Hey there, fellow reader, glad you are stopping by for another monthly financial update, sharing our progress with regards to our savings rate, wealth accumulation and passive income generation as well as our latest moves and decisions we made on our Journey towards Financial Independence.

Note: all numbers an in Swiss francs (CHF). CHF 1 corresponds to around USD 1.10.

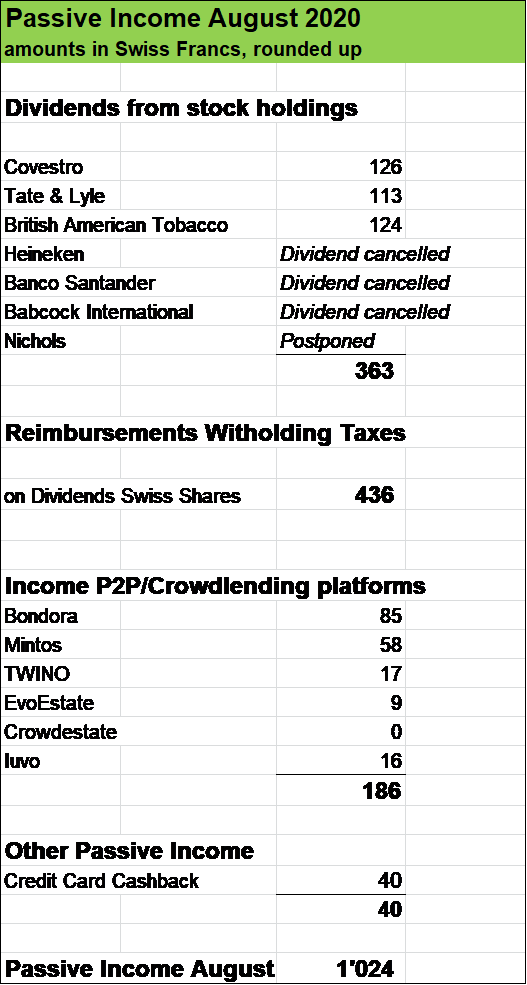

Snapshot on the financial highlights in August

- Our savings rate was slightly higher than in the previous month with 62 % (compared to 60 % in July). My wife and I want to keep our savings rate above 60 %, which will be a real turbo on our Path towards Financial Independence by 2024.

- Wealth climbed by CHF 15’000 in August, driven by stock market performance in August and strong savings from our day jobs

- Our dividend income (numbers always net after taxes) was lower compared to the same month in the previous year (USD 363 versus USD 422) as following three of our August passive income contributors have scrapped their shareholder payouts for the year: beer producer Heineken, Spanish Banco Santander and UK defense company Babcock International. On the positive side, UK soft drink maker Nichols informed that they will reinstate their dividend and pay it out later in September (by the way the same with UK insurance giant Aviva, which is one of our largest dividend contributors). So there are definitively bright spots.

- Income from Peer to Peer (P2P) and Crowdlending platforms was a bit lower than in the previous month (CHF 186 versus CHF 210) due to cash withdrawals we made in July in the total amount of CHF 2’000. Currently we have roughly CHF 22’000 invested on six platforms: Bondora, Mintos, Iuvo, Twino, EvoEstate and Crowdestate.

- We used cash withdrawals from P2P and Crowdlending platforms (in the amount of CHF 2’000) to further strengthen our Tech Portfolio, adding shares of US tech-base payment services company Square and streaming company Netflix.

- Furthermore, I sold stocks of oil supermajor Exxon Mobil which was a long time holding in our Dividend Stock Portfolio to take a stake in electric car maker Tesla (see my stock snapshot on Tesla).

- While our August dividend income was lower compared to the previous year, our Total Passive income was very strong with over CHF 1’000, almost double the amount which was generated in the same month in the previous year. This is in essence due to reimbursements from witholding taxes on Swiss shares like Nestlé, Novartis, Roche etc. I portion of witholding taxes can be reimbursed on the basis of tax treaties. I wrote about that important aspect here.

- We are still targeting CHF 20’000 in Passive Income for the year, which is very ambitious given the challenges several businesses in our stock portfolio face and can be seen in several dividend cuts and even some complete elimination of payouts for the year. Last year, we hit CHF 14’000 and we are very confident that Passive Income for 2020 will be significantly higher than that.

- In June, I started my Passive Income Challenge with the goal to work adding new passive income sources to diversify our cash flow streams. So far, I’ve been able to add Cashback Credit Card (in June). All I have to do, is using my credit card to pay things I would have to pay anyway and receive 1 % or 2 % in cashback. Most of the time I pay in cash or via bank transfer but using credit card more regularily can make sense. I am still very careful and want to keep full control on our spending habits.

- As shared in several of my blogposts, my wife and I are looking to acquiring real estate in France (several appartments/studios to rent out and also a residential property). Unfortunately, due to the COVID-19 pandemic, we had to postpone that project. It’s on hold, but of course we can still prepare some aspects of the due diligence online (legal aspects, “virtual visits” of some real estates etc.).

What about you, fellow reader, how was your August in terms of Passive Income? Did you buy some interesting new stocks or other income producing assets?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.