Strong year over year passive income growth

For my wife and me, building a strong, reliable and ever growing passive income stream from dividend paying stocks will be one of our top financial priorities over the next years.

We target a solid savings rate of at least 50 %, fueling our investment process and we managed to steadily increase that rate over the years (a 60 % savings rate is a real turbo).

Our current projected dividend income for 2018 stands at around USD 6’300, representing an increase of 40 % compared to last year. And together with interest income from bonds and from our savings accounts, we are well on track to hit our 2018 passive income goal of USD 7’000.

And here’s the cool thing: the combination of dividend reinvestments and organic growth will lead to a passive income of USD 7’500 in 2019. That’s an additional USD 500 without breaking a sweat!

And we will work really hard to put as much money to work as possible to achieve the USD 10’000 passive income mark as early as possible. That’s the stage when our income generating stock portfolio will start to make significant money for us.

Now, let’s have a look at the current monthly dividend report.

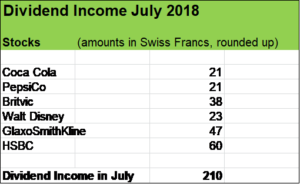

In July, Coca Cola, PepsiCo, Britvic, Walt Disney, Glaxo Smith Kline and HSBC paid me USD 210, representing an increase of roughly 40 % compared to July of the previous year. July is “traditionally” a rather unspectacular dividend income month for us, as the bulk of our stock investments is in European businesses, making their payments once a year, typically in the first semester.

Stocks of PepsiCo and its British peer Britvic are relatively new in our portfolio (added in the first and second quarter 2018). Both businesses have shown good organic dividend growth so far, PepsiCo hiked its quarterly dividend by strong 15 % in January and Britvic gave its semester dividend a nice boost by 9.7 %. Coca Cola has hiked its quarterly dividend by 5.4 % in January and Disney upbeat the semester payouts by 7.7 % (Disney makes its payouts twice a year).

We expect these wonderful businesses to continue to show good organice dividend growth for many years to come.

We consider the positions in British pharma company Glaxo Smith Kline and British bank giant HSBC as high yield stocks. We love to combine them with my dividend growth stocks in the consumer staple or pharma sector.

Investing in high yield stocks is pretty tricky in my view, but so far we are very content with these two positions, providing us with a Yield on Cost of 6 % (Glaxo Smith Kline) respectively 8 % (HSBC).

Initiating a position in British soft drink maker Nichols plc.

Over the first six months in 2018, my wife and I invested over USD 36’000, acquiring shares of PepsiCo, British softdring maker Britvic, Reckit Benkiser, Imperial Brands, British American Tobacco, British insurance companies Legal & General and Aviva and stocks of Swiss banking giant UBS.

And we want more excellent businesses to send us money in form of ever growing dividends.

The consumer staples sector clearly is our favourite one. Our portfolio already has a pretty defensive shape with consumer staple stocks of Nestlé, Unilever, Heineken, Coca Cola, PepsiCo, Diageo, Henkel, J.M. Smucker, Britvic, Reckit Benkiser, Imperial Brands and British American Tobacco.

And we want to put it further, making our income stream even more robust. Early in July, Iwe acquired 200 stocks of Nichols plc. for around USD 4’000.

Nichols is a British soft drinks business selling carbonate and still beverages in over 85 countries. Its portfolio includes popular brands such as Vimto, Sunkist and Levi Roots.

The company can trace its roots back to 1908, when John Noel Nichols invented the soft drink Vimto.

Nichols currently offers a dividend yield of roughly 2.5 %, after having increased the payout by 11.9 % in July. With a payout ratio of around 50 % and having shown good growth over the past decade, there is ample room for nice hikes for many years ahead.

With a market cap of around GBP 550 million, Nichols is very small, it’s only just over a third of Britvic’s size. But with a portfolio including the iconic Vimto brand, Nichols has the characteristics of a wonderful business with consistent annual increases in earnings per share, compelling return from capital and outstanding operating margins.

And there’s another aspect we like about Nichols: the company has a net cash position of almost GBP 33 million, there are litterally no debts.

Stocks of companies with such a track record and such compelling financials rarely go on sale. But from time to time, they show attractive entry prices. Over the last 12 months Nichols’ stock price has come down by roughly 20 % due to shipping problems to some markets. But what’s important: the company sees these as temporary obstacles.

Fair enough, we see stocks of a very robust cash egneration machine with great growth prospects trading at a fair price and happily pulled the trigger.

What about you, fellow Reader, how was your July in terms of dividend income? What do you think About our latest Nichols stock acquisition?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

680€ in divs and interest. plus 200€ from option premiums.

i am struggling to find anything worth buying as everything has a bubble valuation.

Hi Jussi

I’d agree, markets are really richely valued. From time to time, though, there are some nice opportunities arising. It’s important in my view to be very selective and also to keep some dry powder in case of a market correction, which will sooner or later happen, resulting in much more attractive valuations.

Thanks for commenting and all the best!

Cheers

Even though July is a rather unspectacular dividend income month for you, $210 seems pretty good compared to our $0 last month. We just haven’t found the right company to invest in yet, which pays its dividend in the Jul/Oct/Jan/Apr cycle.

You probably won’t believe it, but I’ve never heard of Britvic or Nichols before! But if you found them worthy to invest in, I will definitely have a look at them as well shortly!

Hi David

Never mind, over time you’ll find businesses that pay you dividends in these months, you’ll see. But as your and my portfolio both have several European stock positions, there will always be an uneven dividend income stream (compared to US shares paying quarterly). That’s just fine, what matters is YoY growth.

Yes, Nichols and Britvic definitively are worth a look in my view. I stumbled upon Britvic in connection with PepsiCo and Pernod Ricard which both had a stake in Britvic some years ago. It’s a tremendously interesting business that happened to offer a very nice entry price when I bought some stocks that spring. Nichols is a much smaller company and I knew their products (namely Vimto) from a stay in England.

Thanks, David, for stopping by and commenting.

Cheers

Congratulations with the amazing progress. A 40% YoY is an impressive growth number. I love your PEP dividend. For the months of August and September I plan not to invest in order to have some extra cash in case a DGI stock declines significantly. Recent examples are SBUX at $48 and PEP at $100. The market is indeed richly valued.

Thanks DividendCompounder!

I like your approach, building a nice cash pile in order to take advantage when market tanks (and they will, sooner or later, that’s for sure).

Pepsi Co is just an amazing business and I’d put SBUX even in the same league.

Appreciate you stopping by and commenting!

Cheers