Doubling my August passive income

Hi there, fellow reader. With another month in the books, it’s time for me to look back at the progress made in terms of dividend income.

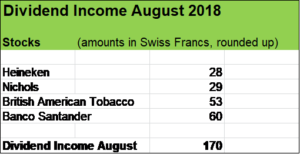

Compared to the previous year, my August dividends jumped by more than 100 % from CHF 80 to CHF 170. That’s mainly due to added stocks of British American Tobacco and British soft drinks maker Nichols plc., strengthening my passive income stream further in 2018. Nichols recently boosted its payout by 12 % and British American Tobacco latest dividend increase was by a juicy 15 %. Both companies offer dividend reinvestment plans which leads to more stocks in my investment portfolio paying me more money which is immediately put to work.

And there was also very nice organic growth from Dutch beer maker Heineken, hiking the dividend by 9.3 % and from Banco Santander, the largest bank in the Euro-Zone, increasing its shareholder payout by 5 %.

My passive income machine is growing quite nicely and I will work hard to make it stronger by further adding dividend growth stocks to my investment portfolio.

The magic power of small amounts

Sometimes, people don’t see the point in comparing each dividend month on a Year over Year (YoY) basis which often “just shows a few more bucks”.

Well, on first sight these small improvements don’t look like a big deal. But as a dividend growth investor accumulating assets in order to generate passive income, it’s tremendously important to stay motivated and consistent. If I compare my 2017 passive income of roughly USD 4’500 with my projected 2018 income of USD 7’000, progress is very obvious.

But such improvement requires many small steps, various actions and decisions have to be taken. And each month has to contribute to that growth.

For instance, in order to boost my dividend income to USD 10’000 next year, each month has to be stronger than the one of the previous year. On average, YoY growth has to be around 40 %. And that has to be replicated over and over again.

If I want to achieve a passive income of USD 10’000 in 2019, I will need to

- stay focused in putting money to work by investing in quality assets,

- consistently take many small steps and

- align my financial and personal resources with that goal.

And once the target is achieved, I will put the bar higher each year. Step by step.

That’s how to use the Domino Effect when investing.

What about you? How was your August in terms of dividend income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

The way to go is not an easy one, but your article is a great motivation to continue the path to FI.

It‘s also great to see your progress. It‘s just as you said – making one step at a time.

August was a really good month for us. In fact, we earned the highest income from dividends in 2018.

– David

Hi David

Happy to read that you had a very successful August in terms of dividends. Couldn’t agree more, the path as a dividend growth investor seeking FI is not easy but incredibly rewarding. Let’s work hard to make our passive income machines stronger year by year!

Thank you for your continuous support!

Cheers

Congrats for the big jump on dividend earnings.

It would be good to compare how much capital was invested last year Vs this year.

keep it up!

Erik

Hi Erik

Thanks! Yes, I’m very happy with the progress made in terms of dividend income.

Appreciate your input, comparing the money put to work to see how efficiently additional funds “produce” further dividend income. I will do so in my next dividend updates.

In 2017, I had on average USD 150’000 invested compared to roughly USD 185’000, on average, in the current year. So, I put about 25 % more money to work which compares quite favorably to an YoY dividend income increase of over 40 %. That’s due to good organic growth (dividend hikes), dividend reinvestments and the new funds have been invested in some higher yielding stocks such as tobacco companies Imperial Brands, British American Tobacco and Insurance Businesses Aviva and Legal & General.

Appreciate you stopping by and commenting.

Cheers

Nice job! You’ve got a great attitude about how big moves happen through small steps. Keep up the great work!

Hi DP

Thanks for the and motivating words!

I will keep the balld rolling.

Appreciate you stopping by and commenting.