With another month in the books, it’s time for another Passive Income Report Update.

In this post, I will show you the amount of dividends and interests income that my wife and I received in May 2021 and the stock moves we made in the past month.

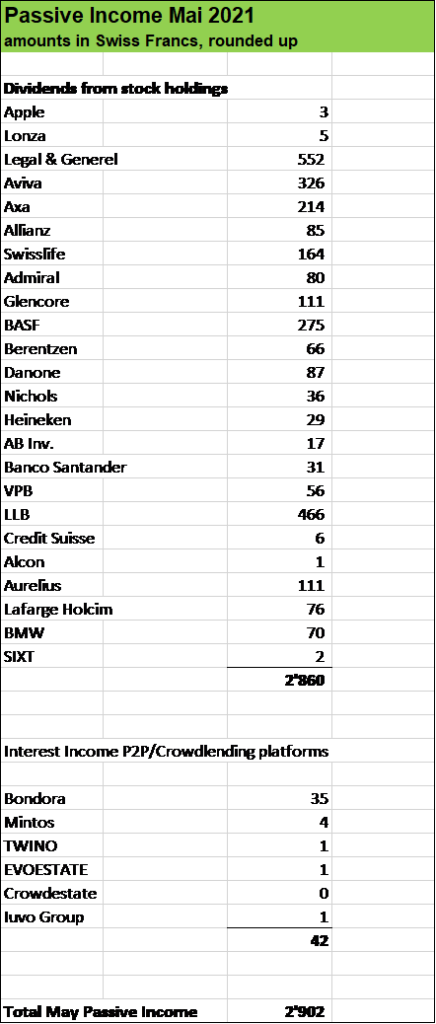

Let’s dive into the numbers (in Swiss francs: CHF; all numbers are net after taxes).

Total dividend income in May 2021 was CHF 2’860 (over USD 3’000), an increase of 30 % from CHF 2230 one year ago. 24 Stock holding positions paid dividend compared to 22 last year in the same month.

Following five businesses resumed their dividend payments after having halted shareholder distributions amid the pandemic in 2020: Banco Santander, Nichols, Heineken, Aviva and Glencore.

Total Interest Income from Peer to Peer and Crowdlending Platforms came in at CHF 42, compared to CHF 311 in May 2020, significantly lower due to significant cash withdrawals which were used to build up our Tech Portfolio in 2020.

Our savings rate was at around 65 %, quite solid and more or less in the range of the last months.

Despite the turbulent stock market movements in the last few weeks, in particular with regard to Tech Stocks and Cryptos, our total share investments hit an All Time High of over USD 460’000!

Our investment portfolio has been lifted by very strong performance of larger positions such as Nestlé, LVMH, L’Oreal, SIXT, Facebook, Alphabet, Legal & General and Tate & Lyle.

In May, we added two new positions to our Dividend Stock Portfolio for roughly USD 2’000 each:

What about you, fellow reader, how was your May in terms of passive income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Pingback: Dividend Income from YOU the Bloggers! – April 2021

Thanks! Yes, May was really an amazingly strong month. In fact, our highest Passive Income ever. New positions and organic dividend growth contributed handsomely and let’s not forget all the positions that halted their payouts last year and now resumed their shareholder distributions.

Appreciate you stopping by and commenting.