Earning more while working less

Early in 2018 I took the decision to reduce my work pensum to 90 % to have more time for my family. It’s just wonderful to spend that additional half a day each week with my loved ones.

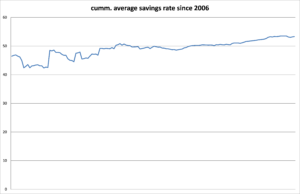

And interestingly, my 10 % lower salary did not lead to a significant drop in our monthly savings. Our savings rate, having averaged 66 % in 2017, has been around 58 % over the first five months in 2018. So, it’s still quite solid, further fueling our investment process.

We managed to cut some spendings (less commuting, lower childcare costs etc.) to cushion the decline in income quite a bit.

AND HERE COMES THE COOL NEWS:

A few days ago, I was told that I would get a pay rise by roughly 10 %. That’s an amazing, unexpected financial windfall and a great feedback, showing that I and my work are appreciated!!!!

Of course we want to make the most of that pay rise.

What we’ll do is to keep our cost level steady or even lower it over time. We want to extract more savings from each Dollar income generated.

That leads to a positive Jaws Ratio which is defined as the Income Growth Rate less Expense Growth Rate (also see my post How to use Jaws Ratio to improve finances). A higher income with a stable spendings level can boost our savings rate quite nicely.

And here’s what we plan: We aim to re-establish our savings rate at 65 % (the level we achieved in 2017), despite me working 90 %.

We want our household

- to become more profitable,

- boost our earnings power,

- gain more financial muscles and

- to become even more flexible.

We also plan to step up our investment process. We will work even harder on building an ever growing passive income machine consisting of strong businesses we like.

Taking advantage of stock market volatility by topping up my position in UBS

By the end of May, financial stocks really got hammered due to some uncertainties in the markets such as Italy’s political turmoils and “trade war rhetoric”.

Well, when shares prices fall, in general that’s really good news for conservative dividend growth investors being in the accumulation phase.

I had initiated a small position in the Swiss bank UBS about eight years ago and now took the decision to add 250 more stocks to my portfolio, increasing my forward dividend income by almost USD 200. Swiss companies usually make their distributions once a year in the second quarter, so my stock acquisition will be accreditive to my 2019 dividend income.

UBS is the world largest wealth manager, currently offering a dividend yield of around 4.3 % and the prospect of good organic growth in a single digit range over the short and medium term.

I see a significantly stronger and more profitable UBS today than almost ten years ago when I bought my first stocks.

And here comes the interesting thing: UBS stock price today is almost at the same level as it was at the time when I initiated my position. So, the same amount of money buys much more earnings power and dividends. For me it’s quite an interesting income play.

The backbone of my investment portfolio clearly consists of defensive stocks in the consumer staple sector (Nestlé, Heineken, Reckit Benkisser, J.M. Smucker, Coca Cola, PepsiCo, Unilever, Henkel etc.) but financials have their place in my share portfolio too.

What about you, fellow Reader, did you buy some stocks recently? What do you think about my recent share acquisition?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

That is amazing that you were able to cut back on work hours to spend more time with your family AND even got a raise. The best of both worlds! Great pick up on UBS with the Italy news. I bet that will be a great position for years to come.

Scott

Hi Scott

Yes, that completely unexpected pay rise gives us a great opportunity to shape our finances even further and keep investing at a slightly larger scale. Picking up some UBS stocks amid recent market volatility should strengthen our passive income stream even further.

Thank you for stopping by and commenting!

Cheers