

Interestingly, less than 50 % of that yearly increase comes from the allocation of new money. It’s the combination of dividend hikes (organic growth) and dividend reinvestments that have an extremely strong impact.

USD 5’500 in dividends for 2018 does not sound like a lot, right?

Well, let’s put that number into the context of a compound annual growth rate of over 15 % I was able to achieve over the last years and make some projections into the future:

- In 2024, my annual dividend income will be roughly USD 13’000 and I will have collected and reinvested over USD 50’000 along the way.

- In 2030, annual cash inflows from my stock portfolio will amount to roughly USD 30’000 and over the time frame of six years, I will have received over USD 130’000.

It really is extremely motivating, when I run all these numbers. It’s all about the compound effect.

But now let’s turn to the current year.

All in all, I expect organic dividend growth to be very robust in 2018. I have over 30 positions in my portfolio and as of today, dividend increases have already been announced resp. signalled with regard to some of my holdings:

- Roche (+ 1.2 %)

- Novartis (+ 1.8 %)

- Chevron (+ 3.7 %)

- ABB (+ 2.6 %)

- UBS (+ 8 %)

- Deutsche Telekom (+ 10 %)

- Zurich Insurance (+ 5.8 %)

- Rio Tinto (+ 61 %)

- Nokia (+11.7 %)

UBS, Zurich Insurance and Rio Tinto furthermore announced stock buyback programs.

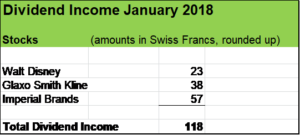

Let’s have a brief look at the dividend income January.

Compared to the previous year, my January income was higher mainly due to the relatively new contributor Imperial Brands.

Walt Disney hiked its dividend by 7.7. % in November 2017 but in combination with a weaker USD against the Swiss Franc (CHF) that dividend boost resulted in a increase of 4.5 %. Glaxo Smith Kline held its payout steady, my dividend income increase was due to the reinvestment of the quarterly dividends and here again, unfavourable exchange rates had a slightly negative growth impact (the GBP is lower against the CHF).

Strenthening my cash generating share portfolio even further

Last week, amid the stock market turmoil, I acquired 32 Shares of PepsiCo (PEP). Share prices have become more favourable now, down around 10 % and furthermore the USD has experience a nice drop against the Swiss Franc of 5 % compared to a few months ago. So, all in all, I had the feeling that I get good value for money when I entered into a new stock position.

So, let’s have a look at the wonderful business I acquired some pieces of.

Many people don’t know that PEP generates more profit from its food brands than from its beverages.

PEP has a huge product portfolio, let’s have a closer look at the most popular brands which include:

- carbonated (sparkling) beverages such as Pepsi, Diet Pepsi, Pepsi Max, Mountain Dew, 7 Up (PEP owns the international rights, Dr. Pepper Snapple the US rights)

- non-carbonated (still) beverages like Gatorade, Tropicana, Aquafina, Brisk, Starbucks Ready to Drink Beverages (partnership with Starbucks)

- food brands such as Lay’s, Walkers, Doritos, Ruffles, Fritos, Cheetos, Tostitos and Quaker

PEP’s diversified portfolio serves the company well. PEP has products meeting diverse tastes and the business also has a great foodprint in the health spectrum.

PEP is a high quality company, I am sure that these stocks will become an important part in my investment portfolio making it even stronger. PEP has a massive brand portfolio and great catalysts for growth. For instance there are huge opportunities in emerging markets like China, Africa, India and Latin America. These regions have a large consumer population and very favourable economic growth rates.

What about you, fellow Reader? How was your January in terms of dividend income? Did you make some nice stock acquisitions?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Nice buy in Pepsi. Congrats on the $61 in dividend income too from another two great companies!

Hi DD

Thanks for your kind words and your support.

Cheers

Hey FS,

I like your recent buy as I’m thinking about buying PepsiCo myself next week. Can you tell us a little bit more about your motivation behind your acquisition? It would be interesting to understand, why you picked PepsiCo under the current market conditions and not some other defensive stock like e.g. Coca-Cola.

Thank you in advance!

– David

Hi David

Of Course!

With regard to Coca Cola for instance, I entered into a position back in 2016 for a price of around USD 40 (as of today price is around USD 43) and I have to say, that I would feel comfortable to increase that position at a price of around USD 36. Even after the successful refranchising process and factoring in the positive effect of the US corporate tax cut, I see Coca Cola’s dividend payout ratio above 80 % in the medium run and marching up from that level year by year. Growth will be in the low single digit range, so I wouldn’t be too surprised to see Coca Cola’s future dividend hikes to be around 3 % per year. There is nothing wrong with that but you want to make sure that your entrance price really is as low as possible.

PepsiCo has a lower payout ratio and more catalysts for growth. They are much more diversified and have more expertise in various areas in the consumer staple sector (beverages, restaurants, snacking, healthy products, breakfast etc.).

I have an eye on several businesses, e.g. Anheuser Bush but here it’s the same thing in my view: prices have not (yet) come down enough. AB Inv is heavily leveraged, growth is sluggish and payout ratio (too) high. To see a sufficient margin of safety, the stock price should come down even further (at least 10 %) in my view.

I hope my thoughts are helpful and have a great week!

Cheers

Congrats on the income and growth.

Nice buy with pepsi. They are more diversified than I thought.

Keep it up!

Hi Rob

Thanks! Yeah, PepsiCo is amazingly broadly diversified, it’s the world leading producer of snacks and number three in beverages. People tend to compare PEP with Coca Cola but it is more like Nestlé or Unilever in my view.

Thanks for stopping by and commenting!

Cheers

Hi, nice blog you have here! Congrats on the $61 income, great results! I really like PEP but havent initiated a position yet. I would like the stock price to come down a little bit more since I want my P/E <20. 'm OCD like that 🙂

In any case the difference is not actually that great (stock is -2% at the moment) and I think its a great company. For some reason it fell of my watchlist so I have added it again to check for my march buy!

Hi Mr. Robot

Thanks for your kind words.

I think chances are good that you can acquire PEP stocks below P/E of 20, just pull the trigger when you feel comfortable with the price.

All the best and thanks for stopping by and commenting.

Cheers

I love Glaxo Smith Kline’s dividend:) I don’t own Pepsi yet but it is on my watch list.

Hi Caroline

Yeah, Glaxo Smith has such a wonderful product portfolio, just thinking of the consumer healthcare brands like Sensodyne, Aquafresh, Dr. Best, Voltaren and so on. It’s a massive company being very generous with us shareholders. I hope they can keep their payouts but either way, I will stick to that holding through thick and thin.

Appreciate you stopping by and commenting.

Cheers

I’m all about the idea of time in the market beating timing the market if you can’t tell by my name. Congrats on the month and some solid buys there!

Many thanks for your kind words. Yeah, TIME IN THE MARKET really is key factor to long term investment success.

Appreciate you stopping by and commenting!