Healthy dividend growth announcements

The first quarter of the new year is always full of finanical highlights for dividend growth investors as many businesses in our portfolios report their full year earnings and make their dividend announcement.

Steadily increasing dividend payments from quality businesses we hold for the long run, that’s what we want to see.

Organic dividend growth is essential for a passive income generation strategy, and our robust savings rate well above 50 % is the basis of our investment process making it possible to put money to work regularly and take advantage of market opportunitites.

Late in 2018, my wife and I set for 2019 a passive income goal of USD 10’000.

Currently, 90 % of our stock holdings have made their dividend announcements, whereas

- 33 companies increase their payouts,

- 11 businesses declared to hold their dividend payouts stable and

- 1 corporation slashed its payout by 50 %.

These announcements allow us to predict our dividend income for 2019. Currently, our forward dividend income for the year exceeds USD 9’400.

It’s just amazing to see how our stock portfolio with a current market value of roughly USD 270’000 is “automatically” churning out these amounts of fresh cash. On average roughly USD 800 per month!

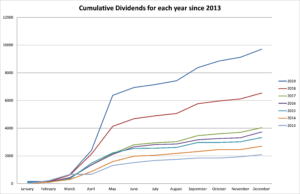

As you can see on the graph above, our dividend inflows are highly concentrad on the second quarter, as the majority of our European holdings make their payments once a year. For instance in May, our cash inflows from dividends will amount to USD 4’000!

Wonderful companies paying us while we can fully focus on our lives, no additional work required, what’s there not to like?

And we want to put the cash generation capabilities of our investment portfolio much further by strengthening our passive income machine with additional stocks of strong businesses.

February has been another busy month in which my wife and I made two nice stock acquisitions.

Taking a stake in SIXT SE and DKSH

While November and December 2018 really were great to invest in businesses due to stock market declines, it has become significantly harder fo find good buying opportunities after prices have substantially recovered since then. The risk of overpaying is now much higher.

But in our view, there’s still some good value for money in the market, that’s why in the middle of February, my wife and I took the decision to invest the total amount of USD 8’000 into Sixt SE and DKSH.

Sixt SE is a German car rental and leasing company with thousands of locations all over the world. Its roots go back to 1912 when Mr. Martin Sixt founded the company, at the beginning with a fleet of three cars, creating the first car rental business in Germany. The majority of the company is still owned by the Sixt family, who manages the enterprise. Sixt SE shows a nice combination of sound financials, attractive dividends and compelling growth projects.

Sixt SE really has been a success story for decades and I cannot think of another company operating in the business segments car rental, leasing and car sharing showing such strong financials. Sixt SE could also be an interesting income play for us over the medium and long term.

Sixt also shows a great deal of innovations. For instance, early in March, Sixt introduced a new app which offers a very interesting car sharing service. What Sixt is trying to do is connecting its vehicles by combining car rental and car sharing, pushing further its mobility services.

Now let’s turn to the second investment we made in February (in the amount of USD 4’000).

DKSH is a Swiss market expansion services group which is deeply rooted in Asia.

How does DKSH make money?

Well, the company is the world largest service business helping companies to enter into Asian markets. For instance, DKSH supports more than 500 consumer group companies (like PepsiCo, Unilever, Kraft Foods or Levi’s) to introduce products into specific Asean markets.

DKSH benefits from economies of scale, extremely strong cross-regional and cross-industry synergies.

I like the sound financials and robust cash generation abilities of DKSH. The stock P/E ratio looked undemanding when we entered into the position after the stock price came under pressure due to mixed 2018 full year results. Medium and long term growth prospects not only look intact but also very attractive to us.

Have a look at the dividend increases of our stock holdings

As said, 90 % of our stock holdings have made their dividend announcements so far. The average dividend increase has been more than 6 % per position.

First, let’s come to the group of “dividend growers” in our investment portfolio showing some nice increases:

- Heineken: + 8.8 %

- Unilever: + 8 %

- Nestlé: + 4.25 %

- Coca Cola: + 2.56 %

- PepsiCo: + 3 %

- Diageo: + 5 %

- J.M. Smucker: + 9 %

- Nichols plc.: + 15.27 %

- Britvic: + 5.2 %

- Reckit Benkisser: + 3.9 %

- Imperial Brands: + 10 %

- British American Tobacco: + 4 %

- Walt Disney: +7 %

- ABB: + 2.6 %

- LVMH: + 20 %

- DKSH: + 12 %

- Zurich Insurance: + 5.6 %

- Axa Insurance: + 6 %

- Swiss Re: + 12 %

- Legal & General: + 7 %

- Aviva: + 9 %

- Novartis: + 2 %

- Roche: + 4.8 %

- BASF: + 3.2 %

- Covestro: + 9.1 %

- Henkel: + 3.4 %

- Chevron: + 6.2 %

- South32: + 18 % plus special dividend

- Deutsche Telekom: + 7.7 %

- Orange: + 7.7 %

- Nokia: + 5.2 %

- UBS: + 7.7 %

- Crédit Suisse: + 5 %

- Banco Santander: + 4.5 %

And so far, following eleven businesses announced to hold their ordinary dividend steady (three of them make a special distribution additionally to the ordinary dividend payment):

- Royal Dutch Shell

- HSBC

- VPB

- OC Oerlikon (additionally, payment of special dividend)

- LafargeHolcim

- Glaxo Smith Kline

- Bayer

- Rio Tinto (additionally, payment of special dividend)

- BHP Billiton (additionally, payment of special dividend)

- Glencore

- Telefónica

Unfortunately, beer giant AB InBev cut its dividends to strengthen its deleveraging process.

Over the next weeks, we expect following companies to announce their dividends:

- Exxon Mobil

- BMW

- Porsche Automobil Holding SE

- Dufry

- SIXT

Hopefully, we will see some nice hikes.

What about you fellow Reader, have you added some new positions to your portfolio? Did you see some dividend increases of your stock holdings?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Very nice. Mostly increases so that’s great news. Hopefully you can continue to add through the year and generate more income. Do you think you’ll DRIP or take the cash in May?

Hi BHL

Thanks, yes I am very glad to see the majority of our stock holdings increasing their payouts. With regard to the reinvestment of our dividends, well I think it will be a mix of DRIPS (e.g. in the case of our British positions like Reckit Benkiser, Imperial Brands, British American Tobacco, Nickols, Britvic, Legal & General etc.) and putting some of the cash dividends (e.g. from Nestlé, Novartis, Roche etc.) into new stock positions.

Thanks for stopping by and commenting.

Cheers

Wow, that’s an impressive development and shows perfectly the power behind dividend growth investing!

I’m currently thinking about increasing the share of German companies in my portfolio, as the so-called “Tag der Aktie” (day of the stock) comes closer.

Every year around mid-March, a few German banks and Frankfurt stock exchange offer to buy stocks without any charges, if you invest at least €1,000 per company (https://www.tag-der-aktie.com/angebot.php).

I’ve already made use of this special occasion in 2017 and 2018. Now, I’m thinking about buying additional shares of Allianz, BMW, Fresenius, MunichRe and SAP as well as initiating a position in BASF.

– David

Hi David

Thanks for the kind words and your continued support!

Adding some more German stocks is a very good plan in my view, and the opportunity to pick some shares without any charges is extremely interesting. Thanks for having informed and provided us with that link! By the way, on March 15, I made a nice acquisition, I’ll keep you informed about that buy in my next blogpost.

I like all of the German businesses you are naming. BASF looks particularily tempting at these price levels. Munich Re and Allianz have been on my watchlist for a long time, I don’t know why, but I missed to pick some stocks several times despite some nice price retreats over the last few years. As shareholder of Swiss Re, Zurich Insurance, Axa and Aviva I have to say that there’s a lot to like about the insurance sector and Allianz and Munich Re are high quality businesses rewarding investors handsomely.

Thanks for swinging by and commenting.