Entering the last month of the year and with the last three months showing some very nice stock market volatility, it’s time for a look back at my latest dividends and share acquisitions.

90 % higher passive income in November

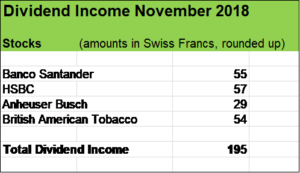

Received dividends in November totaled USD 195, significantly up from the same month in 2017.

Compared to last year’s November, there are two new cash payment contributors in my portfolio:

- Cigarette giant British American Tobacco and

- World biggest beer maker Anheuser-Busch InBev

Dividends from Banco Santander increased organically by 5 %.

Consequently reinvesting the dividends led to a roughly 10 % higher income from bank giant HSBC.

Benefitting of lower stock prices

The last months showed plenty of nice opportunities to take a stake in very interesting businesses for a reasonable price. Stock markets fell due to a number of factors and uncertainties (macroeconomic tensions etc.), followed by relatively sizeable run ups.

I love to acquire pieces of businesses when the mood turns negative towards the market or a particular company.

That’s why I pulled the trigger again to make three more stock buys (for USD 4’000 each):

Initiating a position in Moet Hennessy Louis Vuitton SE (LVMH)

Early in December, I bought 14 Shares of that wonderful French luxury goods conglomerate. I’ve followed LVMH for several years. Just have a look at the amazing portfolio of brands millions love all around the globe:

- Wines & Spirits: Dom Perignon, Moet & Chandon, Hennessy, Glenmorangie etc.

- Fashion & Leather Goods: Louis Vuitton, Fendi, Christian Dior, Givenchy etc.

- Perfumes & Cosmetics: Kenzo Parfums, Givenchy Parfums, Parfums Christian Dior etc.

- Watches & Jewelry: Tag Heuer, Bulgari, Hublot, Zenith etc.

- Selective Retailing: Sephora, Starboard Cruise Services, DFS (a luxury travel retailer)

- Other Activities: Cheval Blanc (luxury hotel), newspapers such as Les Echos, Le Parisien etc.

LVMH is much more broadly diversified than its peers in the luxury good sector such as Tiffany & Co. or Richemont. LVMH also shows stronger growth prospects and has shown very strong financial metrics for years. What I also like is the fact that LVMH also generates a substantial portion of its proftis with rather defensive products, as the sector Wines and Spirits shows.

Such a high quality business rarely gets really cheap but I am happy to have acquired some stocks at a relatively reasonable price. A few months ago, the stock hit an all time high at around EUR 310 and has recently come down roughly 20 % to around EUR 250. And I would be more than pleased if I get the chance to add some more stocks of that amazing company when markets come down even further.

Doubling down in special chemical producer Covestro

I like to build stock positions by buying in several tranches. In my experience, acquiring at different times leads to good average purchase prices.

I’ve initiated a position in Covestro early in November 2018 and was more than happy to seize opportunity to buy more stocks when I saw the stock price almost 20 % lower just a few weeks later of my initial purchase.

What has happened to lead to such a decline?

Well, the management of Covestro has revised its guidance for the full year 2018.

In my view, the outlook changes per se have neither been dramatic nor very surprising. But the timing and the way management is communicating to the investor community is remarkable.

During the third quarter results presentation, management confirmed upbeat and very positive guidances for 2018 just to revise them slightly to the downside a few weeks later.

In a nutshell, what Covestro’s management communicated was that due to

- intensified competition

- price pressure

- increased costs (e.g. low water level of the river Rhine makes transportation more expensive)

2018 profit and Free Cash Flow will be slightly below the 2017 level instead of being above the previous year.

Well, just to put that into perspective:

in 2018 Covestro generates a FCF of roughly EUR 1.8 Billion, covering the dividends more than four times. FCF yield is in the realm of 20 %.

2017 really has been an outstandingly positive year for Covestro. The current year obviously is more challenging. Things will likely become tougher as we all have to be prepared for the next recession which will come sooner or later.

Covestro is a very well established company in a highly cyclical business. It will generate plenty of cash and – due to its moderate debt level – really has the potential to reward stockholders through very attractive dividend payments and share repurchases.

That’s the beauty of a depressed stock price of a highly profitable business: it makes stock repurchases highly effective.

And for me, buying 20 % more stocks for the same amount of money was very compelling, that’s why I was happy to pull the trigger again.

Buying more shares of Bayer

I’ve been a shareholder of Bayer for some years and always been sceptical about the acquisition of Monsanto.

Bayer in my view has unnecessarily taken tremendous risks and a huge cost burden.

The lawsuits related to Glyposate truly are a reasons for concern but do these factors and news really justify the stock price being slashed in half in a matter of a few months? I mean objectively viewed from a financial standpoint?

Here again, as a long term investor I want to put things into perspective:

- the combined company clearly has a truly broad economic moat and significant cash generation abilities. Deleveraging is quite well on track. The underlying business is tremendously strong.

Clearly, the management of Bayer has not been very succesful when it comes to the communinication toward the investor community.

But today, I see an extremely strong business with a stock price being 50 % lower than a few years ago. For me a nice opportunity to triple my position by investing exactly the same money amount like a few years ago.

What about you, fellow Reader. Did you make some nice stock acquisitions recently? Which companies paid you dividends recently?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi FS,

Great stocks that you bought there! I like all three companies.

If I’m totally honest, I probably wouldn’t have bought LVMH myself, as it still looks a bit expensive to me and the dividend yield is not as high as I would like it to be.

However, Bayer and its former subsidiary Covestro are certainly on my mind, when I think about our next purchases. As you rightly stated, both companies have problems of their own. Nevertheless, those issues seem to be already included in their current stock prices. And that’s exactly why Covestro already made it on our watchlist in December and Bayer seems to be a hot candidate to be considered in January, too.

Keep up the good work and good fortune with your investments!

– David

Hi David!

Yeah, December really was a good month to make some nice stock acquisitions. And I am looking forward to strengthen my portfolio even further – at even much more attractive prices.

Bayer and Covestro are very interesting plays at these price levels and should benefit my portfolio in the medium and long run.

And LVMH really is a stock for life in my view. It’s such a high quality business, I see it playing in a league with Nestlé, Coca Cola or L’Oreal. Fully agree with your point that LVMH is certainly not cheap at a price between EUR 250 and 260. I see the forward P/E ratio at around 20 and the forward gross dividend yield somewhat above 2 %, so if I compare it to other holdings in my portfolio, it does not look cheap at all. But just looking at LVMHH’s dividend growth rate in the past five years shows a very attractive potential that the YoC of my LVMH holding will lie at around 4 % in a few years.

As always, appreciate you stoppig by and commenting.

Cheers