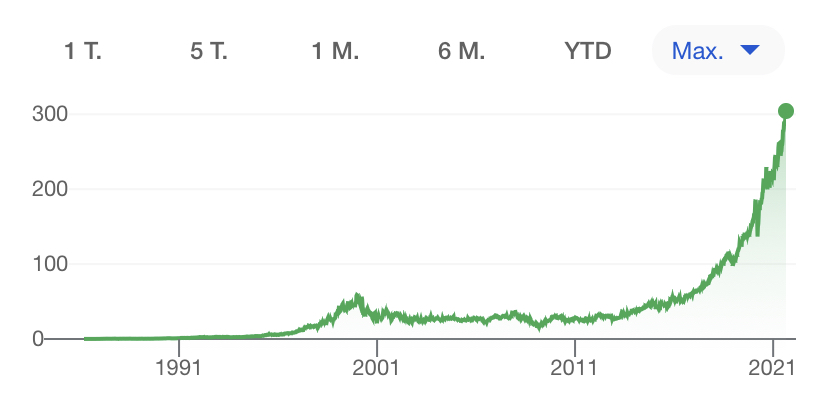

If someone wants to illustrate Warren Buffet’s quote that the stock market in the short term is a popularity contest, but a weighing machine over the long run, then the stock price dynamics of software and cloud giant Microsoft gives the perfect case study. It’s also a great example to show, what long term investing really means: we are talking about sticking to shares of a wonderful business not just for some years, but for decades.

Just look at the last twenty years.

From 2001 to 2011, after the so-called “dot-com bubble” burst and tech company stocks have been out of favor for a long time stretch, Microsoft shares were flat for years.

But just look then at the stock price dynmics from 2011 to 2021, the stock price litterally went parabolic, shooting up from around USD 25 per share to over USD 300 in a matter of just ten years.

But I am not talking here about huge book gains a long oriented investor could have capture here. Even better, Microsoft started paying dividends in 2003 and has been hiking them annually in the high single digit rate. Microsoft – by the way like Apple – is a so-called Dividend Challenger, belonging to a group of companies that have consistently increased their shareholder distribution for more than eight years. My guess would be, that Microsoft will be able to continue that dividend hike streak for many years.

Microsoft is one of the very few Tripple A businesses in the world. Microsoft’s outstanging debt of around USD 64 Bn looks huge at first sight, but when putting into relation to the company’s USD 132 B available cash and equivalents and in particular comparing it with Microsoft normalized annual Free Cash Flow of over 30 Bn, then the leverrage level not only is very well manageable but it looks modest.

Microsoft together with Amazon and Apple belongs to the world’s largest and most successful technology companies. Just think about that: how many businesses have had such an impact on the way we work and communicate as Microsoft did?

For sevaral decades, Microsoft has been a major force in driving the secular trend towards digitalization.

And Microsoft has transformed itself.

Whats extremely interesting is the fact that Microsoft has been able to shift most of its products towards the higher-profit monthly subscription model. The company is so extremely dominant in the business area and many applications in the medical, legal, and other professional fields outright require the use of Microsoft Office and other Microsoft services kind of as a default mode of communicating information.

But there has been even more dynamic, beyond the “money printing model” of Microsoft. For decades, profits came from licensing its software and operating systems. But today, it’s so much more. Over the years Microsoft expanded and diversified and today has following three business segments:

- Productivity & Business Processes,

- Intelligent Cloud and

- More Personal Computing.

In each of its operating segments Microsoft is in a leading position with stable growth in revenues. Microsoft clearly has many levers for further growth and increasing profit margins.

From 2001 on, Microsoft has been able to generate unleveraged earning returns of over 35 % each year. That shows what a compounding machine Microsoft is. That company is three times more profitable than the average fortune 500 company.

Microsoft is so dominant in various areas and has shown again and again its ability to scale up its position. The rating agency Fitch brings it to the point in its latest commentary on the company:

Now, coming back to Microsoft’s stock price, it looks that the dynamic has gone a bit ahead of itself. I mean for decades the Price Earnings Ratio has been below 20. Since mid 2020, amid the COVID-19 pandemic, that has changed significantly. We are looking at siginificantly higher multiples, with a PE-Ratio of over 35. Now we have to bear in mind that growth to the top- and bottom line of the company has even increased and we are looking at a much more diversified company than for instance a decade ago.

The stock market provides a great mechanism, bringing together supply and demand in an efficient way. The stock market has to serve long term oriented investors, showing them from time to time attractive entry prices.

Personally, I will let my Microsoft stock position run. It’s important to let winners run.

And who knows, the popularity of a stock can alter, and share price levels come downs to a more moderate level. Well, that will be then a good time for me to consider even taking a larger stake at that wonderful business.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

I love indeed Microsoft (MSFT), it’s a exceptional company. I’m a shareholder since 2017 and I wish I bought more shares at the time. I added more actually this year. One ofy best performance in my portfolio is from MSFT. I am a long with this company as well like you and I will keep it forever! Thanks for sharing your view my fellow investor friend! 🙏😃📈

Hi Dividendes & FNB

Congrats on that position in MSFT, having entered into that stock in 2017 has been a great move! It’s a businesses with such an incredibly storng moat, it will be interesting to see that company develop further.

Appreciate you stopping by and thanks for commenting, my fellow investor friend.

Cheers

By dumb luck, Microsoft is the first real (non penny) stock that I bought, and the results have been incredible. But I’m talking about a $500 investment just out of college–if only I had more money at the time!

Hi IF

Oh yeah, I can imagine, how huge the performance of an investment in Microsoft several years ago must have been. Congrats on that move you made there. What’s even the best: you are still holding that Microsoft position which is sizeable and you will be handsomely rewarded for many years to come.

I appreciate your comments and thanks for stopping by!

Cheers